Mobile system and method for payments and non-financial transactions

a mobile system and non-financial technology, applied in the field of mobile systems and methods for payments and non-financial transactions, can solve problems such as increased risk of nfc solutions, and achieve the effect of low cost and convenient availability

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

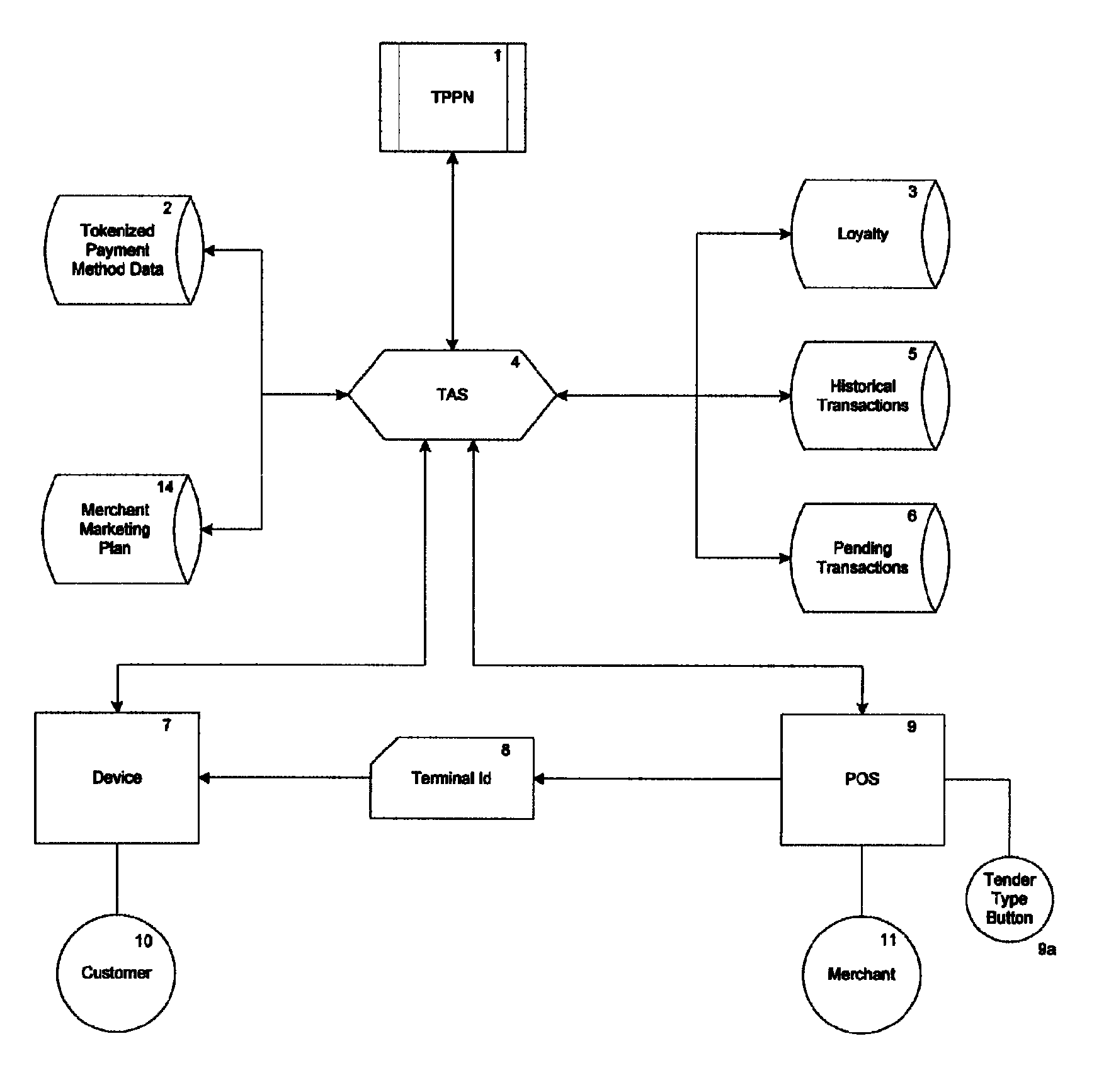

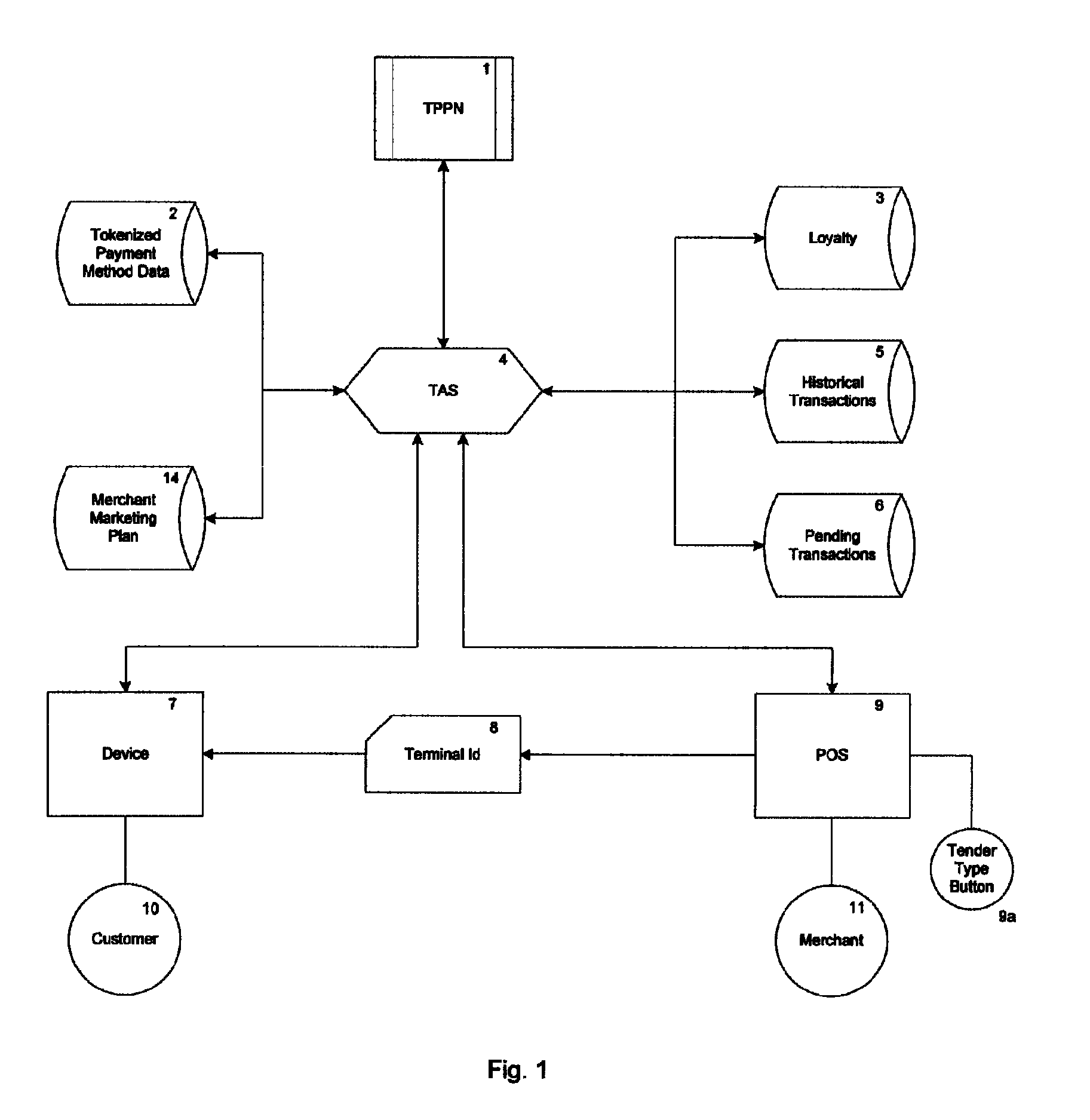

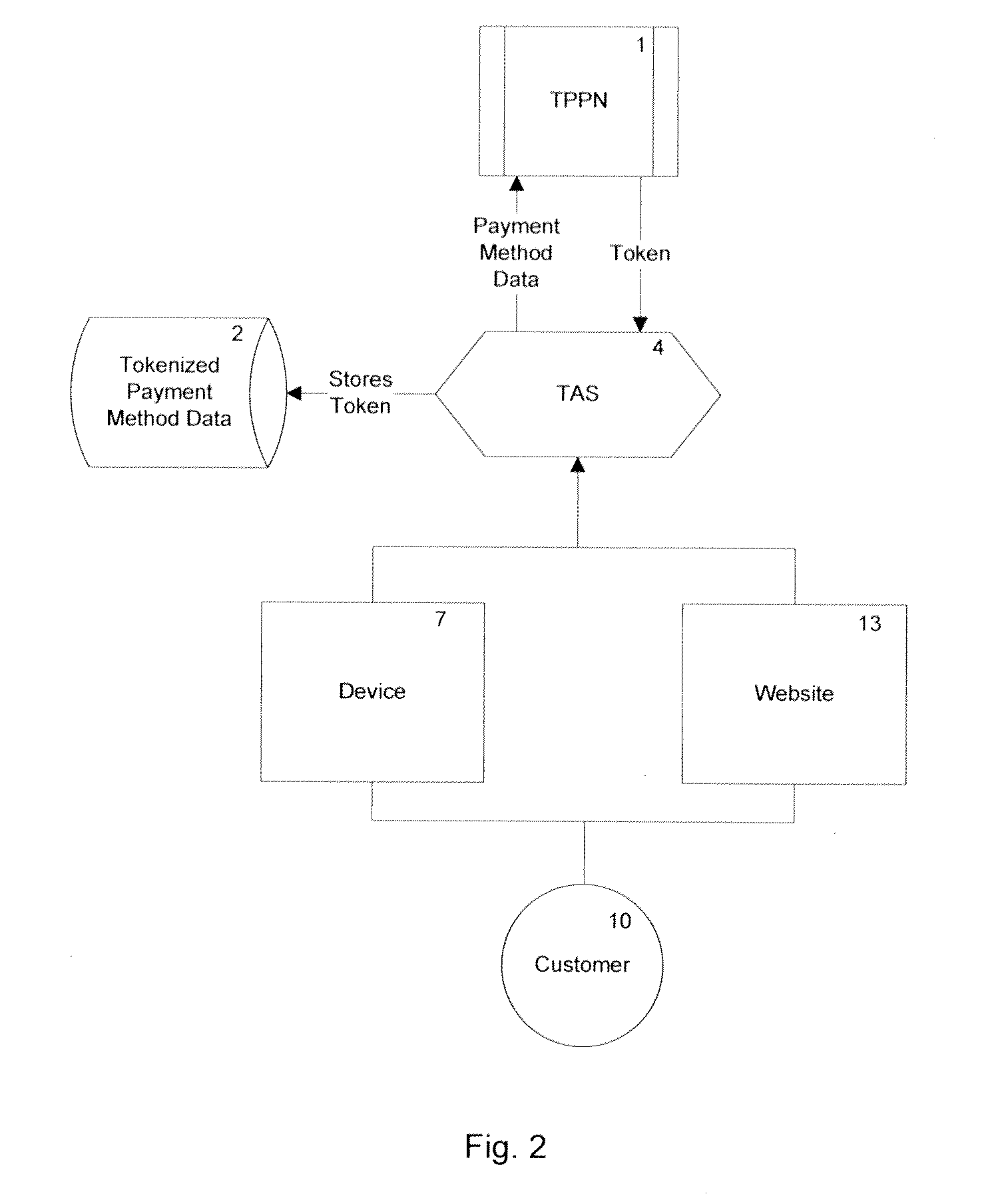

[0010]In view of the above-identified drawbacks, there exists a need for an alternative mobile commerce system and method. Embodiments of the present invention provide systems and methods for mobile commerce, communication, and transaction processing to real-world POS, web, E-commerce, virtual terminal, mobile PDA, mobile phone, or other computer based transactions involving either financial and / or non-financial transactions (such as loyalty based transactions) as a mobile payment system. Some embodiments of the invention provide a more readily available product for market adoption through a highly secure, non-card data transmitting POS process. Such a product provides a relatively low cost solution to implement at the merchant, and is a scalable product for ease of distribution to address both consumer and merchant adoption needs.

[0011]One embodiment of the invention is directed toward using a mobile phone or mobile device via a consumer mobile software application of the mobile pa...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com