Multi-module automatic trading system based on network distributed computing

A distributed computing and trading system technology, applied in the field of multi-module automated trading systems, can solve problems such as support restrictions, market prices, and transaction delays, achieve low latency, improve testing and evaluation efficiency, and reduce the threshold for quantitative trading.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0027] The following will clearly and completely describe the technical solutions in the embodiments of the present invention with reference to the drawings in the embodiments of the present invention.

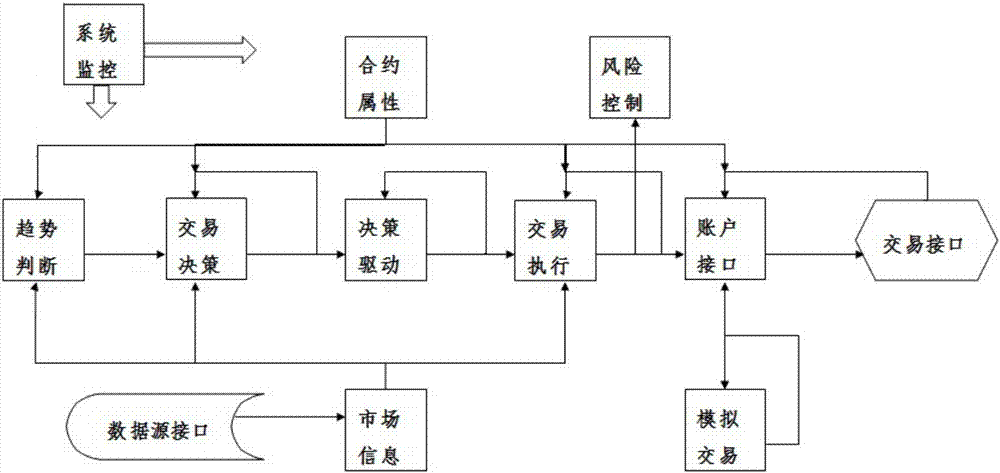

[0028] see figure 1 , is a schematic structural diagram of a multi-module automated trading system based on network distributed computing provided by the present invention. The multi-module automated trading system based on network distributed computing of the present invention is mainly used in the scope of financial quantitative transactions. The trading varieties cover securities, futures, Options, foreign exchange, funds and other financial products that can be used for quantitative transactions, providing database, strategy modeling, historical review and evaluation, strategy trading, program trading, risk control and other services.

[0029] The multi-module automated trading system based on network distributed computing of the present invention includes a historical and...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com