A credit risk monitoring method integrating a deep belief network and an isolated forest algorithm

A technology of deep belief network and forest algorithm, applied in the field of computer software, can solve the problems of less related research and achieve the effect of improving classification performance

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

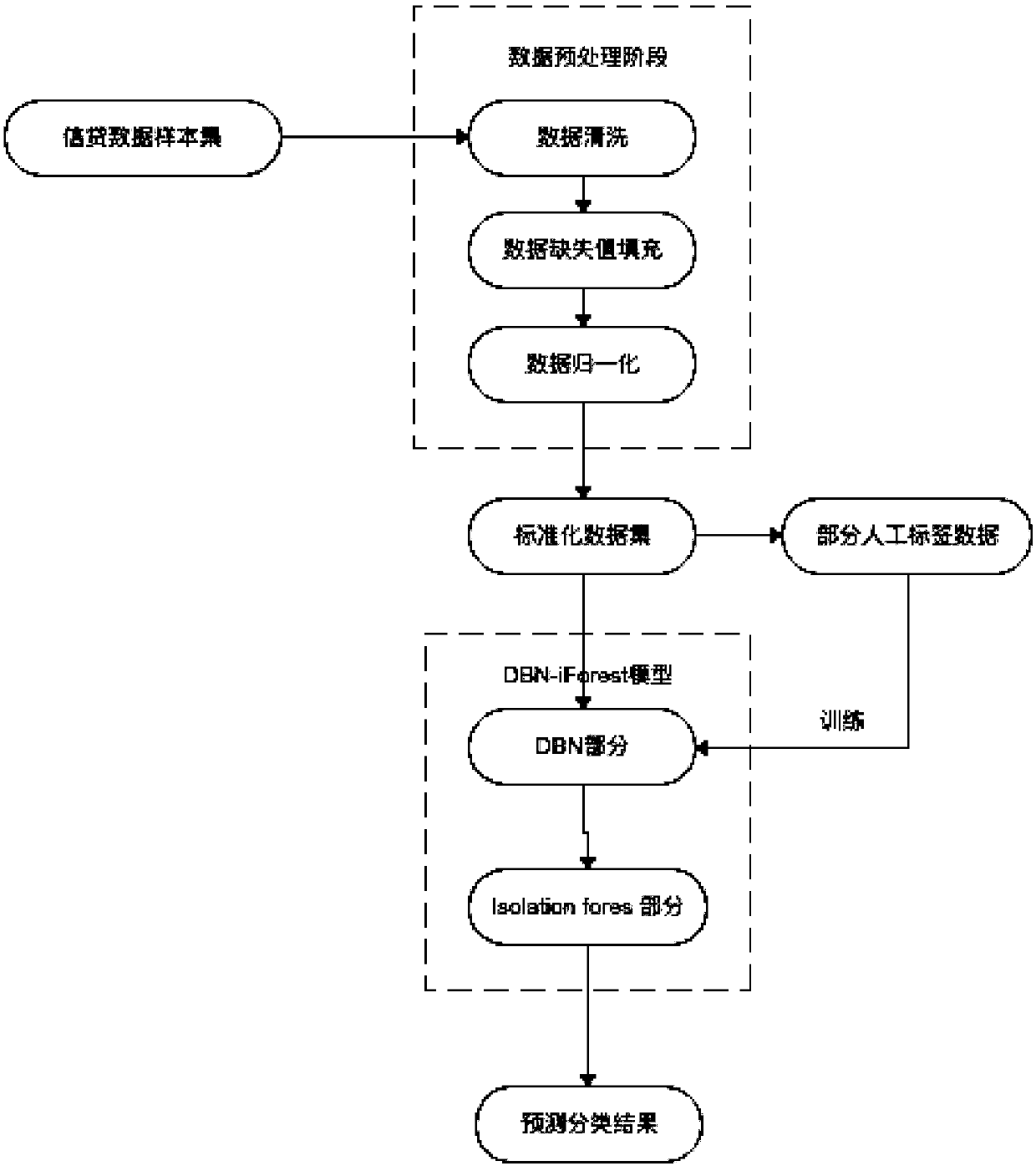

[0020] The invention uses a deep belief network to perform feature learning on high-dimensional data, obtains dimensionally reduced data as an input of an isolated forest algorithm, and improves the classification performance of the isolated forest algorithm for abnormal detection on high-dimensional data.

[0021] figure 1 It is a scheme diagram of the isolation forest algorithm classification method integrated with the deep belief network. First, data cleaning, missing value filling and data normalization are performed on the original financial transaction data, and finally the required data set is randomly sampled for the experiment, and finally standardized training subsets and test subsets are formed. The second part is the DBN data dimensionality reduction part and the optimized isolation forest algorithm, namely step 2, step 3 and step 4. The implementation of these two parts will be introduced in detail below.

[0022] Regarding step 2, construct a deep belief network...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com