Self authentication

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

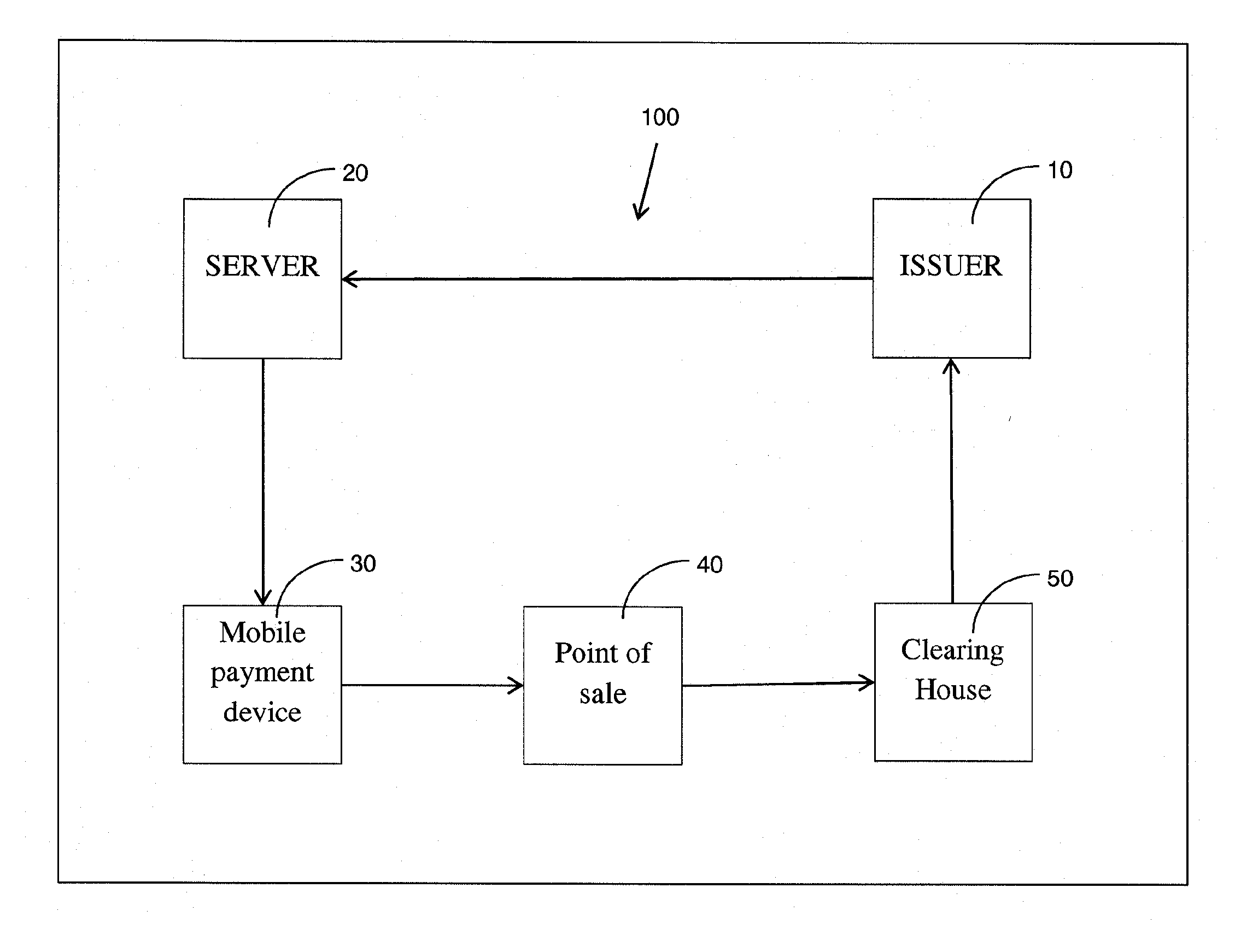

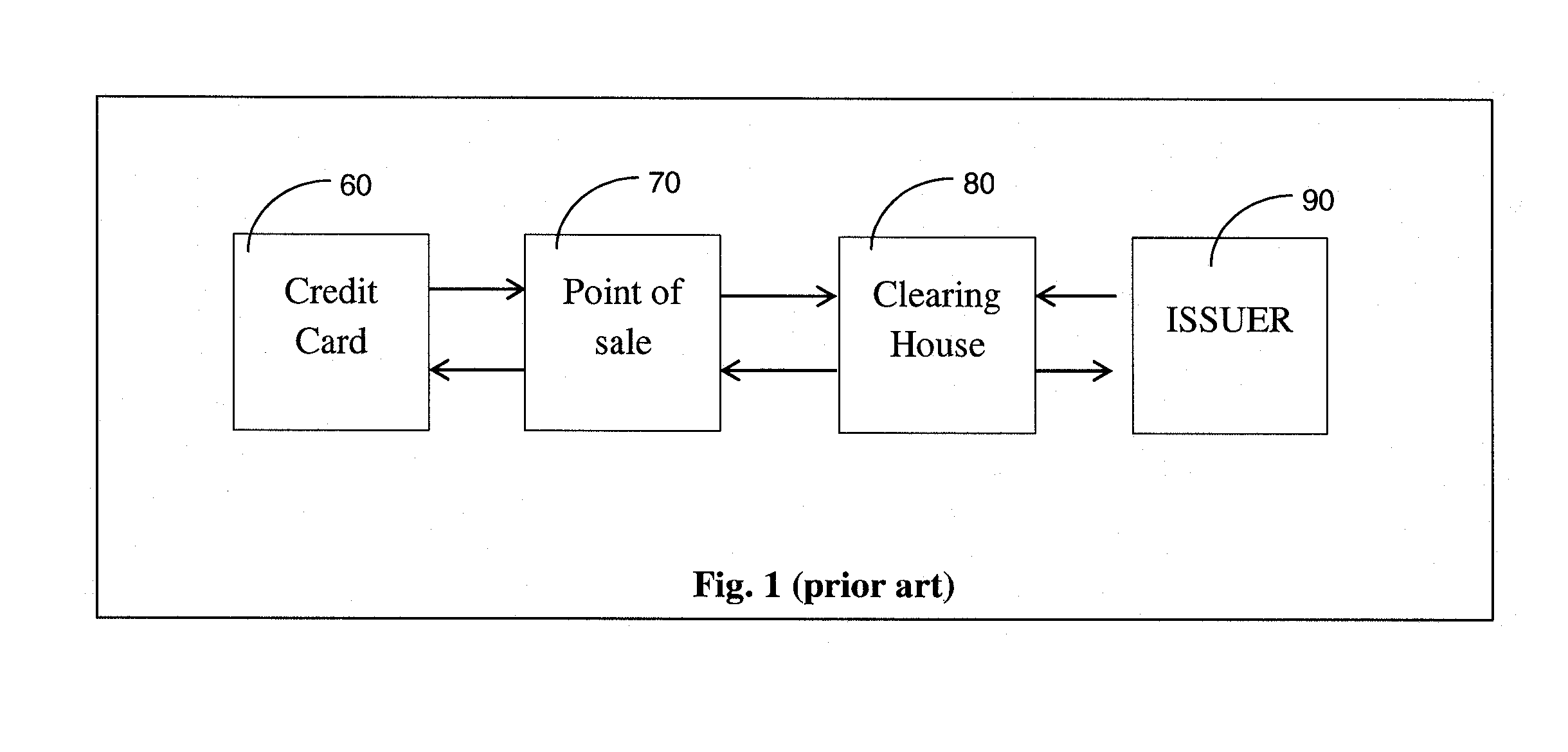

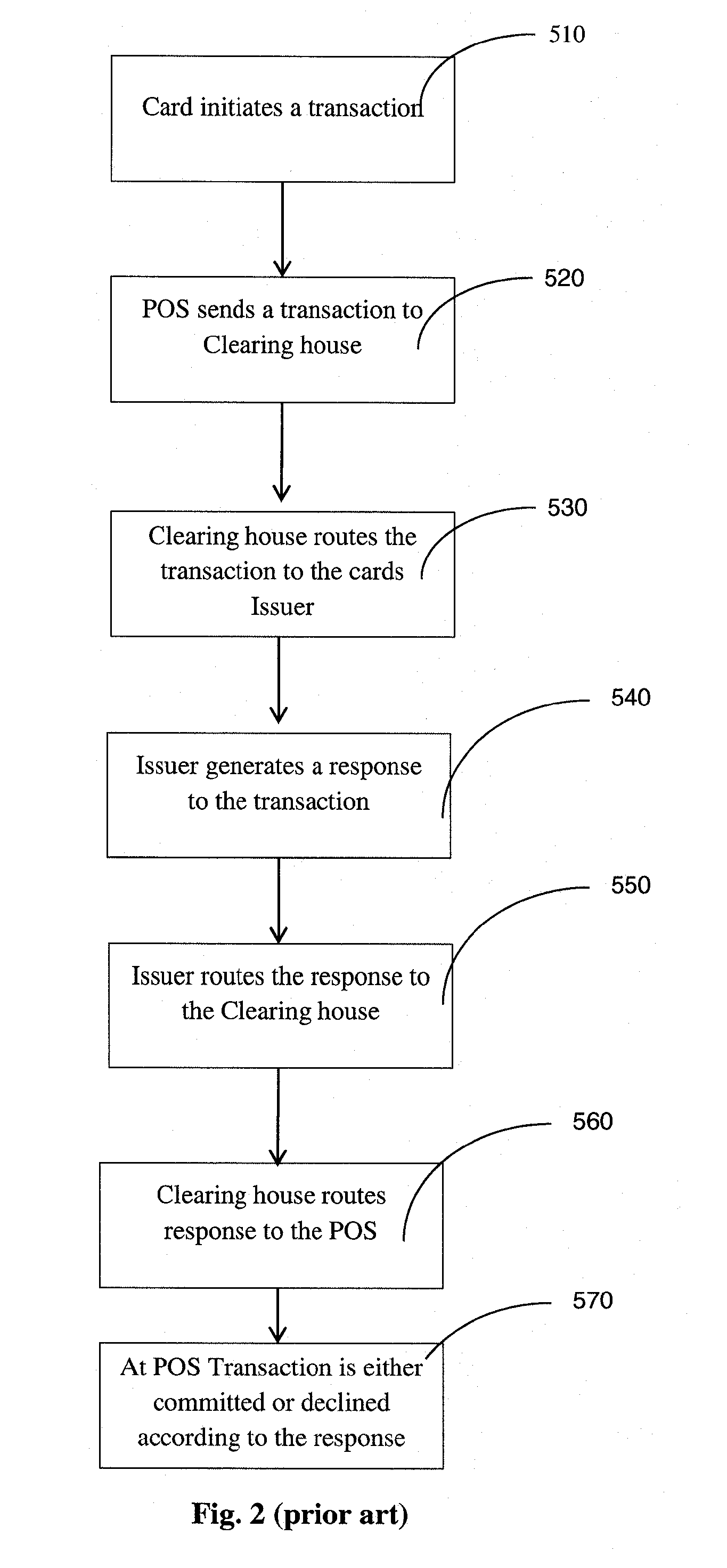

Image

Examples

Embodiment Construction

[0085]The following terminology will be used throughout the description:

[0086]ACH

[0087]Short for “Automated Clearing House”, a nationwide electronic network for financial transactions. The network clears credit and debit transactions. Rules and regulations for the network are set by NACHA and the Federal Reserve.

[0088]Acquirer, Merchant acquirer

[0089]Either a bank, a processor or independent sales organization (ISO) handling the merchant's card acceptance. A processor or ISO will work with an acquiring bank, which is needed to officially accept payment on behalf of the merchant.

[0090]AML / ATF

[0091]Anti-Money Laundering / Anti-Terrorist Financing

[0092]Associations, also referred to as “Payment brands” or “Network”

[0093]In the world of credit and debit cards, this is a legacy term that referred to ownership of networks by groups of financial institutions. Today, the word is sometimes used to refer to companies such as MasterCard, Visa, American Express, Discover, STAR, NYCE and others wh...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com