In-loan behavior monitoring method and system

A Bank of China and behavioral technology, applied in the field of information processing and application, can solve problems such as increasing bad debts, customer defaults, and low review efficiency, so as to avoid the influence of human factors, improve effectiveness, improve review efficiency and effective loan amount Effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

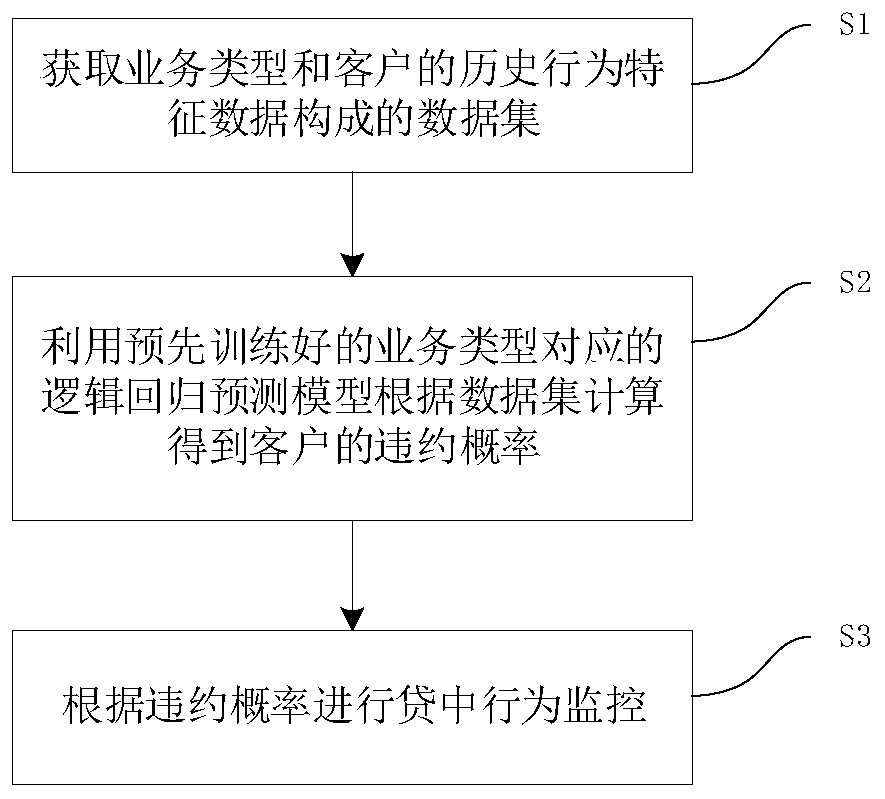

[0039] Embodiment 1 of the present invention provides a method for monitoring loan behaviors, figure 1 A schematic flow diagram of a method for monitoring loan behavior provided by an embodiment of the present invention, such as figure 1 As shown, the method includes the following steps:

[0040] S1: Obtain a data set composed of business type and customer's historical behavior characteristic data.

[0041] For example, customers refer to: borrowers, credit card users and other people related to the loan business. The business types include at least cash loan business, online cash installment business, online consumption installment business, secondary marketing business, etc., among which, cash loan business refers to small Amount cash loan business is a consumer loan business issued to applicants; online cash installment business means that applicants use the credit line in installments; online consumption installment business means that applicants pay bills in installments...

Embodiment 2

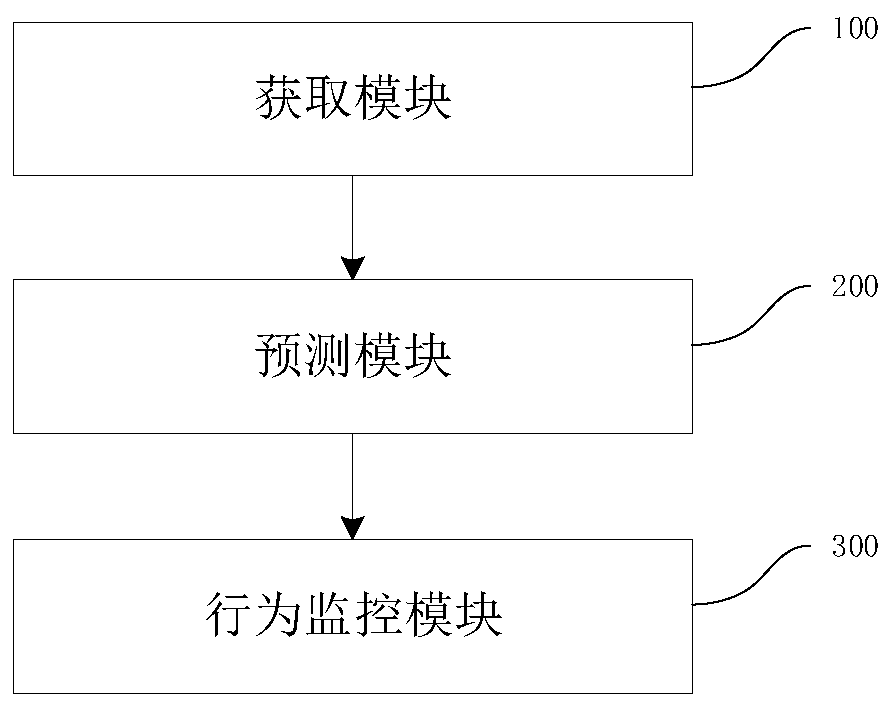

[0085] This embodiment provides a system for monitoring loan behavior, which is used to implement the method for monitoring loan behavior as described in Embodiment 1, such as figure 2 As shown, it is a block diagram of the system structure of the loan behavior monitoring in this embodiment, including:

[0086] Obtaining module 100: used to obtain a data set composed of business type and historical behavior characteristic data of customers;

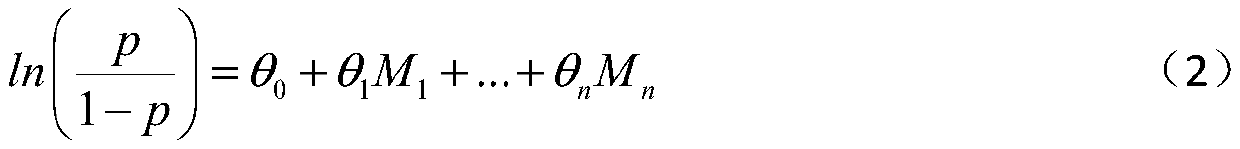

[0087] Prediction module 200: used to calculate the customer's default probability according to the data set by using the pre-trained logistic regression prediction model corresponding to the business type;

[0088] Behavior monitoring module 300: used to monitor the loan behavior according to the probability of default.

[0089] The specific details of each module of the above-mentioned system for monitoring loan behaviors have been described in detail in the method for monitoring loan behaviors corresponding to Embodiment 1, so detail...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - Generate Ideas

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com