Credit assessment model training and assessment method and device

A credit evaluation and training method technology, applied in data processing applications, instruments, finance, etc., can solve the problems of complex calculation process and poor explainability, and achieve the effects of reducing bad debt rate, high accuracy, and high work efficiency

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0061] The method and device proposed by the present invention will be further described in detail below with reference to the embodiments and accompanying drawings.

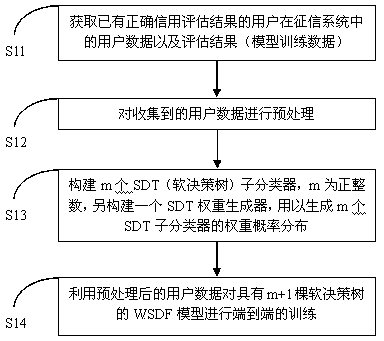

[0062] The flow chart of the credit evaluation model training method based on weighted soft decision forest in this embodiment is shown in the attached figure 1 Shown, the credit evaluation model training method that the present invention proposes is used for training WSDF credit evaluation model, mainly comprises the following steps:

[0063] S11. Obtain user data and evaluation results (model training data) in the credit investigation system of users who have correct credit evaluation results.

[0064] Specifically, user data should have certain relevance or practical significance, including but not limited to demographic characteristics (age, gender, education, occupation, etc.), user asset information (bank deposits, marketable bonds, fixed assets ), social network relationship, transaction behavior and dat...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com