Transformation weighted indexes offering concentrated multi-risk factor exposure

a technology of multi-risk factor exposure and weighted indexes, applied in the field of transformation weighted indexes offering concentrated multi-risk factor exposure, can solve the problems of inability to replicate current methods, and achieve the effect of reducing overexposure and simplifying portfolio managemen

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

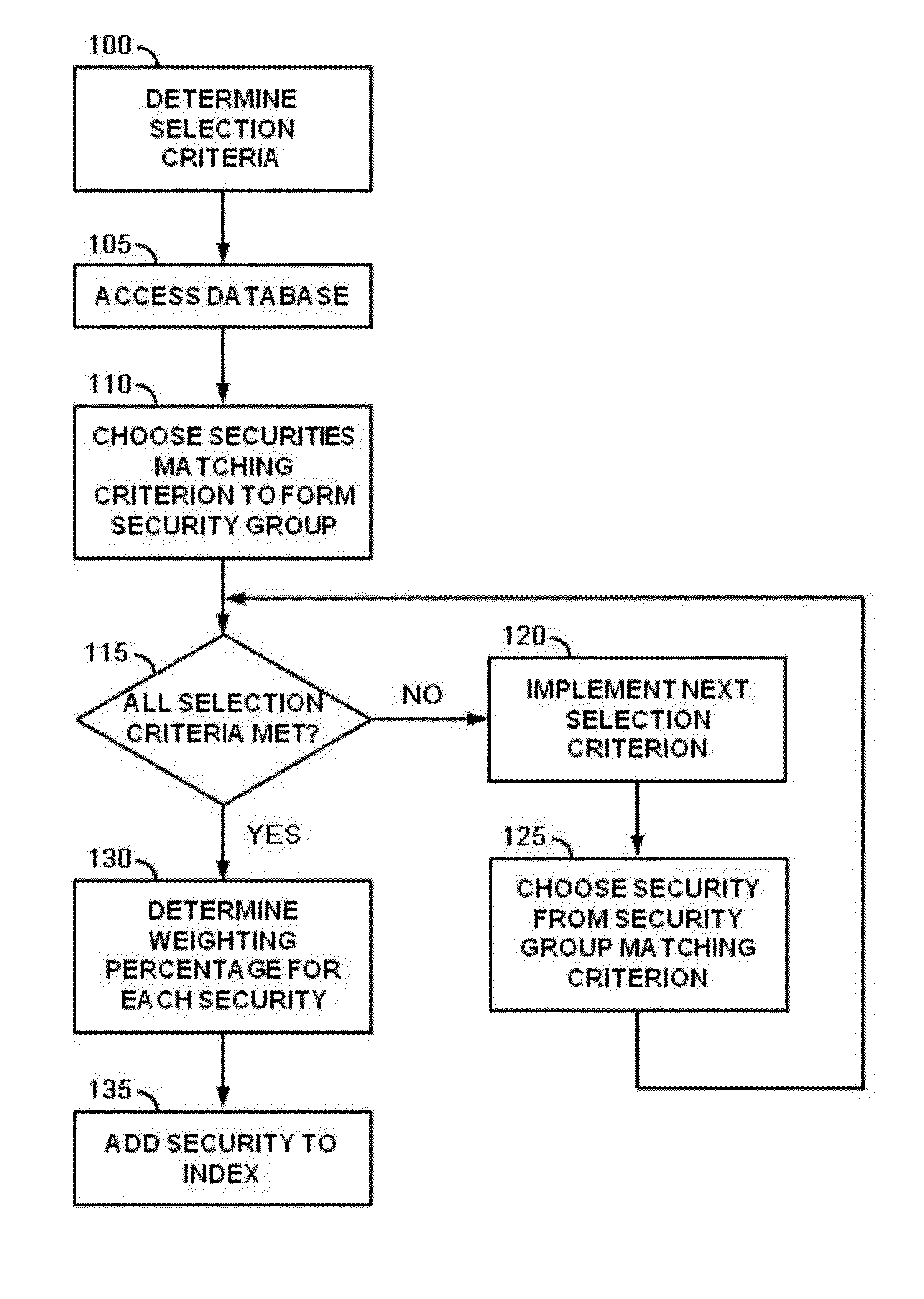

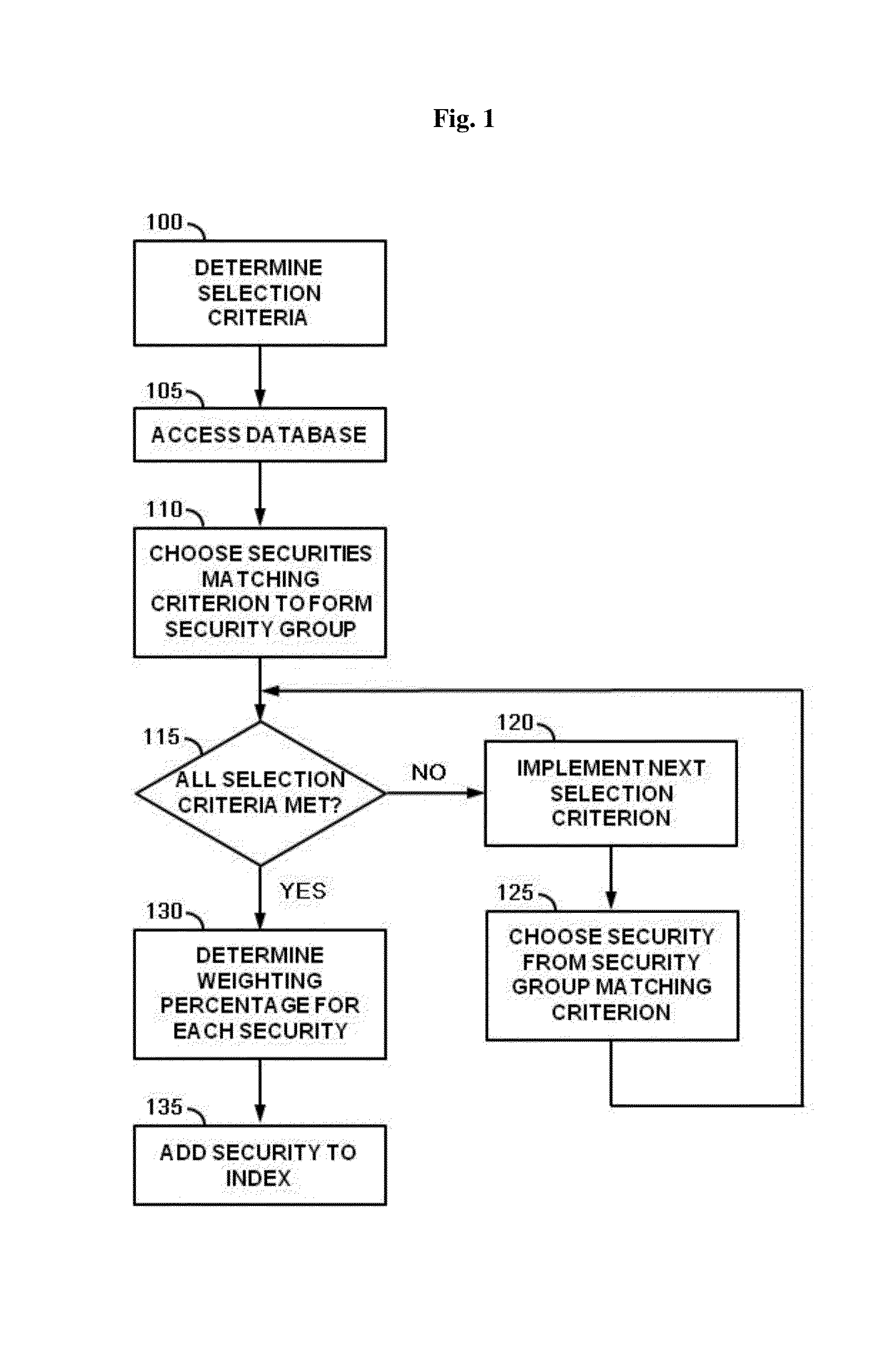

Method used

Image

Examples

example 1

TWI Characteristics

[0099]A percentile transformation is applied to a notional risk factor metric for a set of 1000 securities.

[0100]Table 4 shows a sampling of percentiles at either end of the 1000-member index with weighting percentages calculated by dividing a given percentile by the sum of the percentiles for each index constituent with respect to a notional metric.

TABLE 4Percentiles of a 1000 member index of marketable securities;weighting percentage determined by dividing percentileby aggregate of all index member percentilesWeightingWeightingPercentiles,Percentage,Percentiles,Percentage,Top 10Top 10Bottom 10Bottom 101.00000.2003%0.00900.0018%0.99800.1999%0.00800.0016%0.99700.1997%0.00700.0014%0.99600.1995%0.00600.0012%0.99500.1993%0.00500.0010%0.99400.1991%0.00400.0008%0.99300.1989%0.00300.0006%0.99200.1987%0.00200.0004%0.99100.1985%0.00100.0002%0.99000.1983%0.00000.0000%

[0101]FIG. 3 depicts the graphical appearance of a percentile-based weighting percentage curve compared wit...

