A Financial Fraud Behavior Prediction Method Based on Mobile Device Behavior Data

A mobile device and prediction method technology, applied in data processing applications, electrical digital data processing, error detection/correction, etc., can solve problems such as affecting user experience, large volume of behavior data, and large amount of code, and achieves information mining. Rough, improved performance and efficiency, and clear coding logic

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0047] In order to make the object, technical solution and advantages of the present invention clearer, the present invention is described below through specific embodiments shown in the accompanying drawings. It should be understood, however, that these descriptions are exemplary only and are not intended to limit the scope of the present invention. Also, in the following description, descriptions of well-known structures and techniques are omitted to avoid unnecessarily obscuring the concept of the present invention.

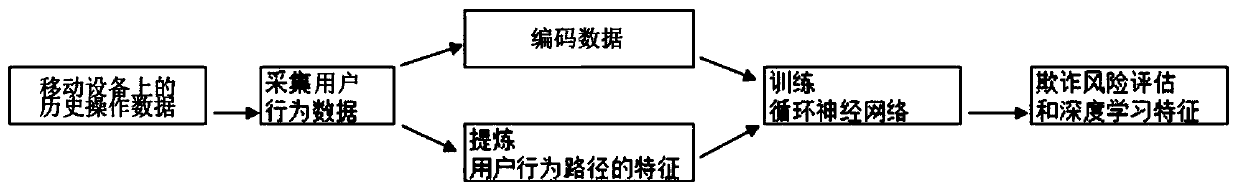

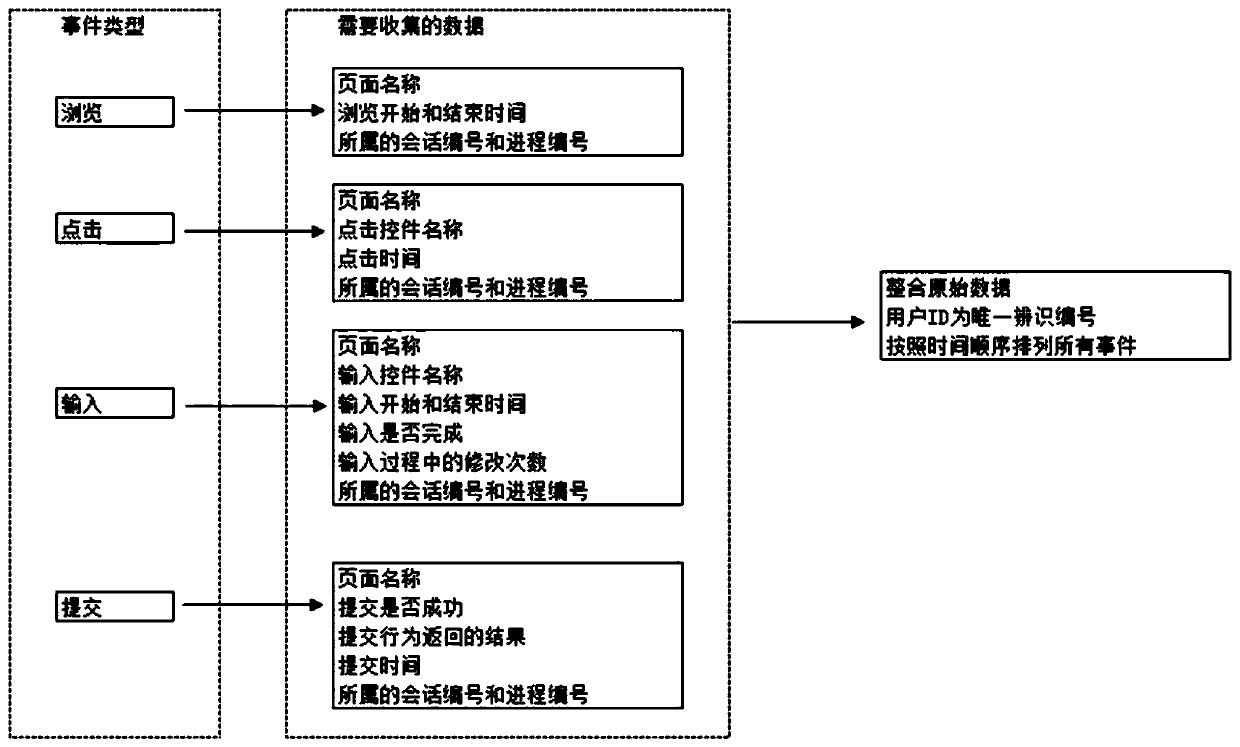

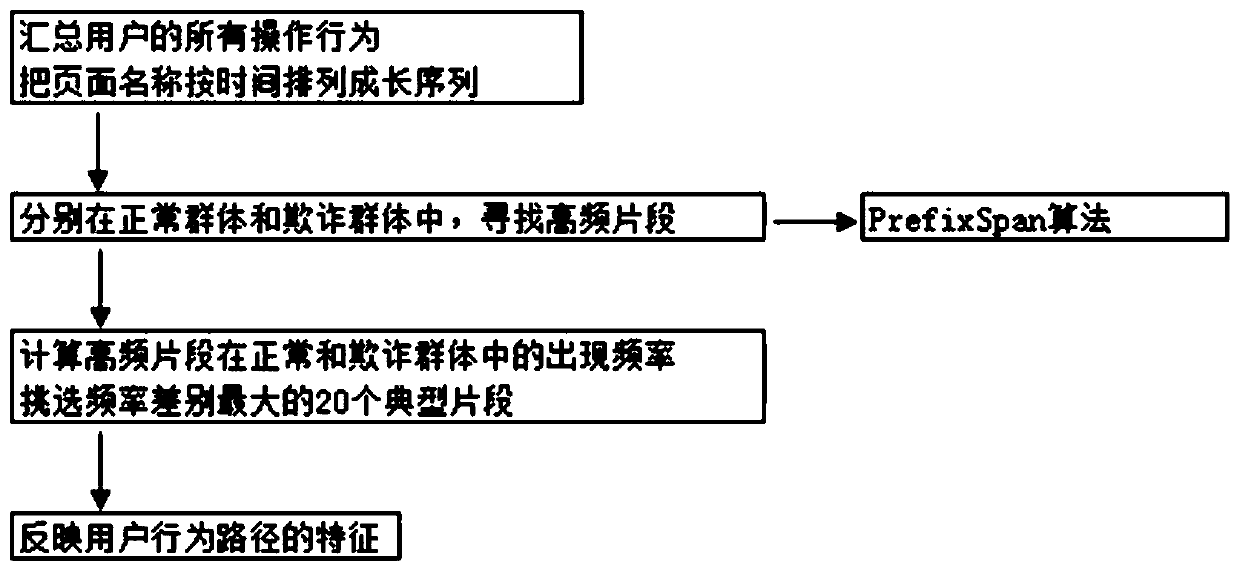

[0048] combine figure 1 Describe this embodiment, the method for predicting financial fraud behavior based on mobile device behavior data of the present invention mines and models the user's behavior data on the mobile device, and digs out the user's behavior habits objectively and quantitatively through the cyclic neural network model , and the prediction probability of fraud risk is given, which makes the behavior data with low utilization rate play a great...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com