Third-party credit supervision and risk assessment system and method

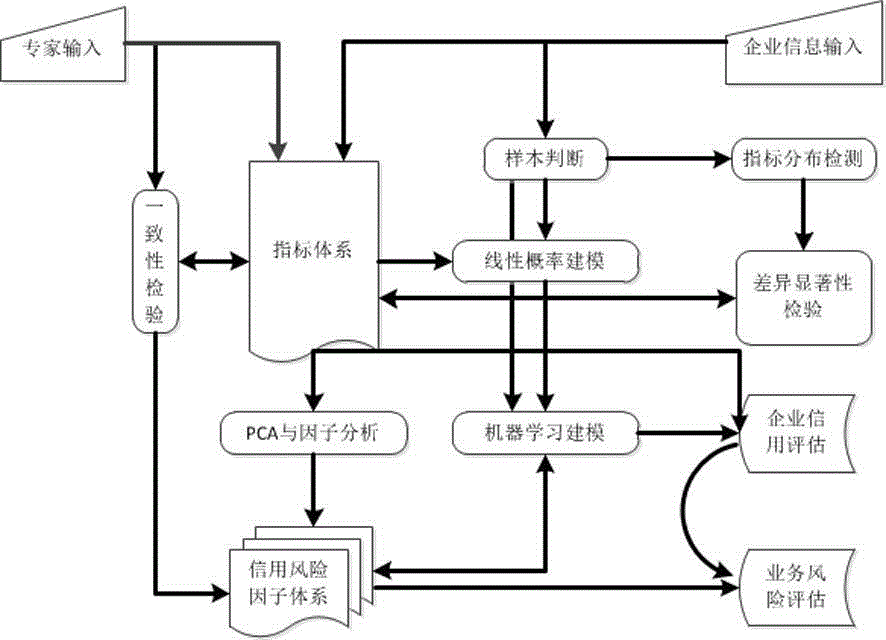

A risk assessment and credit technology, applied in instrumentation, finance, data processing applications, etc., can solve problems such as insufficient corporate integrity records and risk information sharing and communication, difficulty in identifying group customers and related customers, and restricting banks’ post-loan management level, etc. Achieve the effect of saving high-end talent costs, improving post-loan management level and work efficiency, and eliminating human subjective factors

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

[0022] Embodiment 1: A system for third-party credit supervision and risk assessment, including a loan application client, a loan issuance client, a guarantee client and a supervision server, the loan application client, the guarantee client and the The loan issuing client is in two-way communication with the supervisory server respectively.

[0023] The loan application client includes a basic information module for entering and managing the company's basic information; a financial information module for uploading and downloading the company's financial statements; a risk rating module for inquiring about loan risk ratings and rating reasons and Advice; Loan Application module to apply for loans and manage the basic information and status of applied loans.

[0024] The loan issuing client includes a loan application review module, which is used to manage loan application information and approve loans; a loan supervision module, which is used to manage loan information, review...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com