Online lender credit-rating method based on factor score K-Means clustering

A technology of factor scoring and borrowers, applied in the information field, can solve problems such as high default rate, large number of borrowers, and influence, and achieve the effect of reducing index dimensions, significant differences, and reducing the amount of calculation

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment

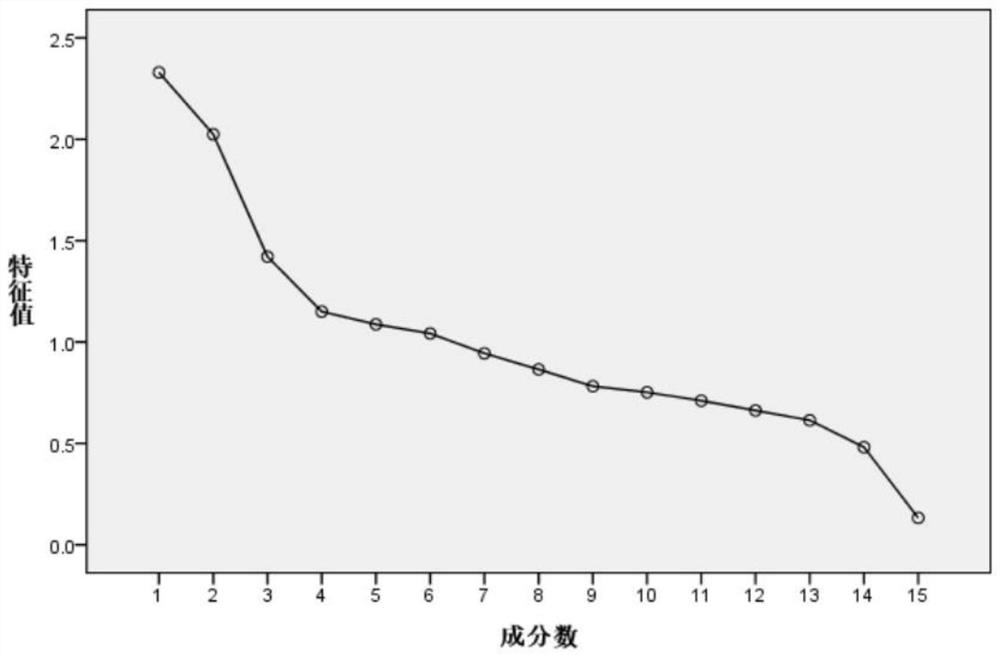

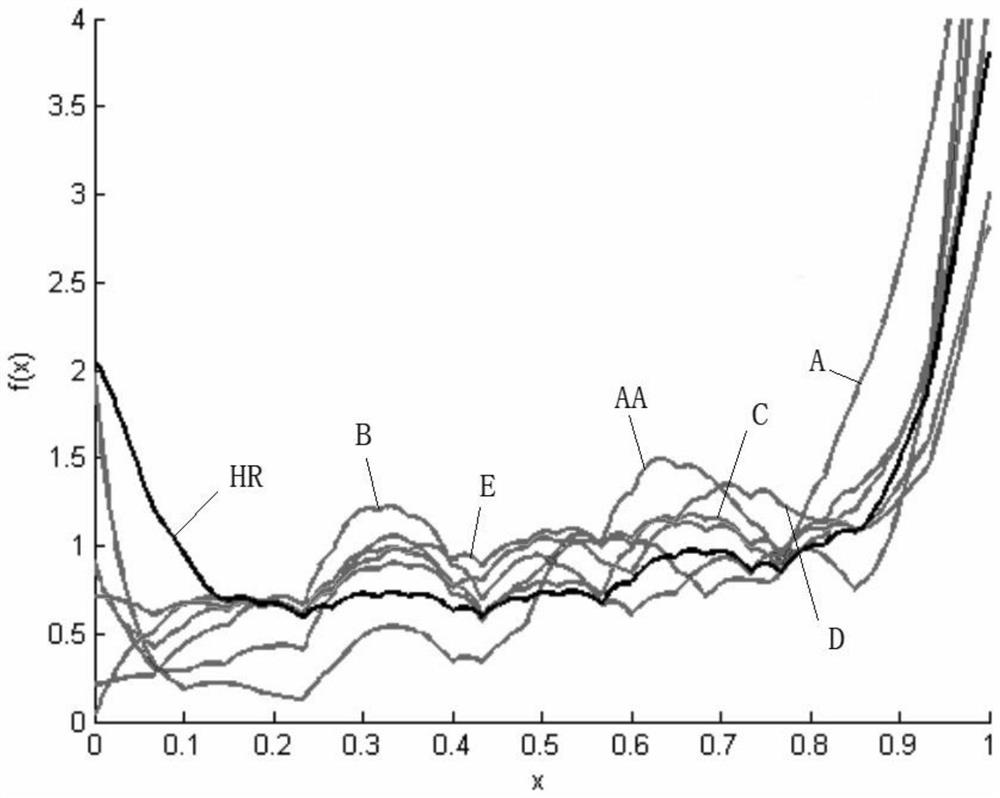

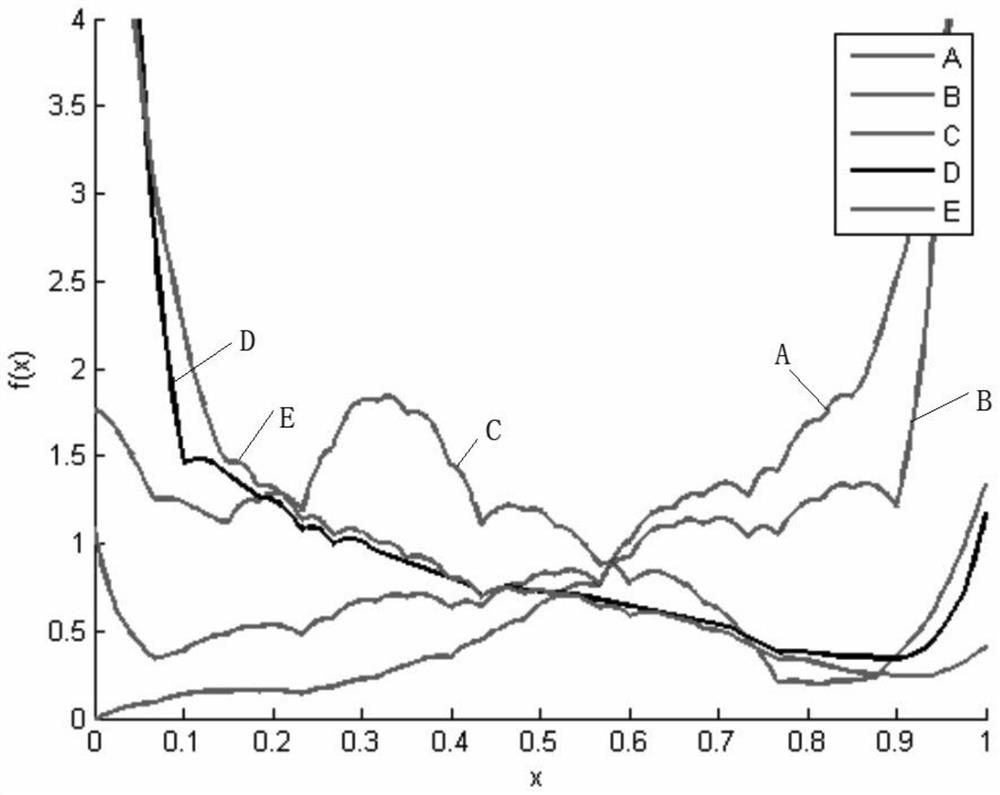

[0035] Embodiment: the online loan borrower's credit rating method based on factor score K-Means clustering, comprises the following steps:

[0036] S1: Obtain sample data, take the sample of underlying assets that have been traded on a Chinese online lending platform as an example, and select 14,558 defaulted underlying assets that have occurred in breach of contract as samples, and preprocess them first, so that extreme and missing data are processed Elimination, the preprocessing also includes converting the text information into digital information (that is, the scoring standards of some qualitative indicators, as shown in Table 1), and a total of 13467 sets of data are obtained.

[0037]

[0038]

[0039] Table 1

[0040] Since there are both positive indicators (repayment ratio, certification information, regional per capita disposable income) and negative indicators (amount, interest rate, term, serious overdue ratio) and interval indicators (age) in the sample da...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com