example 2

TWI Construction

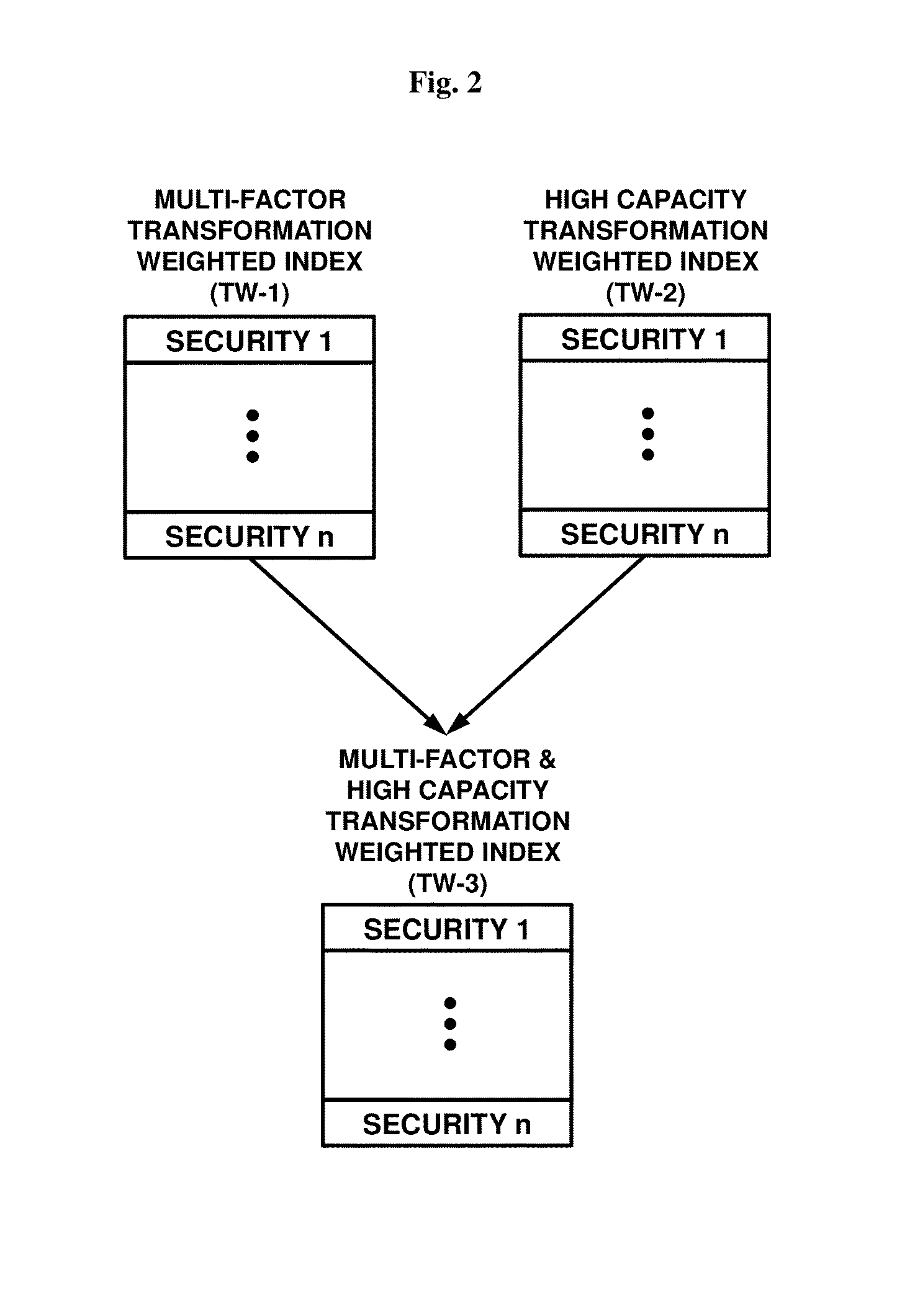

[0106]In this example, three TWIs are derived from a 1000-stock universe selected by highest market capitalization.

[0107]A first Transformation Weighted Index, TW-1, may directly access three risk factors: low volatility, value, and momentum. TW-1 may also provide inherent exposure to the size and market factors. For each stock, percentiles of the following metrics may be multiplied: Shareholder Equity for the most recent quarter (a value risk factor), four-quarter Share Price Change (a momentum risk factor), and a twelve-month exponentially weighted average Beta (a volatility risk factor; here the percentile may be subtracted from 1.00 to emphasize low volatility stocks). To this product, a subsequent percentile-power transformation may be applied, using an exponent of two, to produce a weighting value. An investor may consider most relevant benchmark to be an equal weighted index because of TW-1's relatively similar investment capacity and constituent weighting per...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com