System, method and database for processing transactions

a technology of transaction processing and database, applied in the field of transaction processing and analysis systems, can solve the problems of reducing the efficiency of the checkout process, affecting the safety of customers, so as to maximize the protection against bad checks, improve customer relations, and reduce the effect of efficiency

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

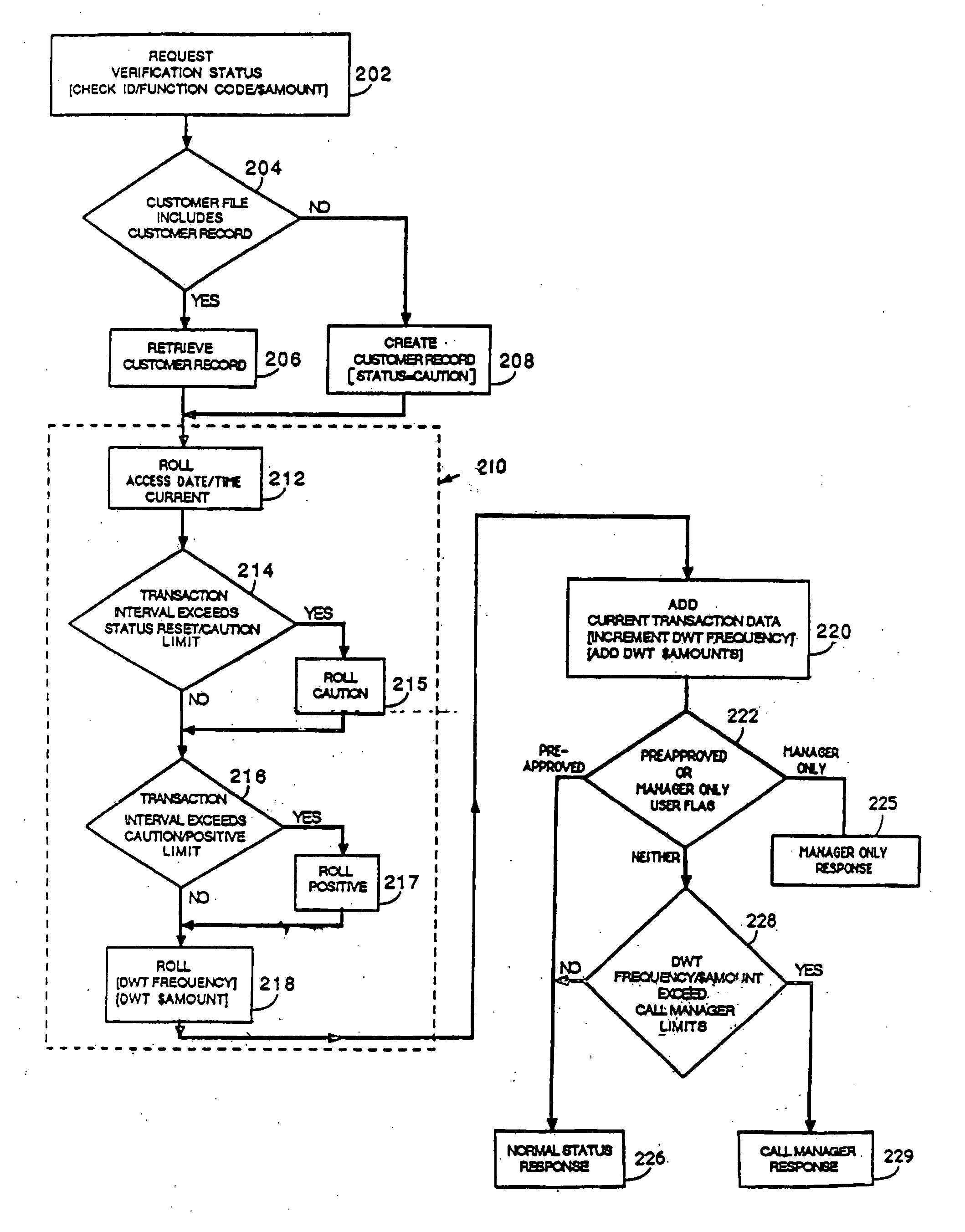

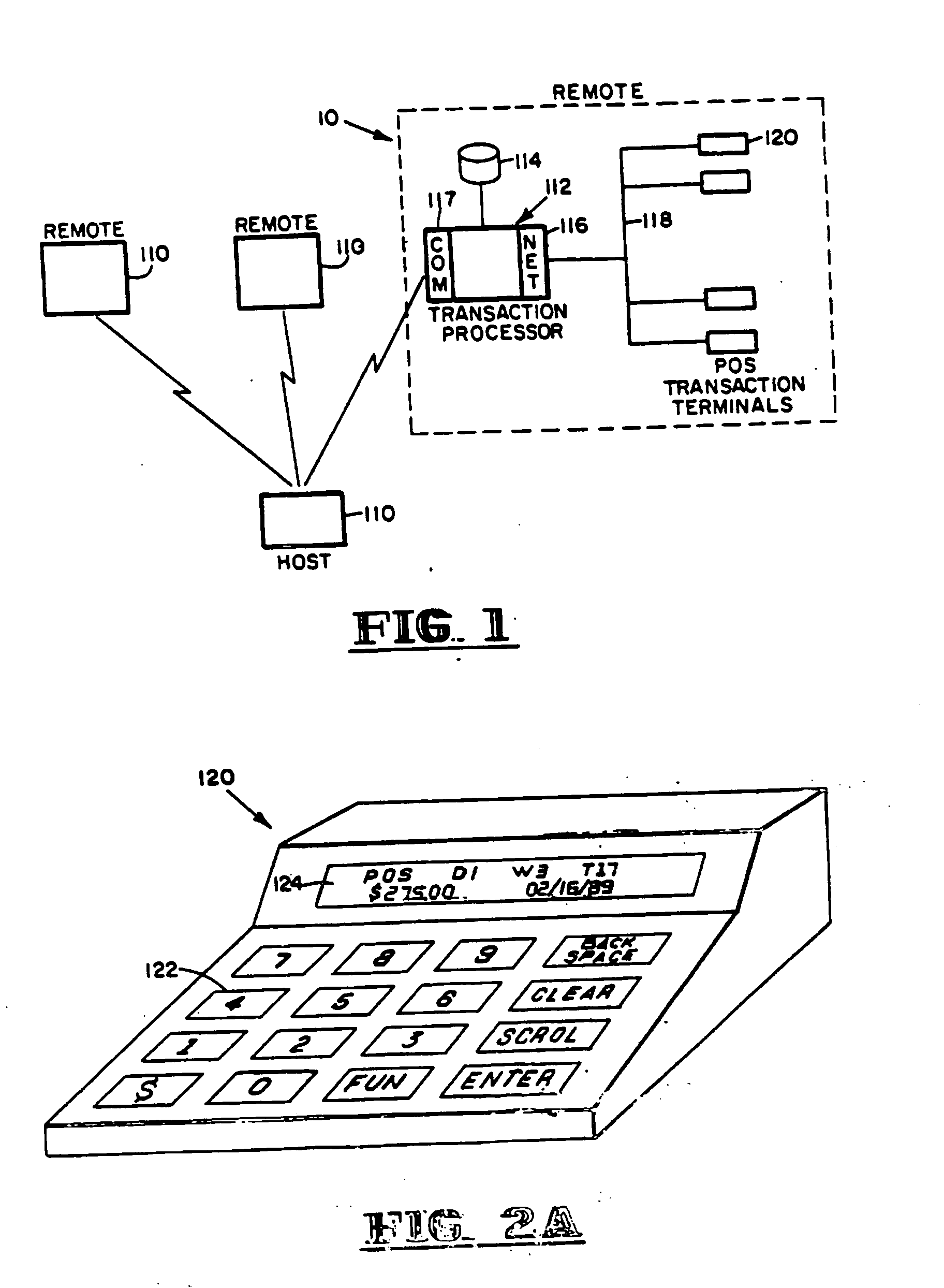

