Automatic feature engineering credit risk evaluation system and method

A technology of risk assessment and feature engineering, applied in data processing applications, instruments, complex mathematical operations, etc., it can solve the problem that nonlinear models cannot establish causal connections, cannot predict results interpretation, omissions, etc., and achieve a significant model classification effect. Effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0029] The present invention will be further described in detail with reference to the accompanying drawings and embodiments.

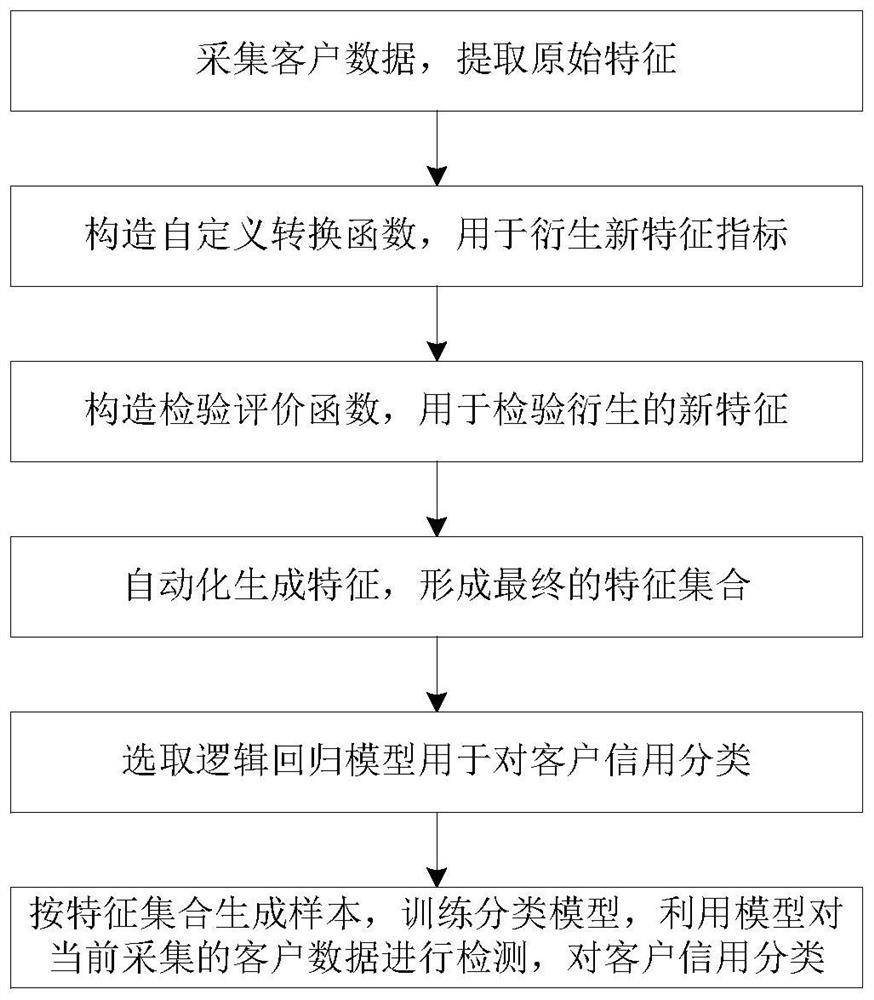

[0030] Such as figure 1 As shown, the automatic feature engineering credit risk evaluation method of the present invention includes the following six steps.

[0031] Step 1, define samples and construct original features.

[0032] First of all, understand the characteristics of the customer group, while ensuring the pass rate, it is goal-oriented to reduce the credit overdue rate. It is necessary to determine the observation period and performance period of the modeling sample, the definition of good and bad samples, and the sampling method. At the same time, for the collected customer data, the original features are constructed and added to the feature set.

[0033] In the credit business scenario, samples are divided into two categories: good and bad. Good samples are no overdue customers. On the basis of accepting a certain degree of overdue, i...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com