E-bank account fraudulent conduct and risk detecting method and system

A technology for electronic banking and risk detection, applied in payment systems, payment system structures, instruments, etc., can solve problems such as lack of detailed descriptions in the rule generation process, inability to adapt, pressure on system processing capabilities, etc., to improve data processing efficiency, The effect of reducing the detection false positive rate

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0032] In order to make the purpose, technical solutions and advantages of the embodiments of the present invention clearer, the present invention will be described in detail below in conjunction with the accompanying drawings.

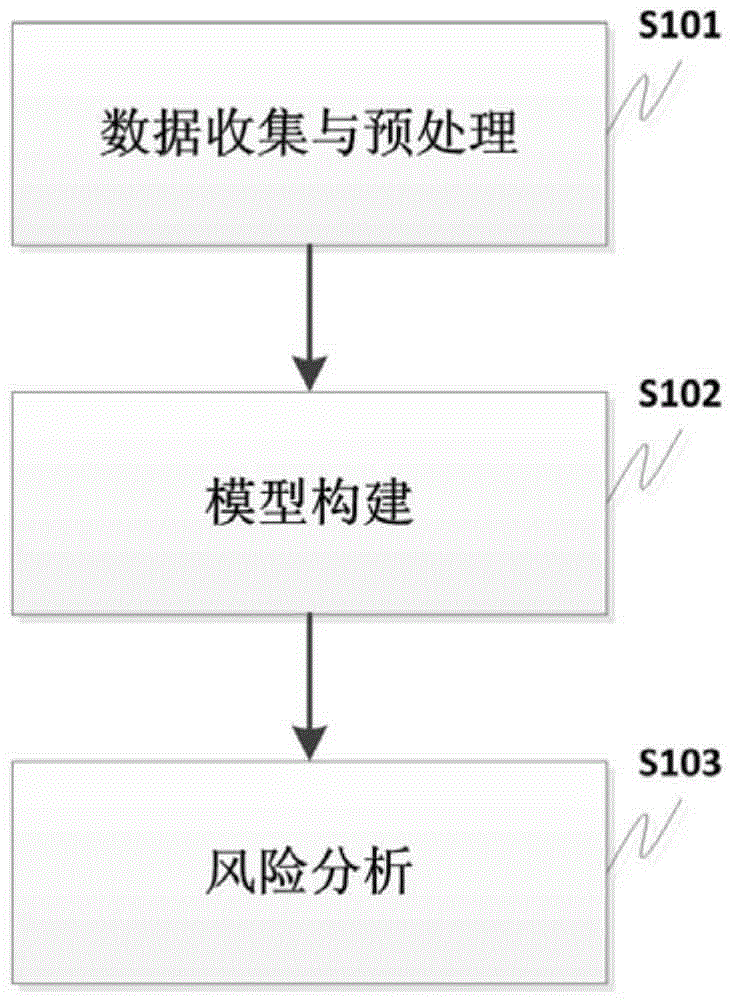

[0033] 1. figure 1 It is a flow chart of the electronic bank account fraud and risk detection method of the present invention. Such as figure 1 As shown, the method includes:

[0034] 1) S101, data collection and preprocessing, collect the data stored in the business system into the distributed data storage platform in real time or in batches, such as using Storm and HDFS, and use parallel computing methods, such as MapReduce, to session and account as a unit to organize the data;

