A credit risk assessment model generation method based on machine learning and related equipment

A risk assessment model and machine learning technology, applied in the field of machine learning-based credit risk assessment model generation, can solve problems such as increasing the iteration cycle of the machine learning model, and achieve the effect of shortening the iteration cycle

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0038] It should be understood that the specific embodiments described here are only used to explain the present invention, not to limit the present invention.

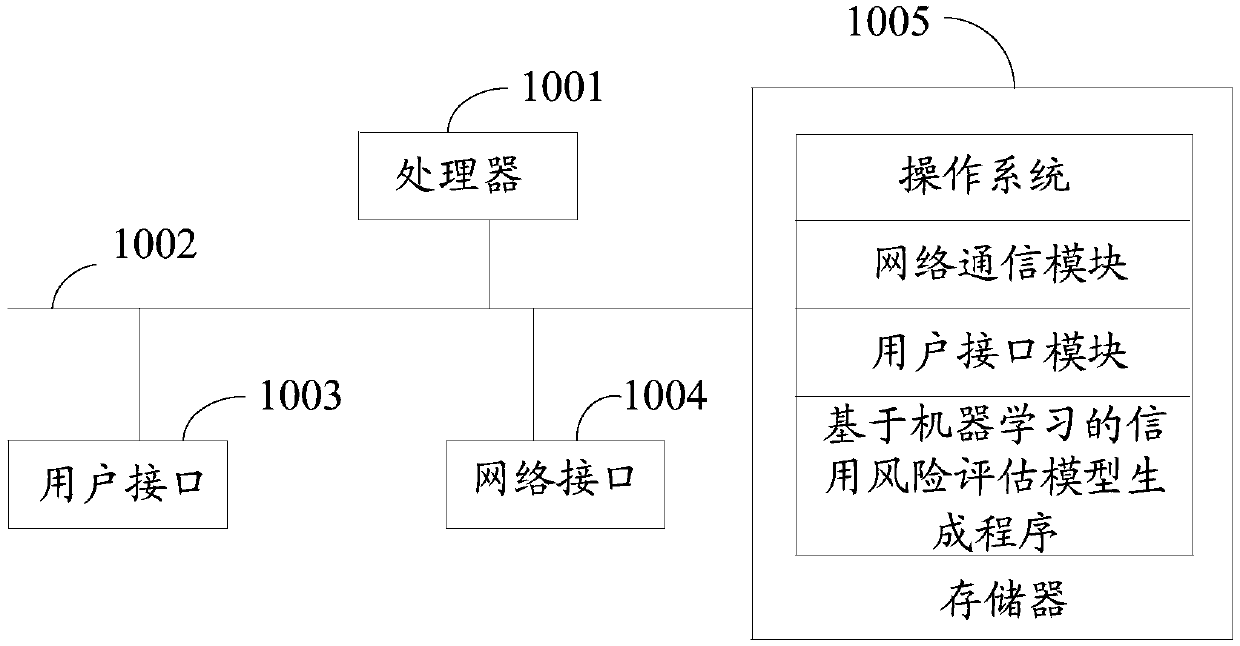

[0039] refer to figure 1 , figure 1 It is a schematic structural diagram of a terminal device in the hardware operating environment involved in the solution of the embodiment of the present invention.

[0040] like figure 1 As shown, the terminal device may include: a processor 1001 , such as a CPU, a communication bus 1002 , a user interface 1003 , a network interface 1004 , and a memory 1005 . Wherein, the communication bus 1002 is used to realize connection and communication between these components. The user interface 1003 may include a display screen (Display) and an input unit such as a button, and the optional user interface 1003 may also include a standard wired interface and a wireless interface. Optionally, the network interface 1004 may include a standard wired interface and a wireless interface (such a...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com