Car loan risk control model generation method and device and score card generation method

A model generation and scorecard technology, applied in the field of credit risk control, which can solve problems such as no big data risk control solution yet

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

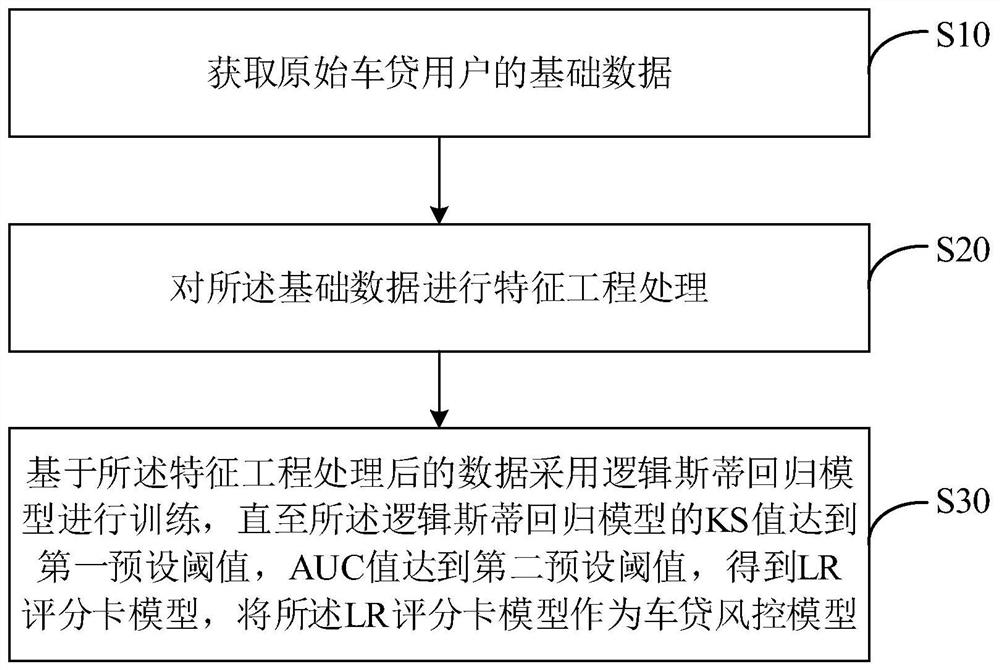

[0062] The present invention proposes a method for generating a car loan risk control model. The method includes: obtaining the basic data of the original car loan user; performing feature engineering processing on the basic data; The regression model is trained until the KS value of the logistic regression model reaches the first preset threshold, and the AUC value reaches the second preset threshold, so as to obtain the LR scorecard model, and use the LR scorecard model as a car loan risk control Model.

[0063] According to the current existing problems, this embodiment formulates a method for generating a car loan risk control model. The logistic regression algorithm can predict the default risk of the car loan scene and provide an effective measurement method for the access of the car loan business. .

[0064] In a specific embodiment, such as figure 2 As shown, the method includes:

[0065] S10. Obtain the basic data of the original car loan user, wherein the basic d...

Embodiment 2

[0119] refer to Figure 7 , as an implementation of the method for generating the above-mentioned car loan risk control model, this application provides an embodiment of a device for generating a car loan risk control model. figure 2 The method embodiments shown correspond.

[0120] Such as Figure 7 As shown, the car loan risk control model generation device of this embodiment includes:

[0121] The obtaining module is used to obtain the basic data of the original car loan user;

[0122] A feature engineering processing module, configured to perform feature engineering processing on the basic data;

[0123] A model generation module, configured to train using a logistic regression model based on the feature engineering processed data until the KS value of the logistic regression model reaches a first preset threshold, and the AUC value reaches a second preset threshold , get the LR scorecard model, and use the LR scorecard model as the car loan risk control model.

[01...

Embodiment 3

[0127] The LR scorecard model is a linear classification model based on logistic regression. It adopts binning and discretization methods and WOE value interval coding. Under the premise of processing and intervention by modelers and business experts, it can have High predictive performance is a classic algorithm model widely used in the field of credit risk control, such as scoring the credit level of customers.

[0128] Such as Figure 8 As shown, the application provides a method for generating a scorecard, the method comprising:

[0129] S130. For each characteristic variable of the car loan risk control model described in Embodiment 1 and Embodiment 2, compare the regression coefficient of the car loan risk control model with the WOE value corresponding to each binning interval of the characteristic variable Multiply to get the score of the binning interval

[0130] S132. Perform standard normalization on the scores to obtain a standard score card.

[0131] In a specif...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com