Mobile-terminal-based general transaction method and its system

A mobile terminal and transaction method technology, applied in payment system structure, data processing applications, instruments, etc., can solve problems such as increasing the risk of virtual card number theft and limiting business scope, and achieve the effect of preventing theft and ensuring security.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

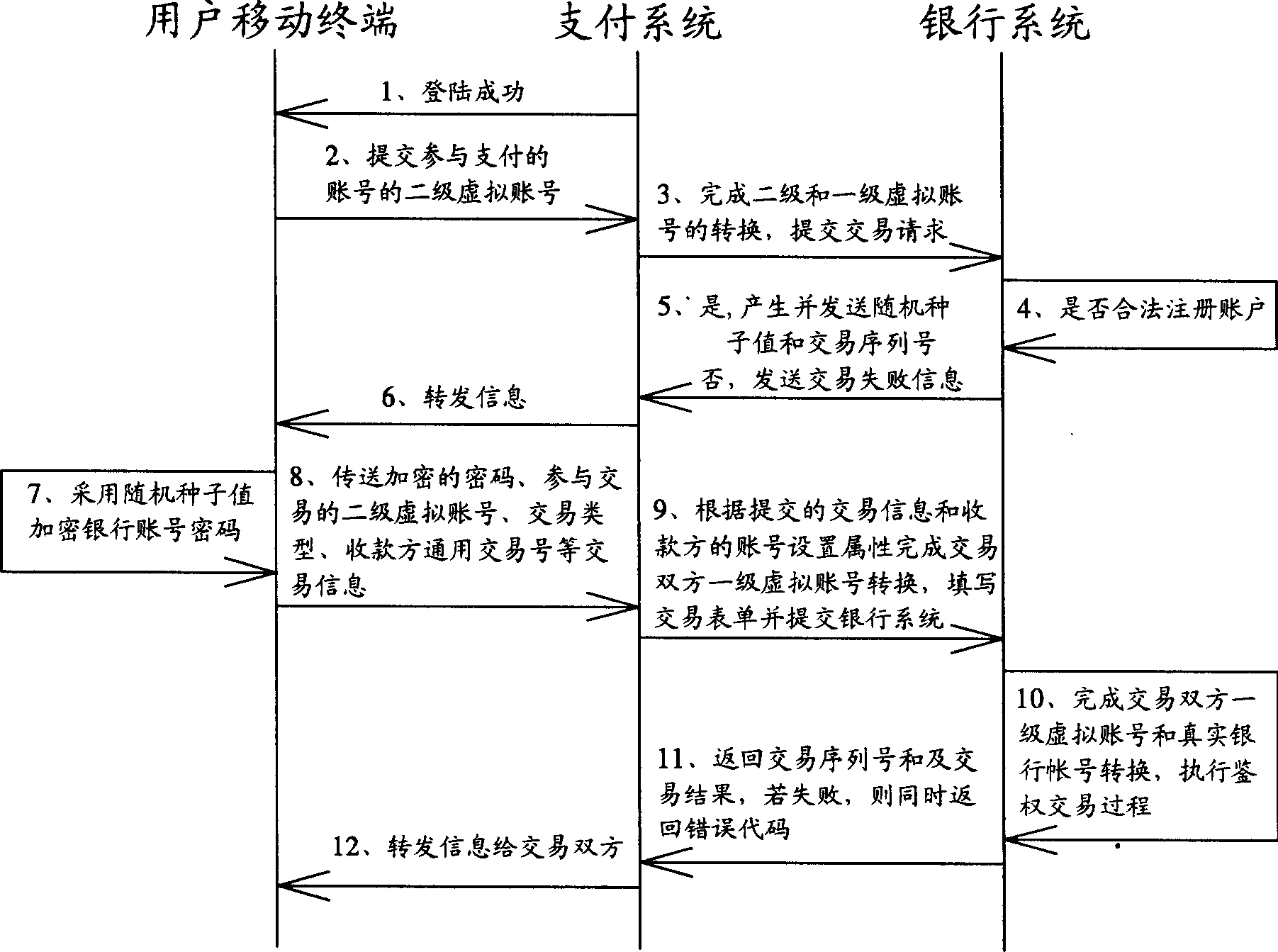

[0074] If the transaction is an ordinary payment, such as figure 2 shown. After the user logs in, he submits the secondary virtual account of the account that needs to participate in the transaction to the payment system, and the process of submitting can also adopt encryption means. The payment system completes the conversion between the general transaction number and the payment system identification number according to the general transaction number of the payer, and at the same time combines the payment system identification number and the submitted secondary virtual account number into a primary virtual account number and submits it to the banking system. The banking system generates a transaction serial number and random seed value for this transaction, and sends the transaction serial number and random seed value back to the payment system, and the payment system sends the transaction serial number and random seed value back to the mobile terminal of the payer. The mo...

