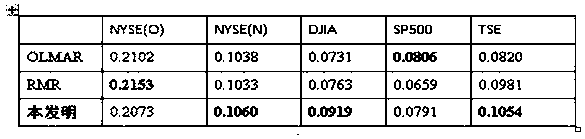

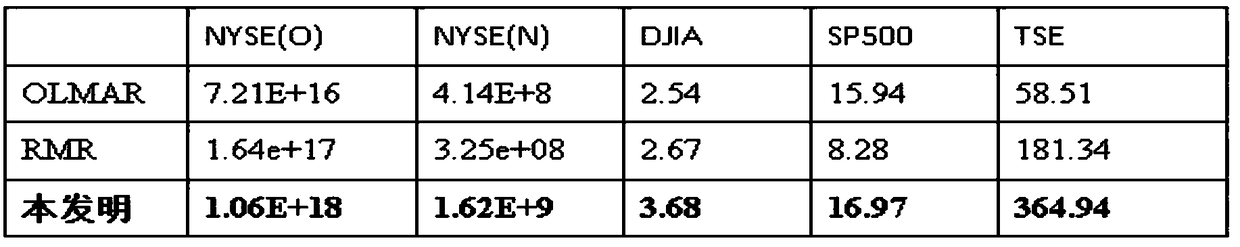

A short-term sparse portfolio optimization system based on alternating direction multiplier criterion

A technology of alternating direction multipliers and asset portfolios, applied in the field of machine learning, can solve problems such as unsatisfactory investment returns

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

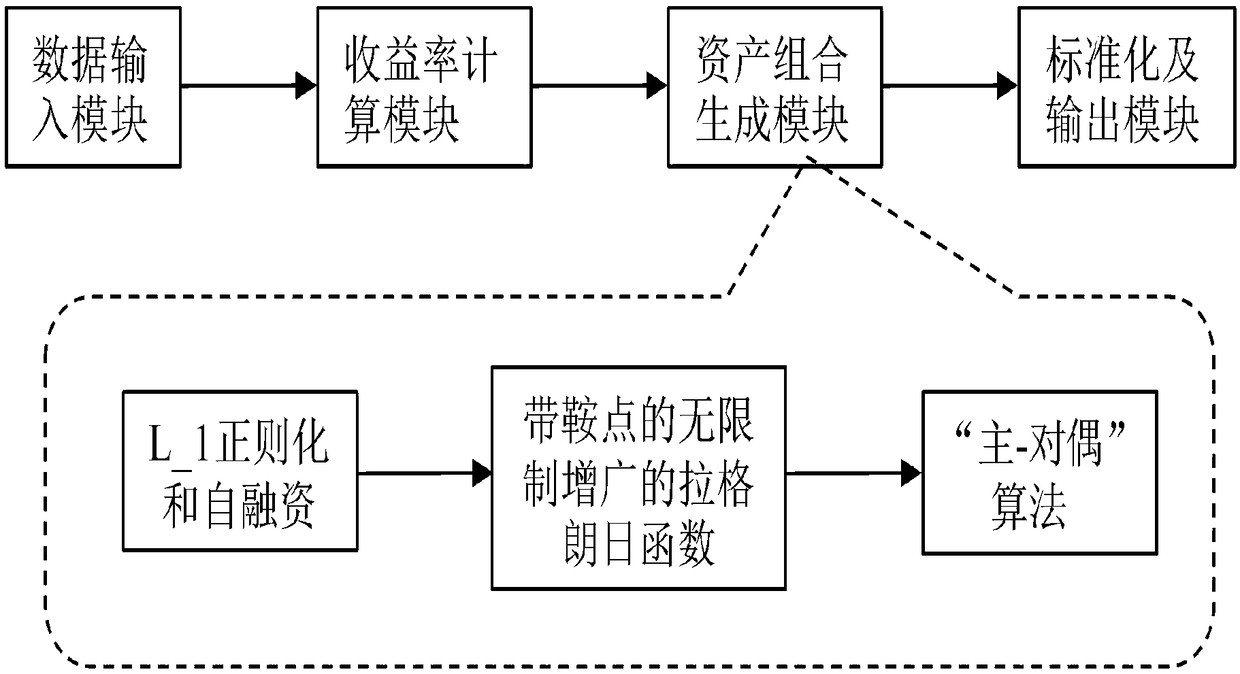

[0093] A short-term sparse asset portfolio optimization system based on the alternating direction multiplier criterion, including a data input module, a yield calculation module, an asset portfolio generation module, a standardization and an output module;

[0094] The data input module is used to collect historical asset price data and transmit it to the yield calculation module;

[0095] The rate of return calculation module is used to calculate the received historical asset price data, obtain the generalized logarithmic rate of return, and transmit it to the asset portfolio generation module;

[0096] The asset portfolio generation module is used to calculate the received generalized logarithmic rate of return and the stored historical asset portfolio by using a solution algorithm based on the alternating direction multiplier criterion to obtain a sparse next-period asset portfolio, and transfer it to the normalization and export module;

[0097] The standardization and ou...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com