System and Method of Recurring Payment Transactions

a payment system and payment method technology, applied in the field of processing recurring payment transactions, can solve the problems of financial harm to these entities, affecting the security of the payment system, and not being applicable for internet purchases or recurring bill payments, so as to facilitate secure payment transactions

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

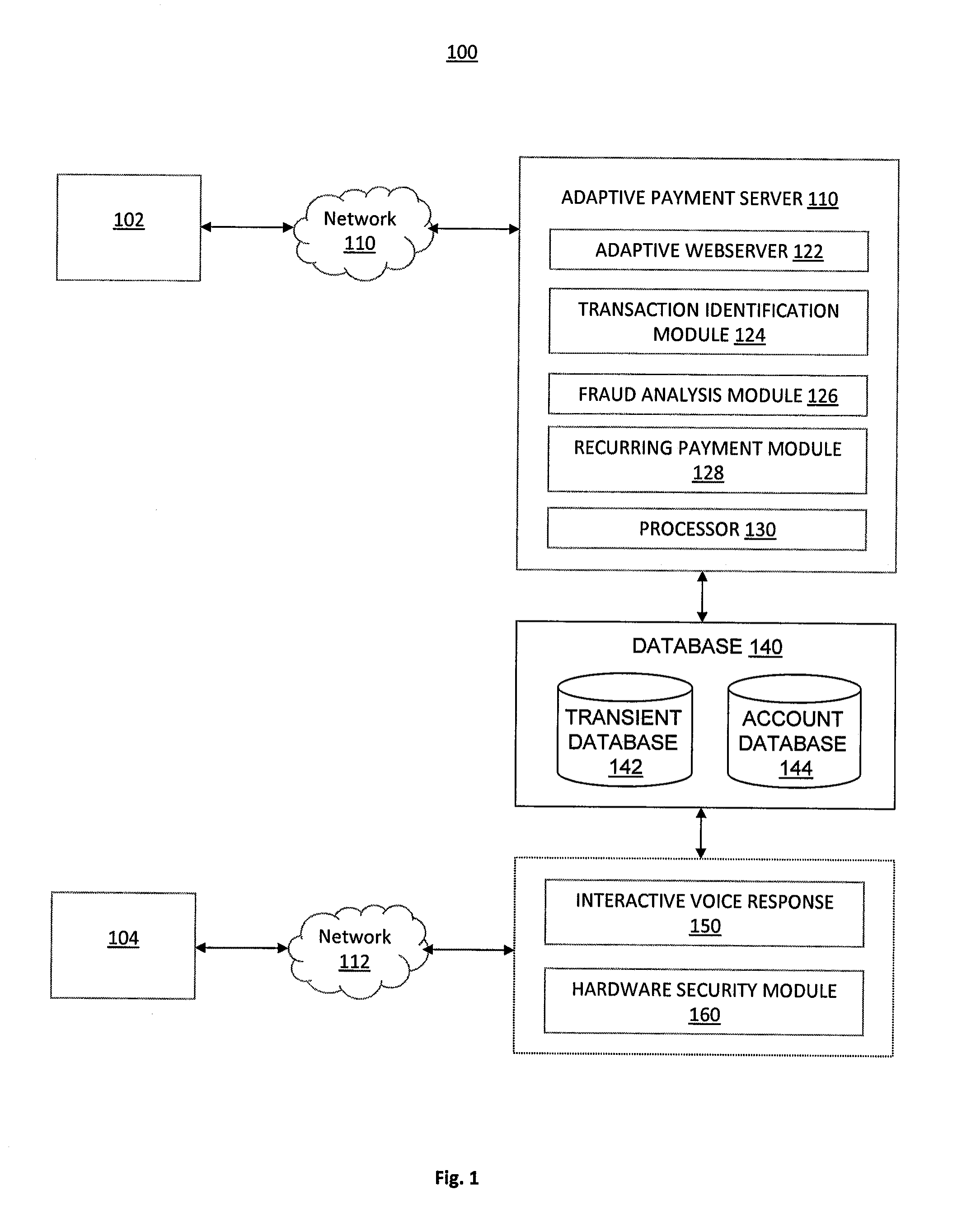

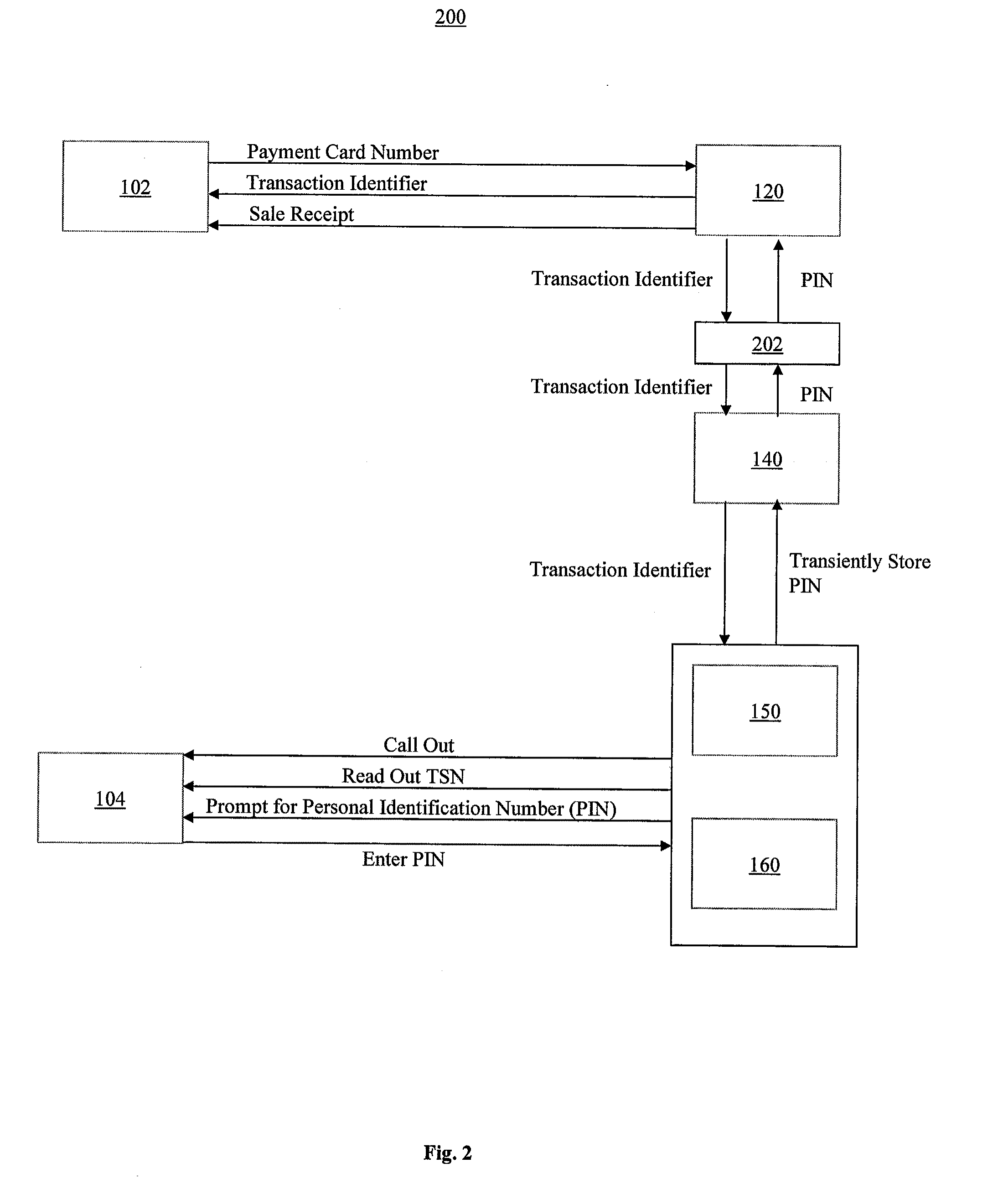

[0021]According to various implementations of the invention, various systems and methods may facilitate secure PIN-based payment transactions over the Internet by receiving payment card numbers from a payor over a first communication channel, such as, for example, over the Internet, and collecting PIN input from the payor via another communication channel by, for example, calling the payor for PIN input using an automated Interactive Voice Response (IVR) system. In this manner, even if the Internet communication channel, for example, is compromised, the PIN input may remain secure over another communication channel.

