Financial risk prediction method and device based on Bayesian deep learning and electronic equipment

A technology of risk prediction and deep learning, applied in neural learning methods, finance, character and pattern recognition, etc., can solve problems such as poor results, difficulty in improving prediction results, and many parameters, so as to achieve stable learning effects and enhance general The effect of optimizing prediction ability and improving fitting accuracy

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

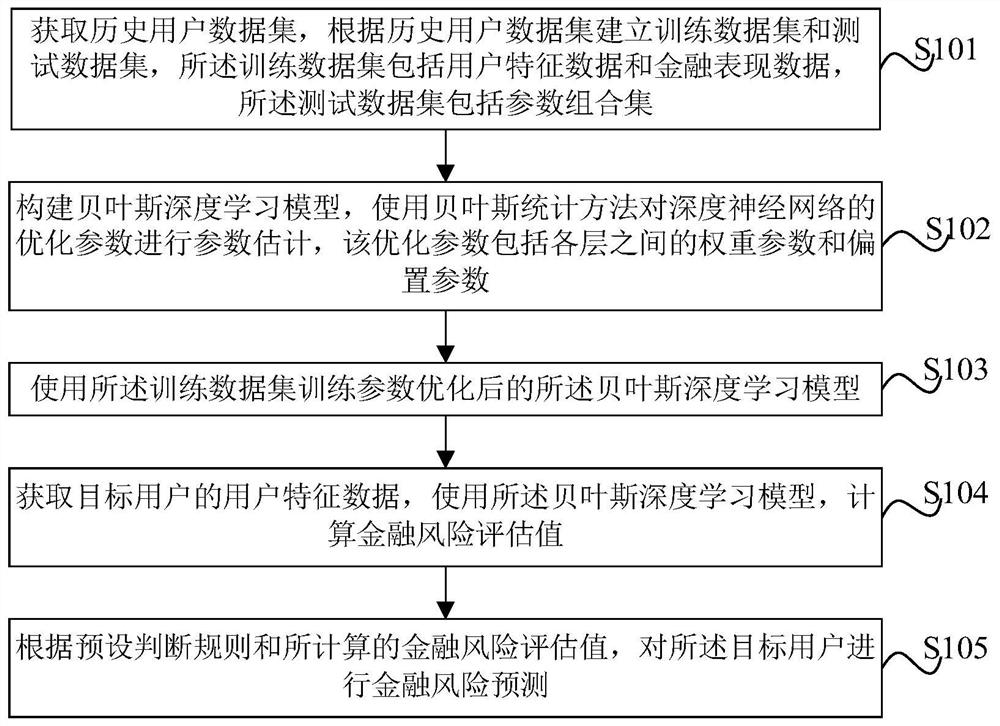

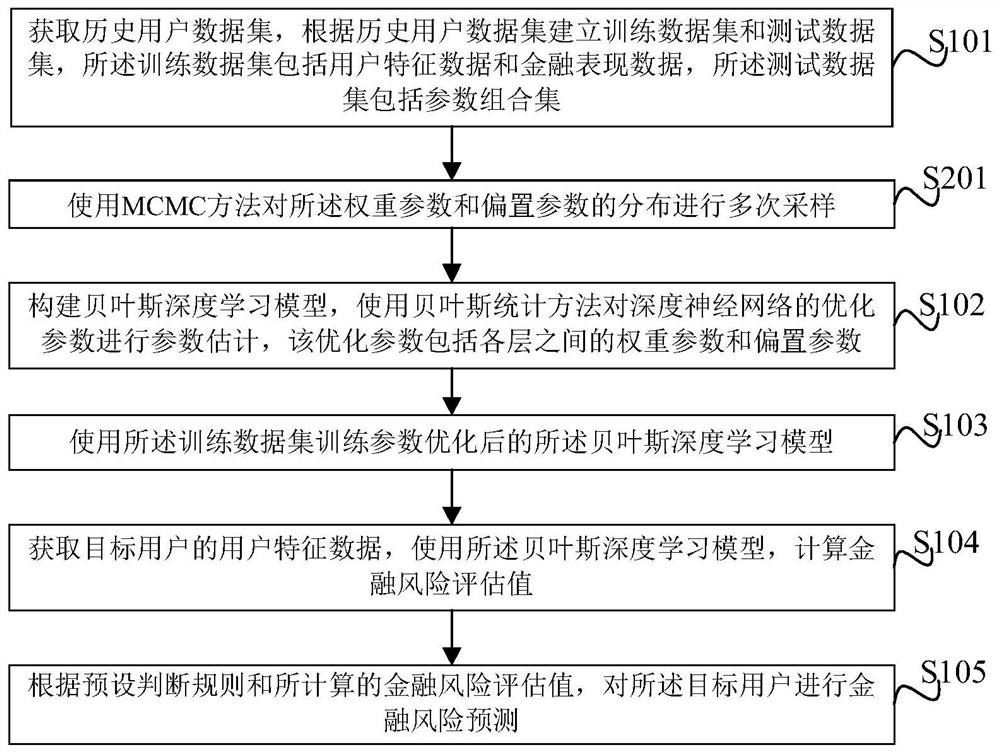

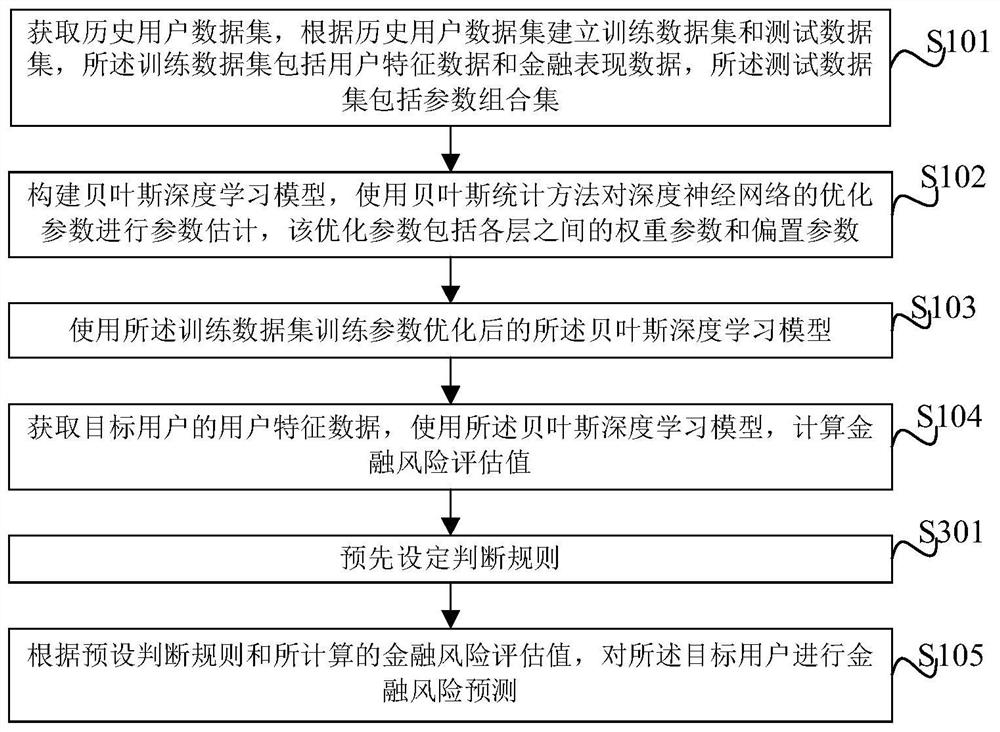

[0045] Below, will refer to Figure 1 to Figure 3 An embodiment of the financial risk prediction method of the present invention is described.

[0046] figure 1 It is a flow chart of the financial risk prediction method of the present invention. Such as figure 1 As shown, a financial risk forecasting method includes the following steps.

[0047] Step S101, acquiring historical user data sets, and establishing a training data set and a testing data set according to the historical user data sets, the training data set includes user characteristic data and financial performance data, and the testing data set includes a parameter combination set.

[0048] Step S102, constructing a Bayesian deep learning model, and using Bayesian statistical methods to perform parameter estimation on the parameters to be optimized of the deep neural network, the parameters to be optimized include weight parameters and bias parameters between layers.

[0049] Step S103, using the training data s...

Embodiment 2

[0096] An apparatus embodiment of the present invention is described below, and the apparatus can be used to execute the method embodiment of the present invention. The details described in the device embodiments of the present invention should be regarded as supplements to the above method embodiments; details not disclosed in the device embodiments of the present invention can be implemented by referring to the above method embodiments.

[0097] refer to Figure 4 , Figure 5 with Figure 6 , the present invention also provides a financial risk prediction device 400, including: a data acquisition module 401, configured to acquire a historical user data set, and establish a training data set and a test data set according to the historical user data set, the training data set includes user Feature data and financial performance data, the test data set includes a parameter combination set; the construction module 402 is used to construct a Bayesian deep learning model, and us...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com