Method of securitizing a portfolio of at least 30% distressed commercial loans

a distressed commercial loan and portfolio technology, applied in the field of asset securitization, can solve the problems of significant near-term risk that the borrower will ultimately default on its obligations, subject the lender to increased capital requirements and regulatory scrutiny, and the credit facility is considered “distressed”, so as to save valuable economic and regulatory capital, outsource the time-intensive and resource-intensive workout effort, and save costs

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

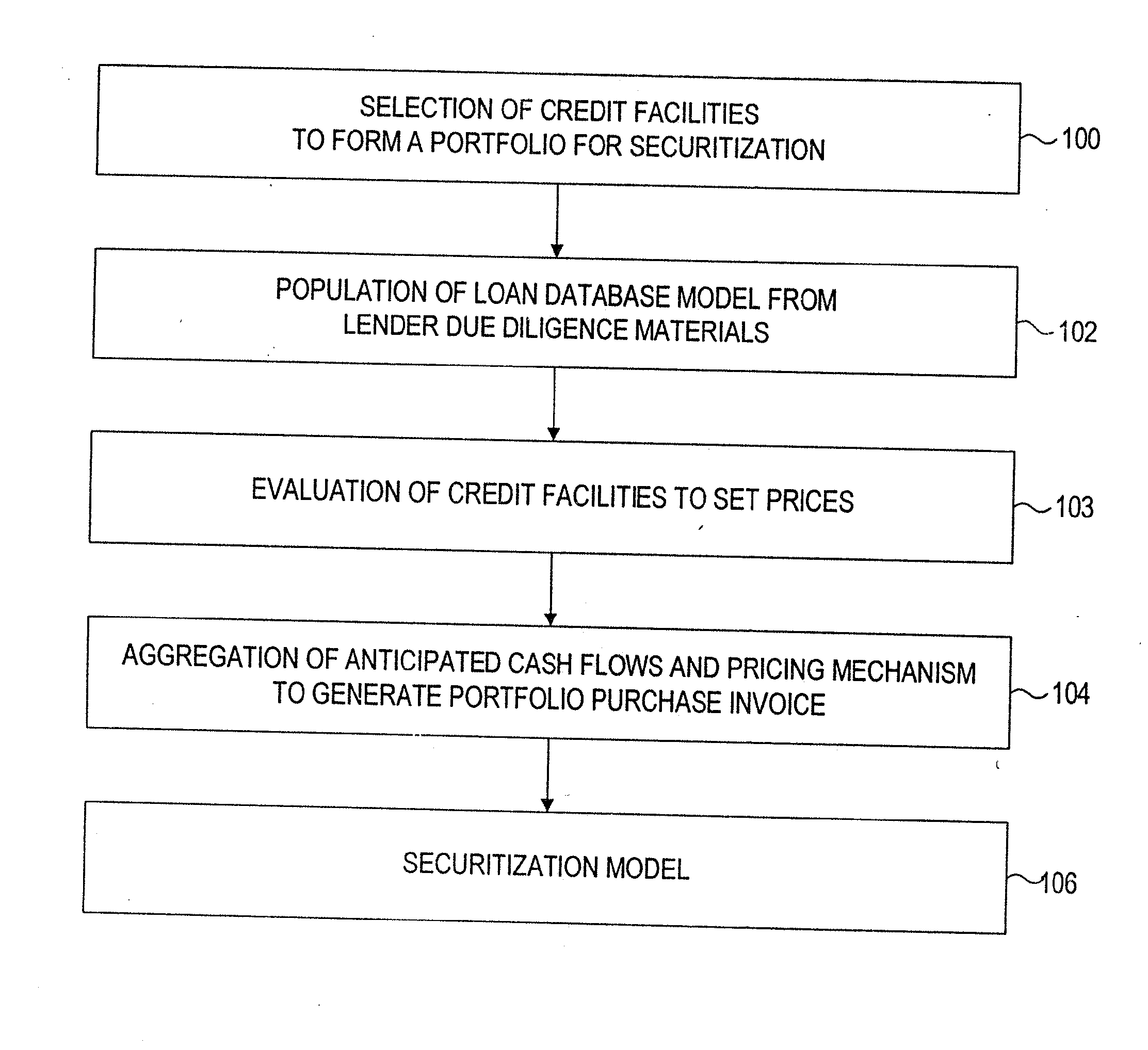

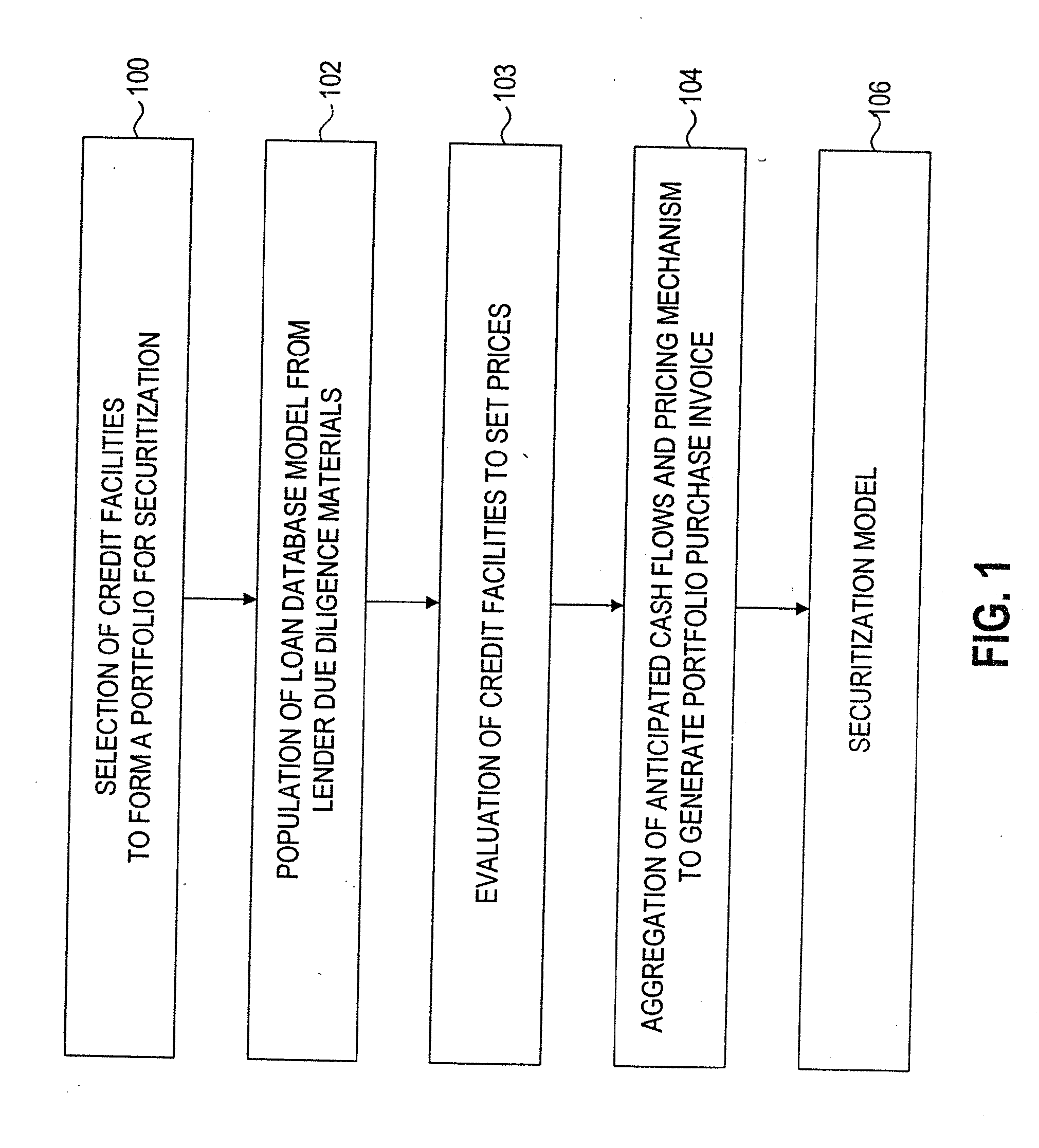

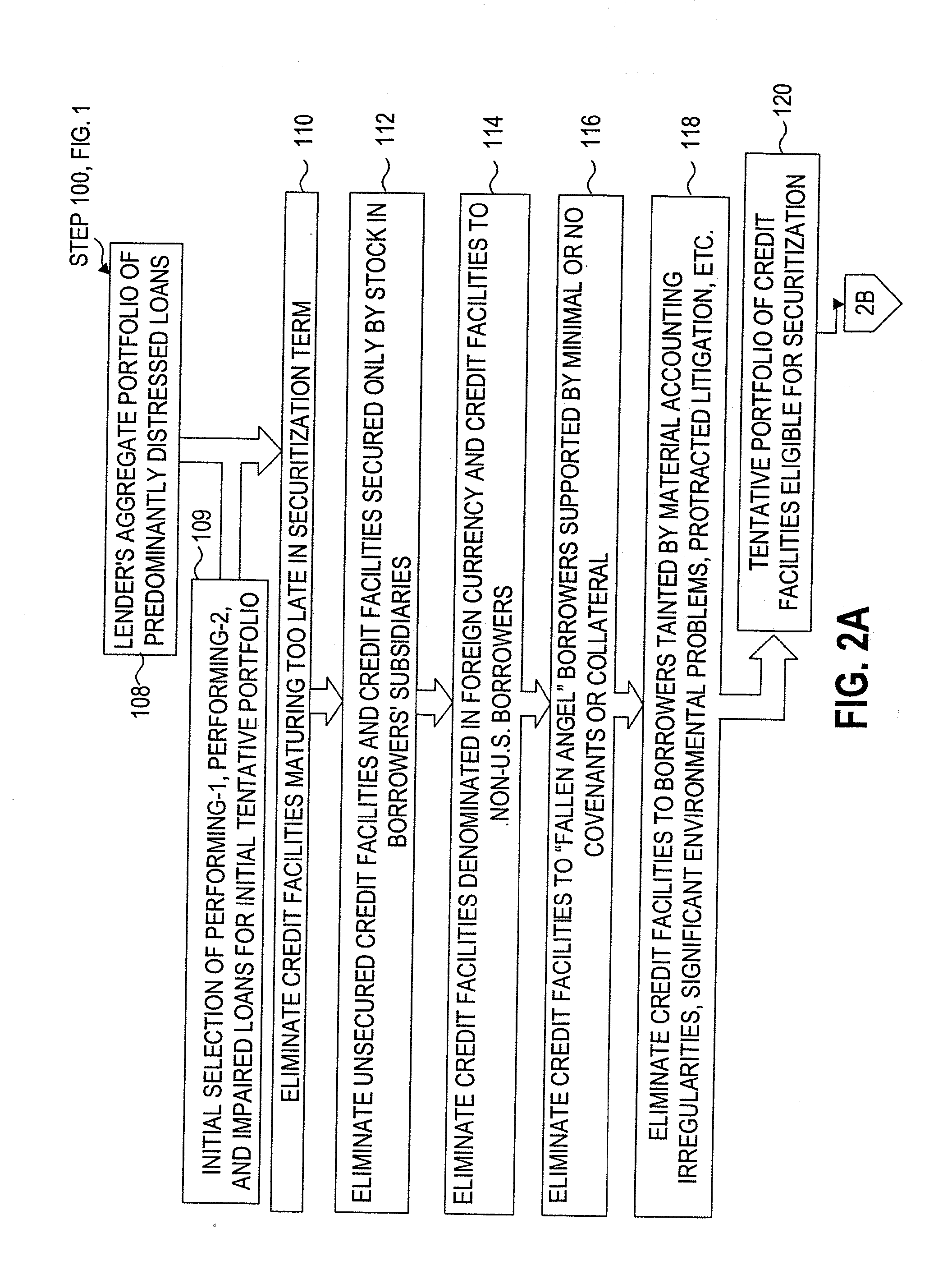

Overview of the Process

[0044]The methodology of the present invention includes: (1) a portfolio of performing (if any) and at least 30% distressed commercial credit facilities selected to meet predetermined borrower and industry diversity criteria; (2) a self-amortizing and static SPE; (3) a mechanism to fund any unfunded revolver commitments; (4) a methodology to provide additional liquidity to certain borrowers; (5) a model and structure that aggregates the anticipated cash flows and which facilitates the requisite credit rating agency stress tests premised upon multiple default and recovery assumptions; (6) a methodology for the determination of optimum levels of interest reserves that ensure the timely repayment of interest on the investment grade debt issued in connection with the securitization of the underlying portfolio of distressed credit facilities; and (7) a capital structure designed in classes (or “tranches”) and sized for receipt of investment grade ratings on all of ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com