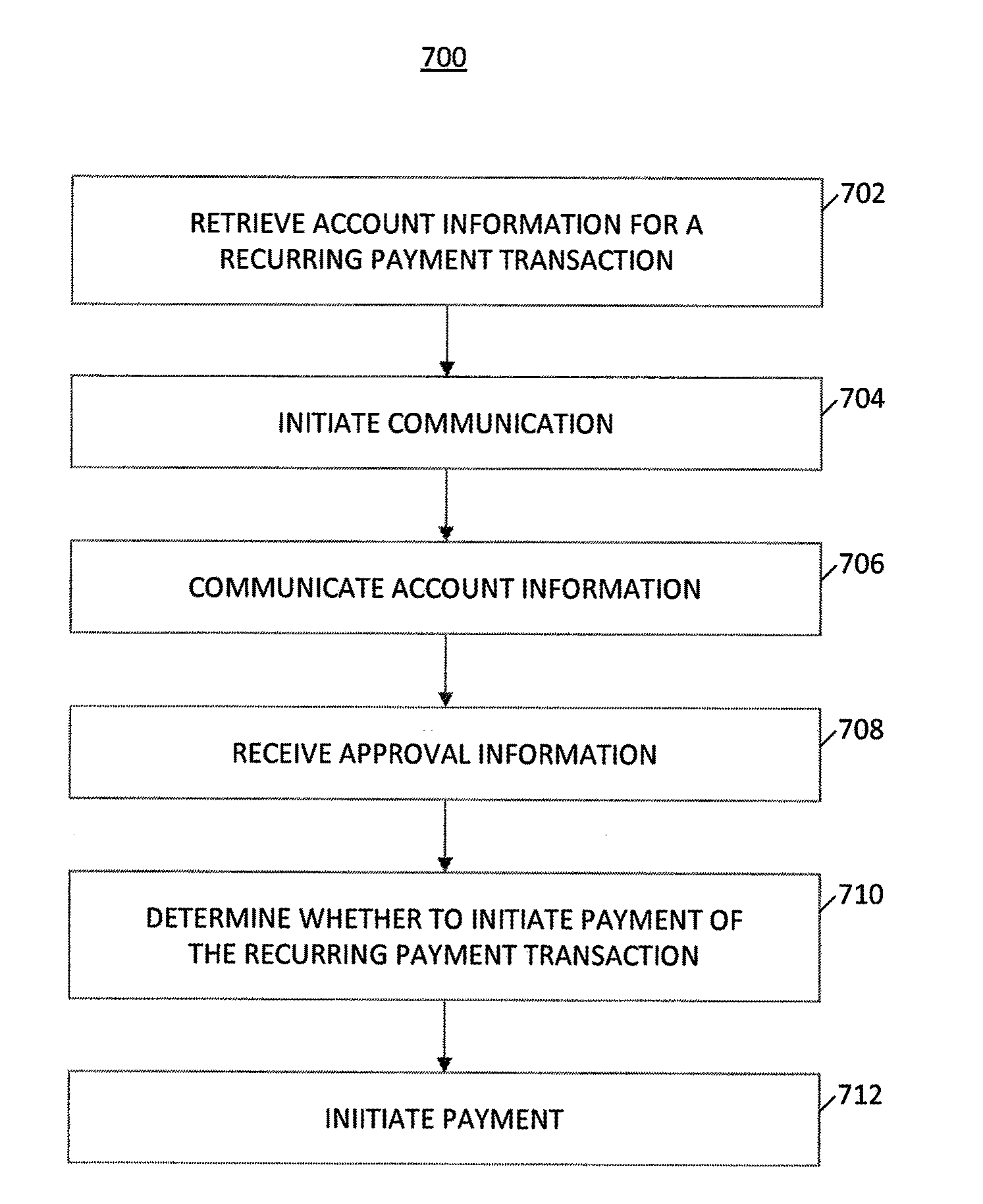

[0022]According to various implementations of the invention, various systems and methods may facilitate recurring payment transactions by initiating a communication on a communication channel to the payor (such as, for example, by calling the payor) on or before a payment date and prompting for input of authorization information by the payor. In this manner, the payor may...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com