System and method for estimating credit risks

A credit and risk technology, applied in the field of credit risk management, can solve problems such as the inability to achieve objective, accurate and efficient evaluation, and achieve the effect of efficient evaluation and improved accuracy

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0047] In order to make the object, technical solution and advantages of the present invention clearer, the present invention will be described in further detail below in conjunction with specific embodiments and with reference to the accompanying drawings.

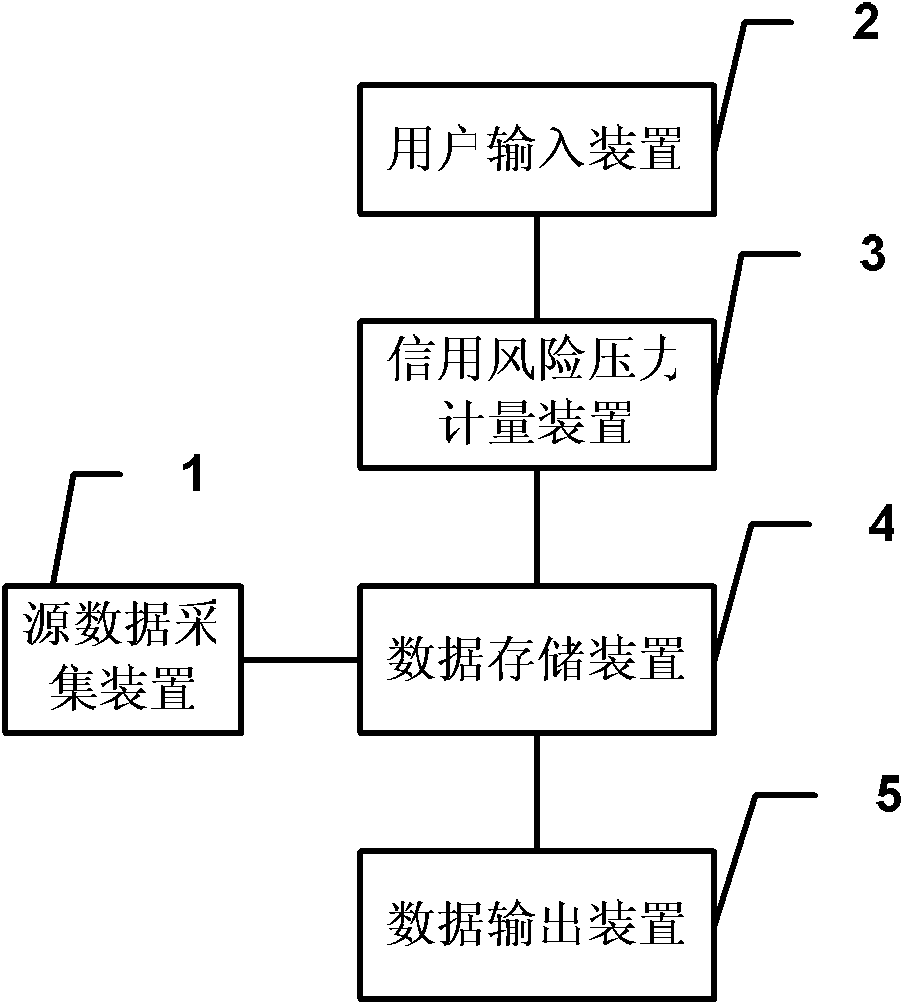

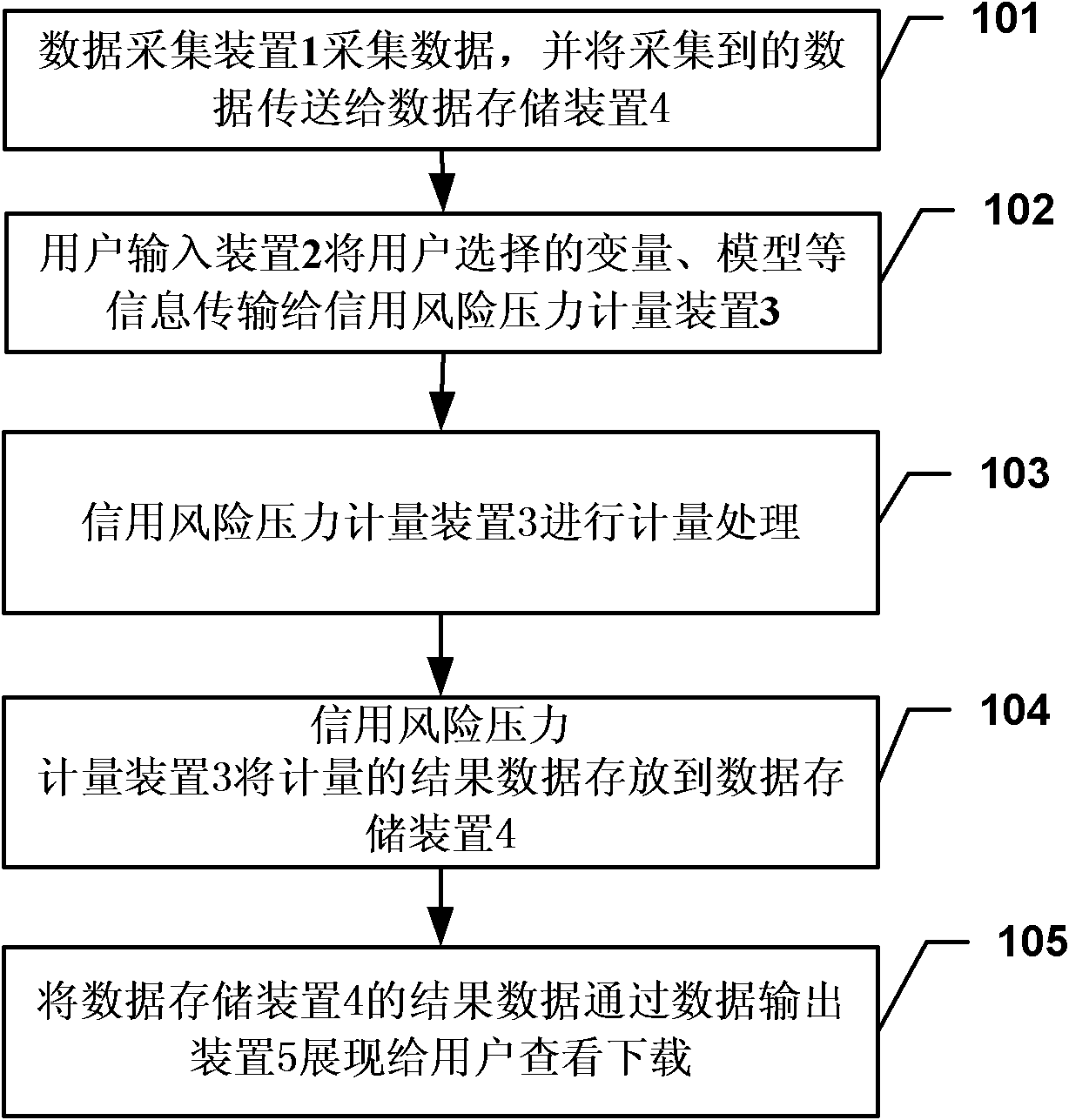

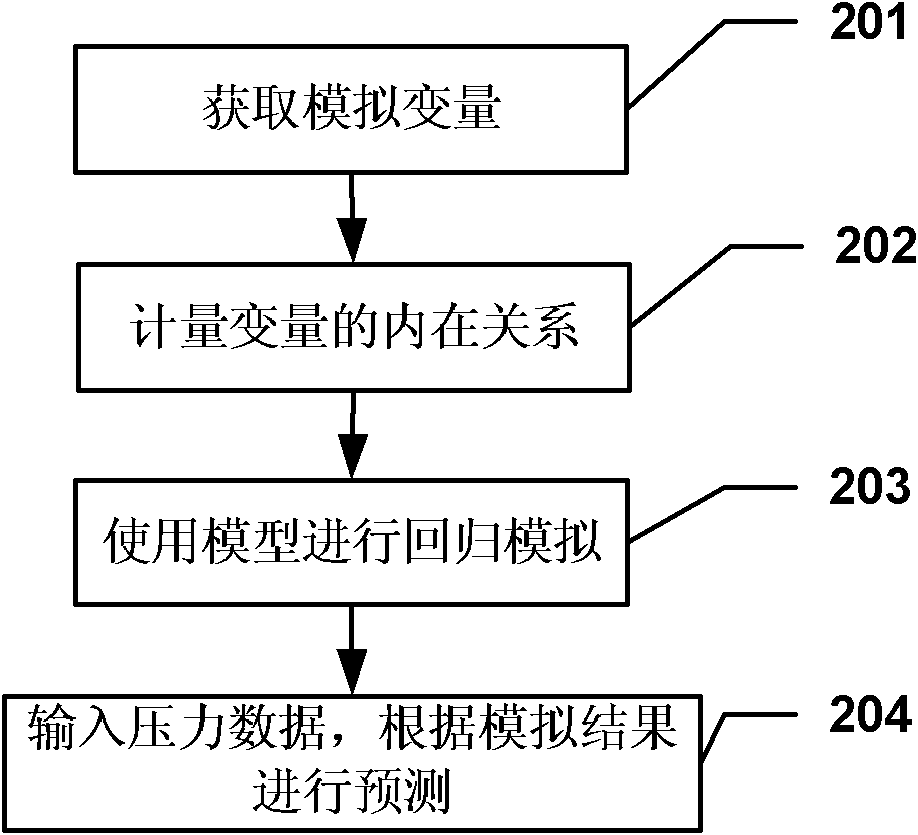

[0048] The system and method for evaluating credit risk provided by the present invention adopts a "top-down" (Top-Down) macro model method to automatically collect the source data of each business system, and perform logical regression on these source data , panel regression, time series analysis and other means to measure and evaluate credit risk in extreme cases, generate evaluation result data, and store the generated evaluation result data in the data storage device. The final evaluation result is the credit risk analysis data in extreme cases (such as PD after pressure, economic capital EC after pressure, non-performing loan ratio NPLR after pressure, etc.). Describe in detail below with reference to the accompanyin...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com