Credit risk early warning method and device

A risk early warning and credit technology, applied in character and pattern recognition, instruments, finance, etc., can solve problems such as high error probability, lower credit risk assessment work efficiency, and high analyst threshold requirements, and achieve the effect of improving efficiency.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0041] Exemplary embodiments of the present invention are described below with reference to the accompanying drawings, which include various details of the embodiments of the present invention to facilitate understanding and should be considered as exemplary only. Accordingly, those of ordinary skill in the art will recognize that various changes and modifications of the embodiments described herein can be made without departing from the scope and spirit of the invention. Also, descriptions of well-known functions and constructions are omitted from the following description for clarity and conciseness.

[0042] It should be noted that, without affecting the implementation of the present invention, the various embodiments of the present invention and the technical features of the embodiments may be combined with each other.

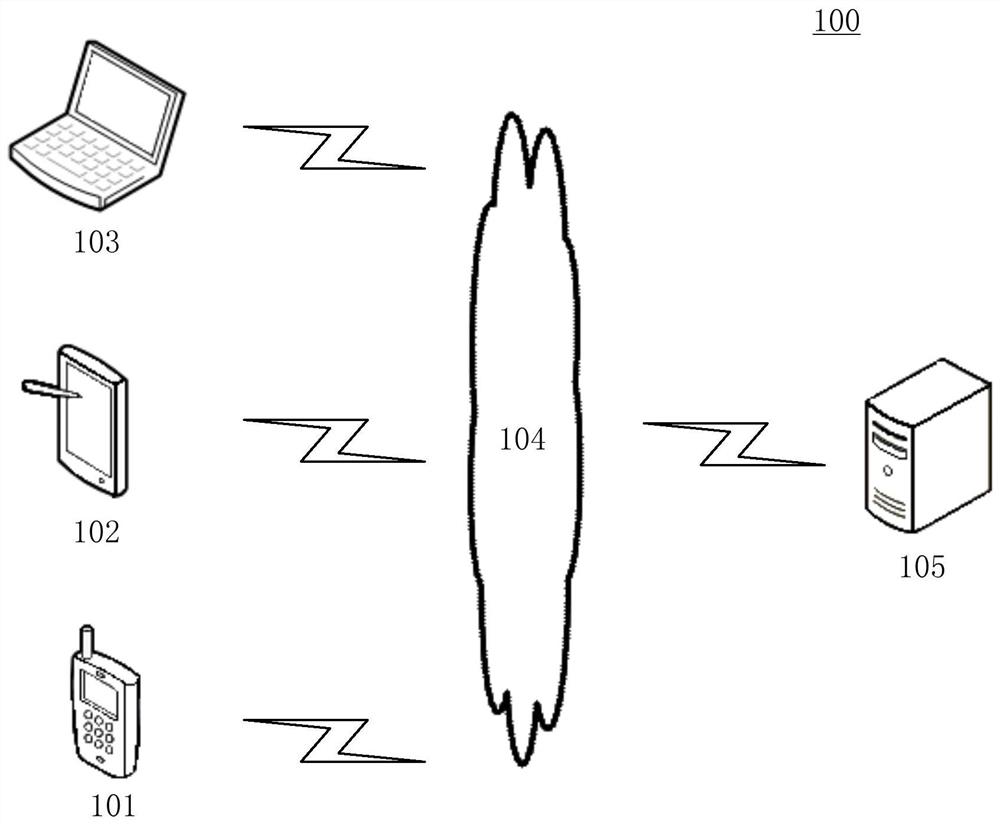

[0043] figure 1 An exemplary system architecture 100 to which the credit risk early warning method or credit risk early warning apparatus of the embodiment...

PUM

Login to view more

Login to view more Abstract

Description

Claims

Application Information

Login to view more

Login to view more - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap