Use method for the third party telecommunication pressing payment for loan honest management system

A management system, honest technology, applied in digital data processing, special data processing applications, record carriers used by machines, etc., can solve the problem of unsatisfactory results, the inability of lenders to dynamically supervise and urge payment, and the effective management of bank funds. and value-added issues, so as to reduce loan risks and costs, facilitate timely access to loans, and improve the return rate of funds.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

[0063] 1. Introduce a new financial product

[0064] A small consumer loan is generally provided to college students. Its target customer group is not poor students who account for about 20% of the total number of college students. amount of consumer credit”.

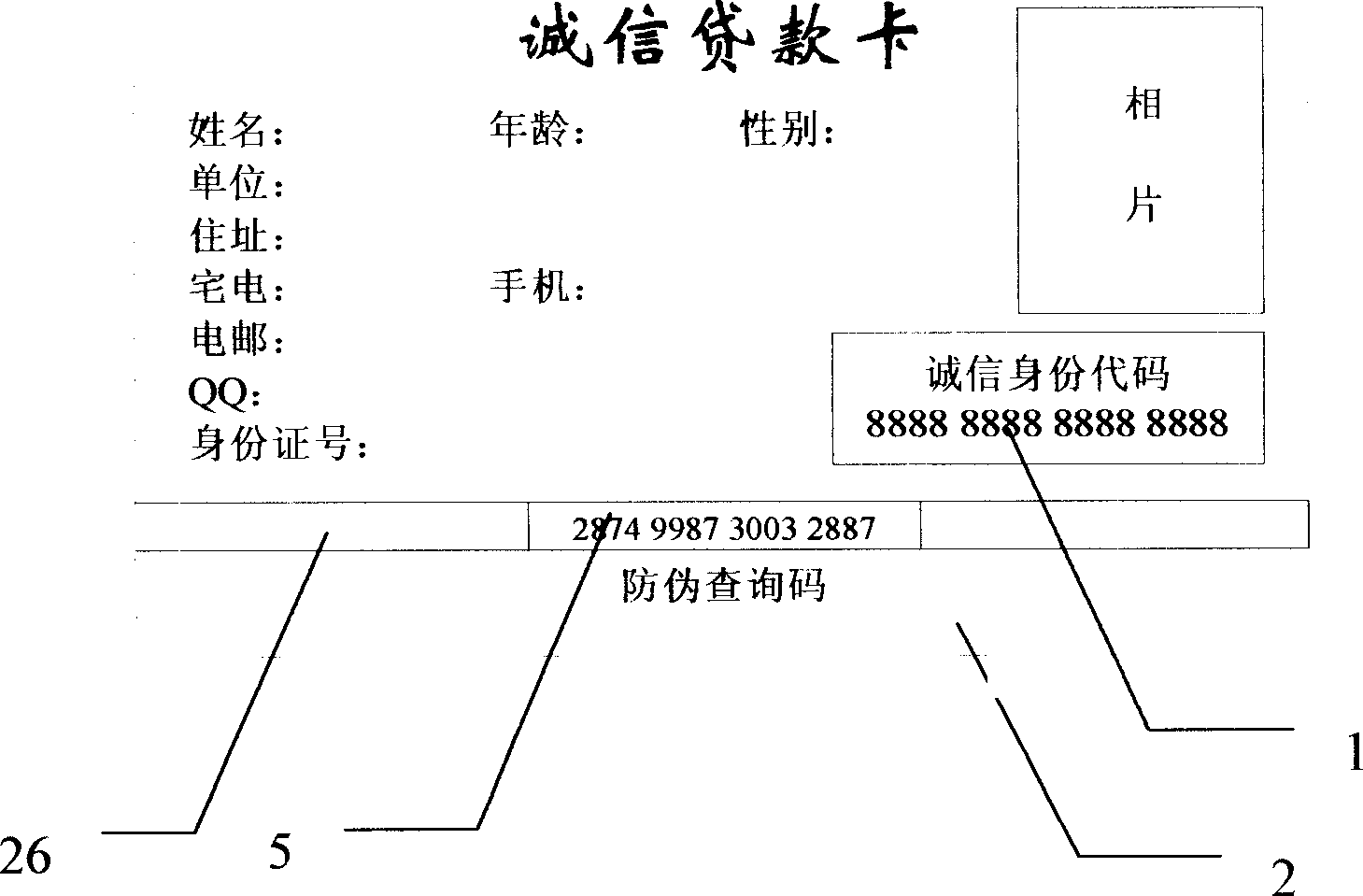

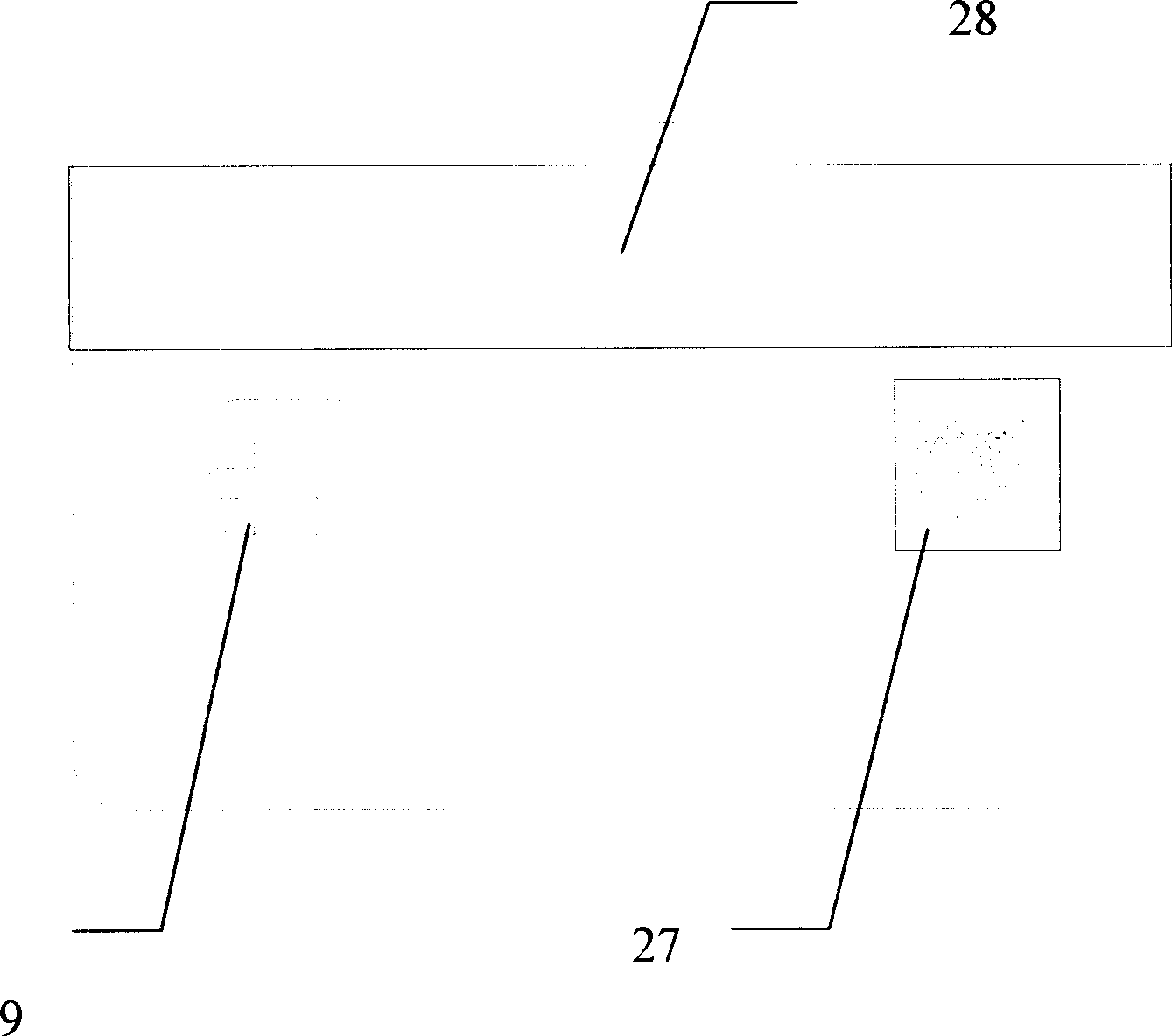

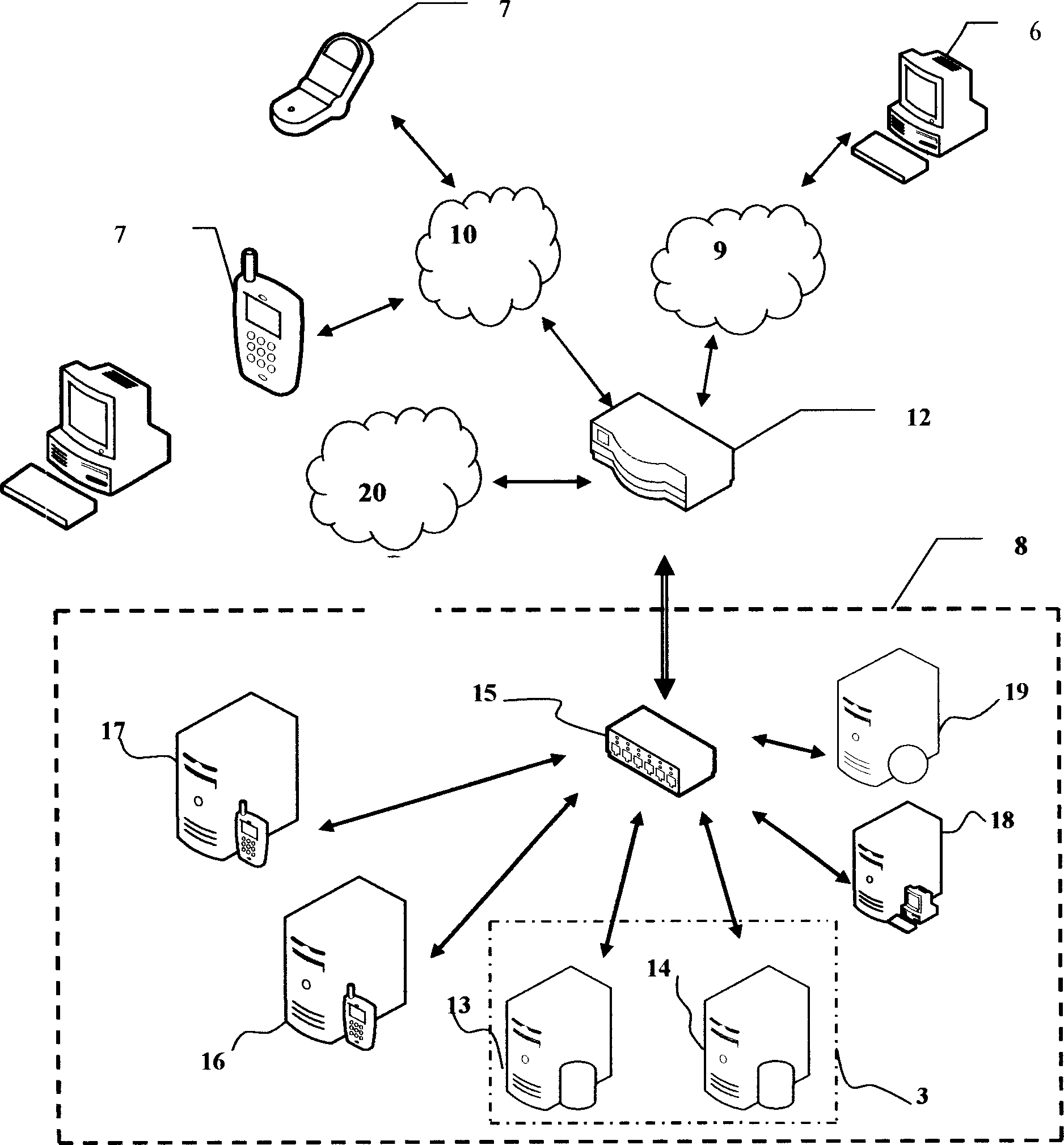

[0065] In order to reduce the burden of banking business and at the same time exercise the financial management ability of college students, the student union takes the lead in establishing a "virtual integrity bank" in the university. The third-party loan integrity management