Embodiment 2

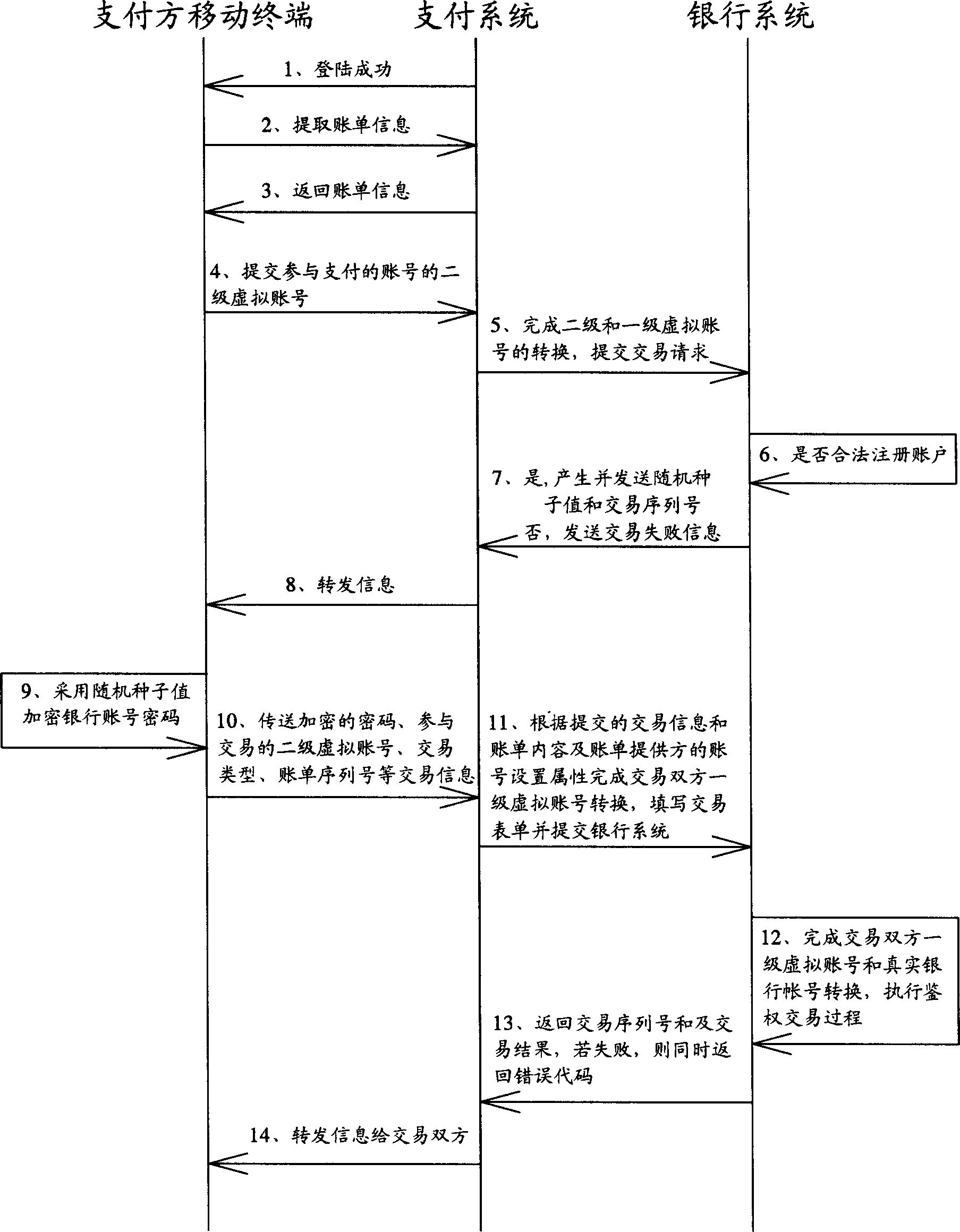

[0076] When the transaction process is a bill transaction, such as image 3As shown, when the user logs in to the payment system through the mobile terminal. The payer obtains the unpaid bill from the payment system, and the bill is submitted to the payment system by other commercial systems through the standard interface provided by the payment system. The bill includes the validity period of the bill, the transaction amount, and the common transaction number of both parties and other important transactions. information. It may also include the account information of the bill provider, the name of the bill provider, the payer of the service fee, the processing method for bill expiration, and the transaction amount. The bill processing method between the payment system and the commercial system should include bill submission, bill receipt, bill processing, bill processing result feedback, etc. To ensure the integrity of information transmission, each processing adopts the req...

Embodiment 3

[0078] During transactions with bank terminals, such as Figure 4 shown. The user is the transaction party, and the transaction party uses the mobile terminal to log in to the payment system through the general transaction number and login password, and submits complete transaction information including: transaction type, general transaction code of the bank terminal participating in the transaction, the general transaction number of the payer and payment Party secondary virtual account number and transaction comments, etc. According to the submitted transaction type, the payment system determines that it is a bank terminal transaction, and completes the conversion between the general transaction number of the transaction party and the bank terminal and the payment system identification number. The general transaction and payment system identification number of the machine is used to obtain the first-level virtual account numbers of both parties to the transaction, and fill i...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com