Personal credit risk measurement model based on PSO-BP

A PSO-BP, measurement model technology, applied in the field of personal credit risk measurement model, can solve the problem of low prediction accuracy, achieve the effect of improving accuracy and reliability, preventing market risks, and good application value

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

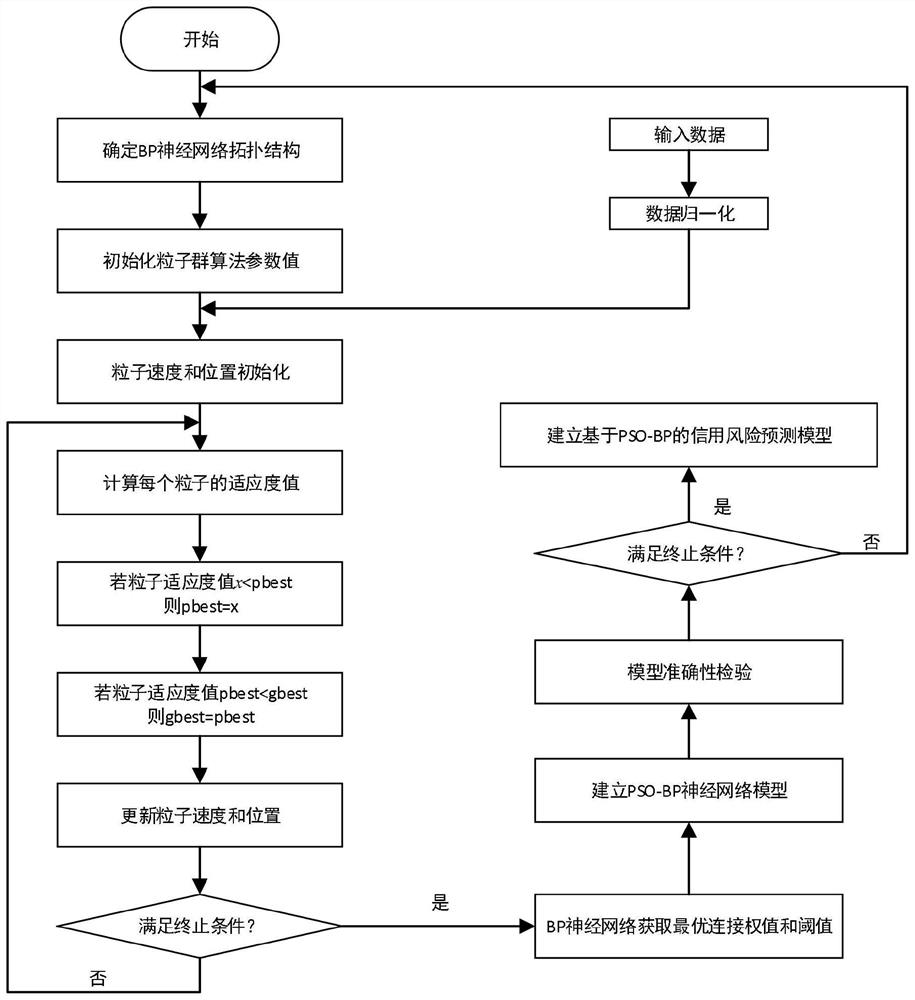

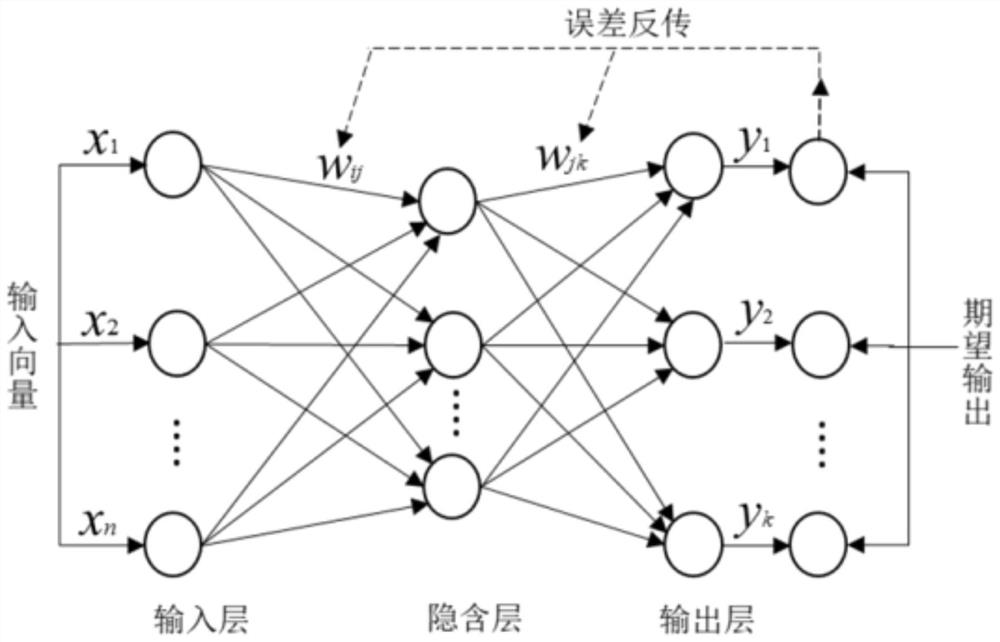

[0040] Such as Figure 1-2 As shown, the embodiment of the present invention provides a personal credit risk measurement model based on PSO-BP, including the PSO-BP model, the PSO-BP model is based on a neural network and a particle swarm algorithm, and the BP neural network algorithm includes signal forward propagation and error reverse propagation Two parts, assuming that the number of neuron nodes in the input layer is n, the number of neuron nodes in the hidden layer is s, and the number of neuron nodes in the output layer is 1, the principle of the PSO algorithm is V i =(v i1 ,v i2 ,...v in ) and X i =(x i1 ,x i2 ,...x in ) respectively represent the speed and position of the i-th particle in n-dimensional space, evaluate the fitness function value of each particle in each iteration, and judge the individual optimal position p passed by each particle at time t best and the optimal position g of the entire group best , each particle in the group updates its speed a...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com