agency provides credit guarantee for the university's "virtual integrity bank" and applies to the bank uniformly. Obtain small consumer loans for college students. College students can apply for an integrity loan card (2) from the "Virtual Integrity Bank" as soon as they enroll (see figure 1), obtain an integrity identity code (1), college students can use this integrity credit card (2), and pay a pledge deposit of 100 yuan to a third-party loan...

Embodiment 2

[0073] With the integrity guarantee provided by the creditworthiness management system of the third-party telecommunications call loan of the present invention, and the "entrepreneurship training", project evaluation guidance, project implementation guidance and other measures organized by the community management agency, the bank launched a "small cash pledge dynamic Supervision, monthly equal installment telecommunication call for repayment" business loan varieties, generally provide a one-time 20,000 yuan business loan to laid-off workers, demobilized soldiers and unemployed people, the loan period is 24 months, starting from the fifth month of the loan, every month The monthly repayment of the loan principal is 1,000 yuan, the loan interest is paid in one lump sum, and the loan pledge is 2,000 yuan.

[0074] For example, Lao Liu applied for a good faith loan card from the bank and paid a deposit of 2,000 yuan as a pledge. Information such as the amount, date and amount of ...

Embodiment 3

[0076] 1. Launch a new financial product "National Lifelong Education Loan"

[0077] In order to generally improve the quality of citizens, the China Development Bank relies on the "third-party credit management agency" to launch a policy-based loan "National Lifelong Education Loan" for those who are willing to study for a master's or doctor's degree through distance education, or for further professional knowledge and professional education. Skilled on-the-job personnel are provided with financial support.

[0078] 2. Implementation method

[0079] Xiao Liu is a college graduate working in a factory research institute. In his work practice, he found that in order to complete his job development work, he needs to learn more professional knowledge. He decided to study for a doctorate, so he proposed a total of 100,000 yuan to the China Development Bank. For the 20-year "National Lifelong Education Loan" application, Xiao Liu submitted the relevant materials and submitted a pl...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com