Electronic invoice storage management method and device

An electronic invoicing and management method technology, applied in invoicing/invoicing, data processing applications, business, etc., can solve the problems of difficult search, long time consumption, and the accuracy cannot be effectively guaranteed, so as to ensure the accuracy and authenticity, avoidance of storage costs, ease of management and review

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

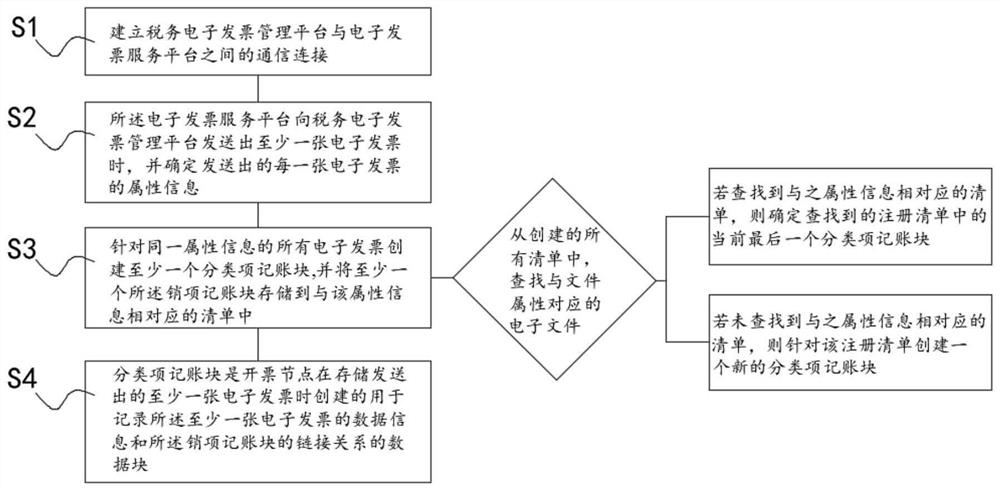

[0041] like figure 1 As shown, this embodiment provides a storage management method and device for electronic invoices, and the storage management method includes:

[0042] S1. Establish a communication connection between the tax electronic invoice management platform and the electronic invoice service platform;

[0043] It can be understood that the communication connection between the two can use the HTTPS encryption protocol, and a secure encrypted channel is built between the client of the electronic invoice service platform and the server of the tax electronic invoice management platform to ensure the security of information exchange.

[0044] S2. When the electronic invoice service platform sends at least one electronic invoice to the tax electronic invoice management platform, and determines the attribute information of each electronic invoice sent out;

[0045] It can be understood that the types of electronic invoices required by humans are different, so the attribut...

Embodiment 2

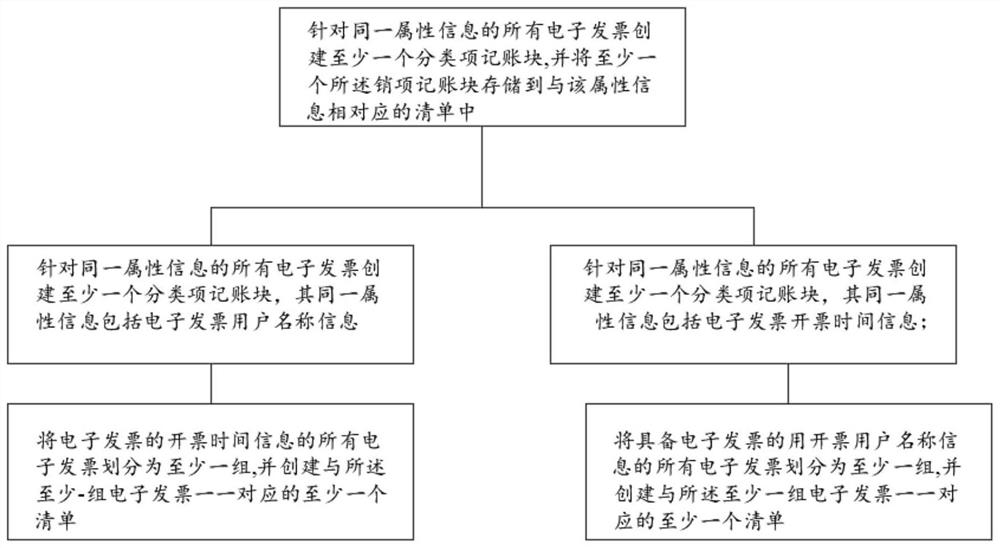

[0050] like figure 2 As shown, before creating at least one classification item accounting block for all electronic invoices with the same attribute, search for the electronic file corresponding to the file attribute from all the created lists; if the list corresponding to its attribute information is found, Then determine the current last classification item accounting block in the found list; if no list corresponding to the attribute information is found, create a new classification item accounting block for the list.

[0051] It can be understood that the same attribute of an electronic invoice includes methods such as time data, user information data, and data of invoicing types, and a new classification item accounting block is established for different classification methods. Therefore, for different attributes An electronic invoice has a classification item accounting block, and subsequent electronic invoice information will be stored in the corresponding classificatio...

Embodiment 3

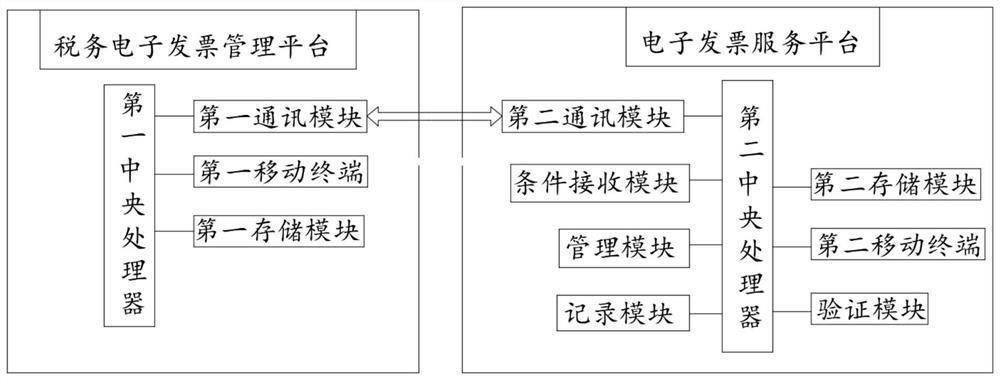

[0058] The steps of judging the authenticity of an electronic invoice by the information interaction between the electronic invoice service platform and the tax electronic invoice management platform are as follows:

[0059] First, the electronic invoice service platform sends a first acquisition request to the tax electronic invoice management platform to acquire electronic invoice template file information; then, the electronic invoice service platform sends a second acquisition request to the classification item accounting block to acquire the storage classification item record The electronic bill data file information in the account block; finally, verify whether the electronic invoice template file information is consistent with the electronic bill data file information.

[0060] The advantage of the communication connection between the tax e-invoice management platform and the e-invoice service platform is that the e-invoice data of the same attribute obtained by the e-in...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com