Bank credit system risk assessment method and device

A risk assessment and credit technology, applied in the field of information security, can solve problems such as the accuracy of assessment results, lack of globality, and difficulty in achieving expected assessment results

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

[0056] The basic principle of the construction and use method of the risk assessment model based on the inter-enterprise capital circulation network described in the present invention is as follows:

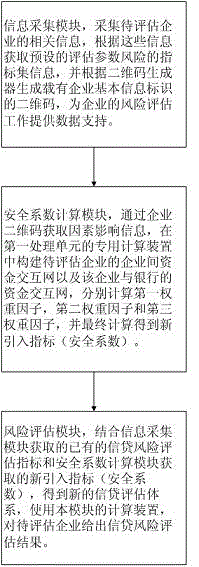

[0057] see figure 1 , the evaluation model used in the present invention is mainly divided into three modules, namely, an information collection module, a safety coefficient calculation module and a risk assessment module, corresponding to the aforementioned first processing unit, second processing unit and third processing unit respectively. This model is composed of the above three modules working together to complete the enterprise credit risk assessment. Each module is introduced separately as follows:

[0058] Information collection module (first processing unit):

[0059] This module completes the preprocessing of the original information of the enterprise, including data cleaning and information collection, processes the original information with chaotic structure, obtai...

Embodiment 2

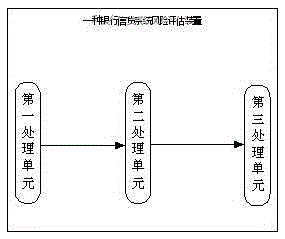

[0065] see figure 2 According to the present invention, a bank credit system risk assessment device includes three processing units, which are respectively a first processing unit, a second processing unit and a third processing unit.

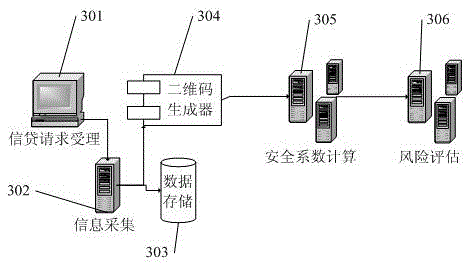

[0066] see image 3 , the first processing unit includes components 301, 302, 303 and 304 to complete information collection. The two-dimensional code identification of the enterprise to be evaluated generated by component 304 in this unit is used as an information source for follow-up work, and at the same time, the processed information is transmitted to the storage component 303 for permanent use. The second processing unit completes the calculation of the newly introduced index (safety factor). This unit uses the information provided by the first processing unit to complete the construction of the inter-enterprise fund interaction network and the enterprise-bank fund interaction network in component 305, respectively. Each weight factor ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com