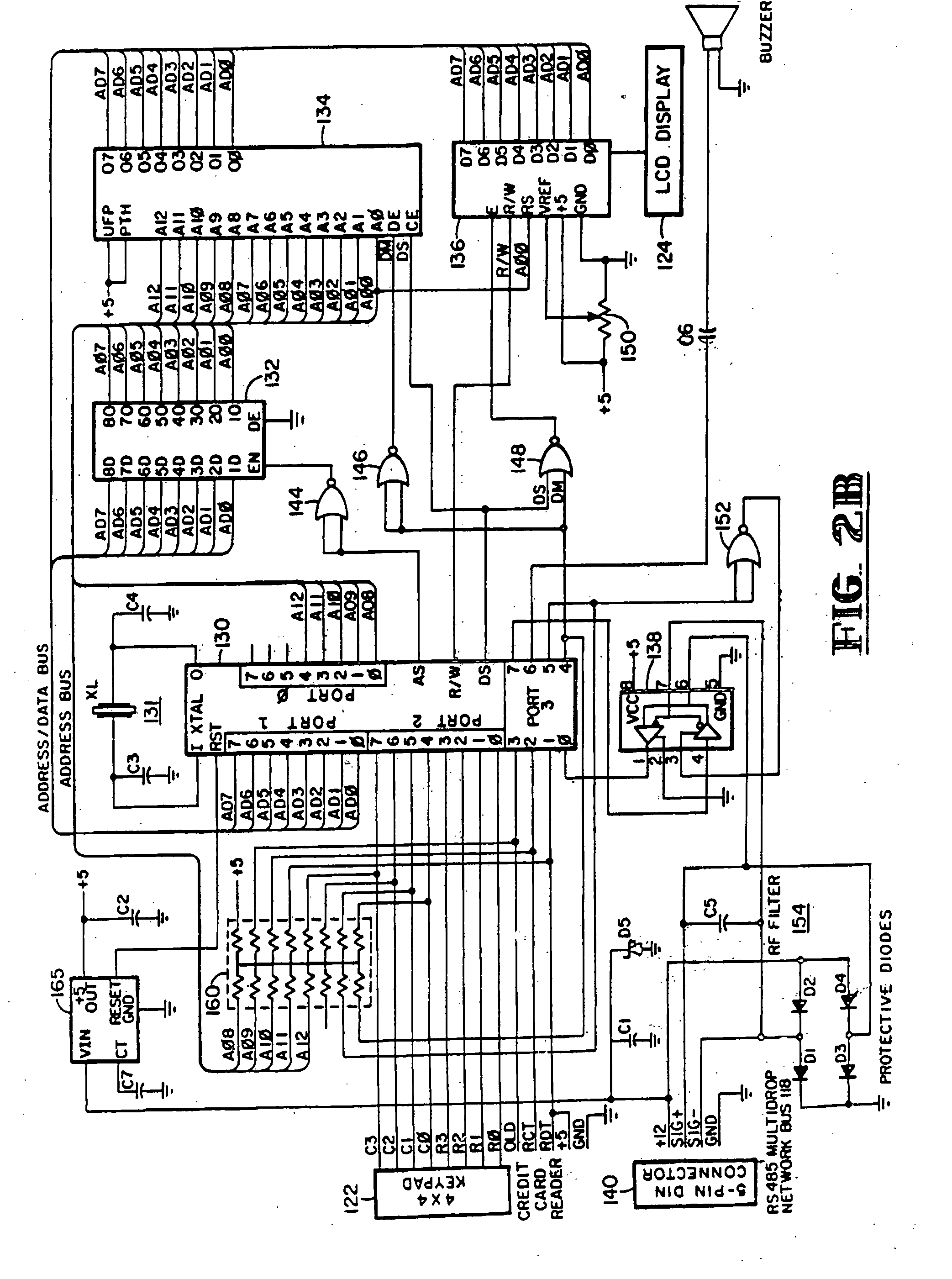

[0049] The check transaction processing system of the present invention enables a store with a significant volume of check transactions to accumulate and process transactional customer information for two main purposes: check verification and customer profiles. The system operates at the store using a local database of customer information useful in that store's business.

[0050] A customer's bank checking account number provides a unique identification for that customer—using this check ID, a customer record is created and included in the local customer database. The customer record includes an assigned customer verification status, as well as selected transactional data. Customer status designations include POSITIVE, NEGATIVE and CAUTION, while transactional data includes transaction frequency and dollar volume over given intervals (such as Day / Week / Total or DWT). Selected transactional (CALL MANAGER) limits are assigned to both CAUTION and POSITIVE status. This customer informatio...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com