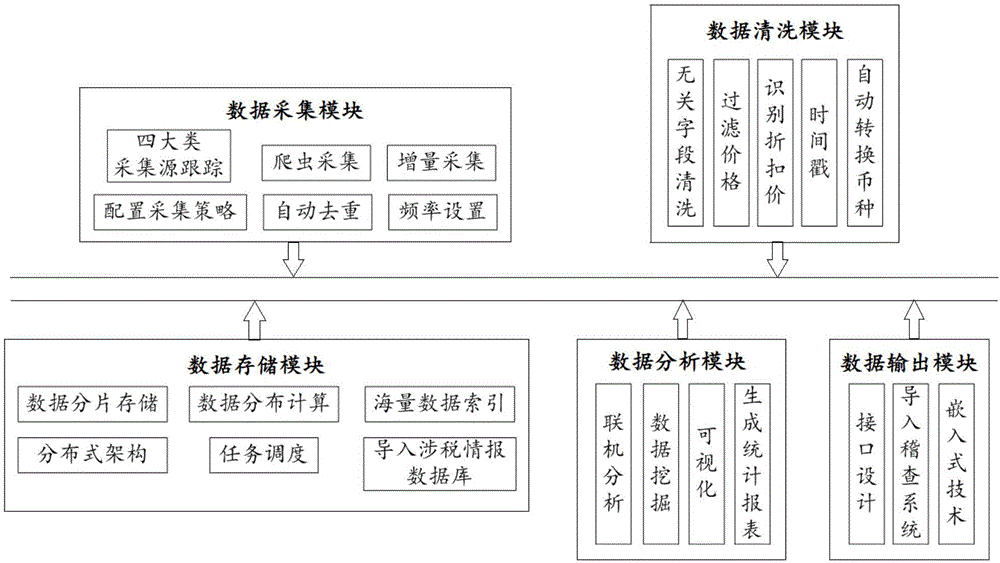

Big data tax-related information analysis system

An analysis system and big data technology, applied in the field of big data analysis, can solve the problems of tax management vacuum, tax management department too late to study collection and management countermeasures, tax loss and other problems, to achieve stable performance, high storage and calculation speed, and low overall cost. Effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment

[0025] Example: Regarding the determination of the identity of the taxpayer and the nature of the enterprise, the tax authority should be able to correctly determine the taxpayer and transaction activities within its jurisdiction. This determination is based on the actual physical existence. Therefore, in traditional transaction activities In , there is no problem in determining the identity of the taxpayer. But in the environment of the Internet, the store on the Internet is not a physical market, but a virtual market, and any product on the Internet cannot be touched. In such a market, shopping malls, storefronts, and salespersons in the traditional concept cannot be seen, and even the procedures involving commodities, including contracts, documents, and even funds, all appear in a virtual way; moreover, Internet users have Concealment and mobility, both parties conducting transactions through the Internet can hide their names and places of residence, and companies can easil...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com