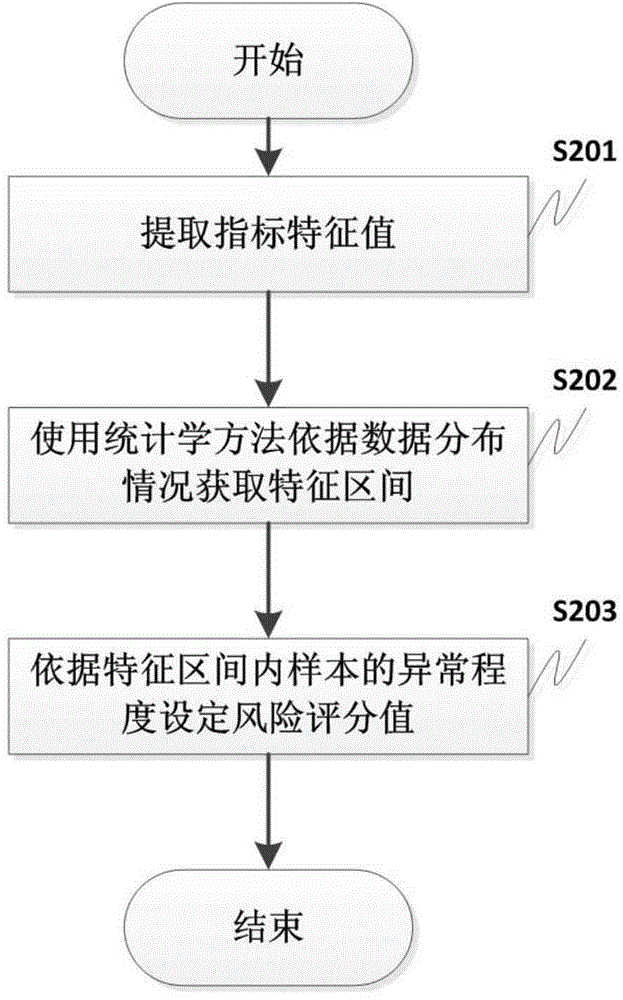

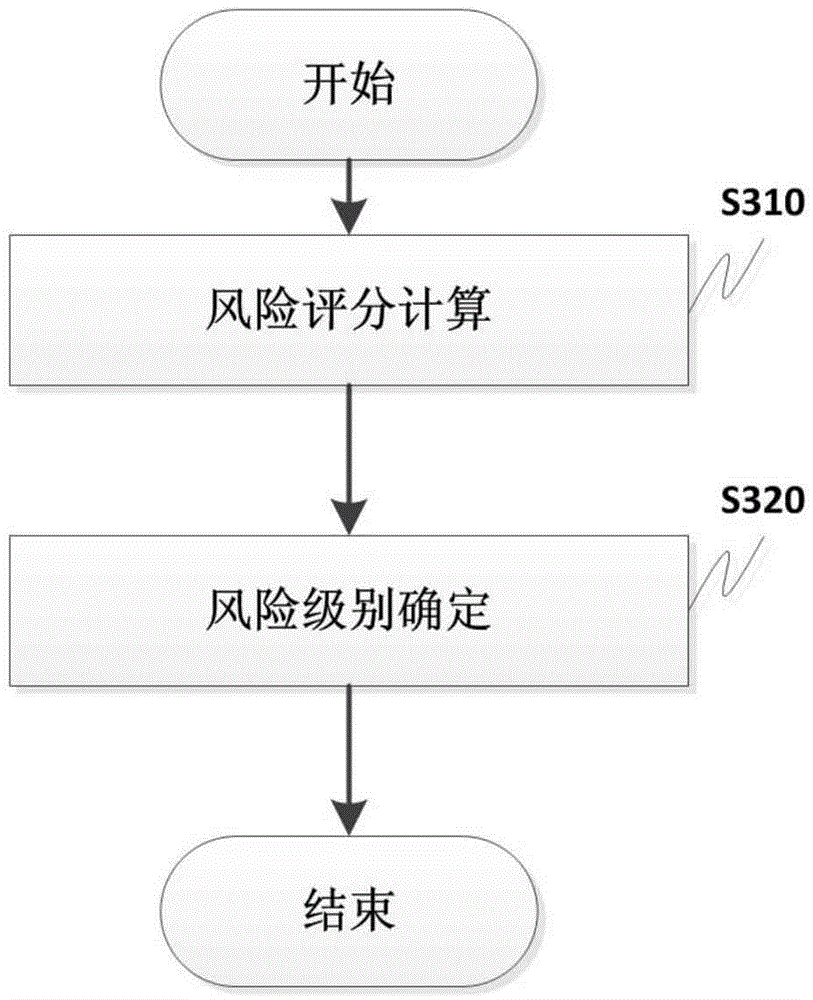

[0035] 2) S102, model construction, extracting overall indicators and individual indicators from the sorted historical sample data, and using statistical methods to divide indicator feature intervals based on data distribution, and setting a risk score value for each fe...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com