Payment method and system

A technology of payment system and payment request, which is applied in the direction of payment architecture, instruments, data processing applications, etc., can solve the problems of high cost, low security, inconvenience, etc., to prevent fraud, solve low security, and improve security Effects on sex and reliability

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

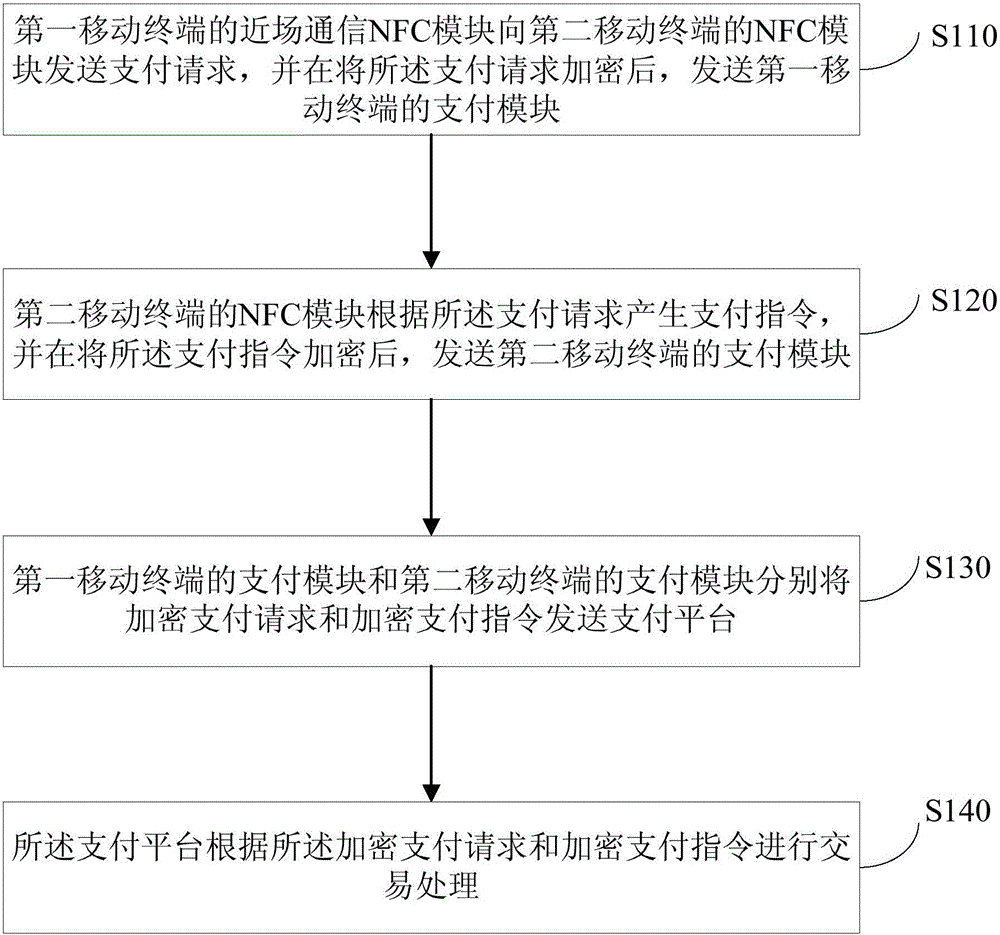

[0024] figure 1 It is a schematic flow diagram of a payment method provided by Embodiment 1 of the present invention. The payment method provided by the embodiment of the present invention is applicable to various payment scenarios such as consumption, transfer, remittance, and borrowing. It specifically describes the connection between an NFC mobile terminal and another NFC mobile terminal. Terminal, the process of making payment through the payment platform. In order to distinguish between buyers and sellers, the present invention uses "first" and "second" to distinguish different NFC mobile terminals, rather than other limitations on NFC mobile terminals. The method of this embodiment specifically includes the following operations:

[0025] S110. The NFC module of the first mobile terminal sends a payment request to the NFC module of the second mobile terminal, and after encrypting the payment request, sends the payment request to the payment module of the first mobile ter...

Embodiment 2

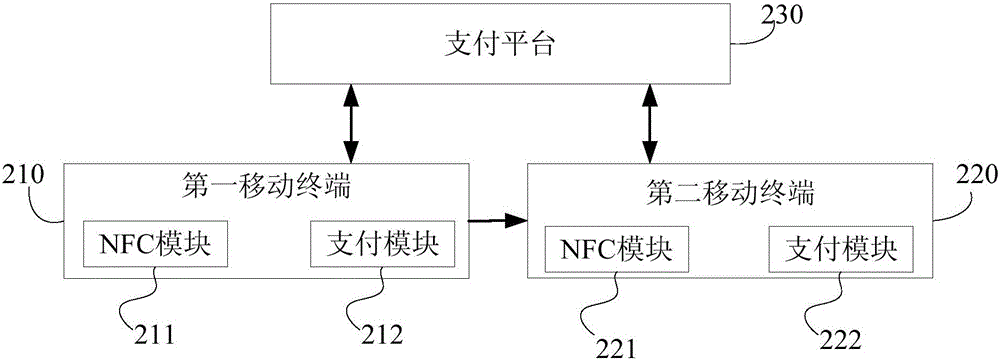

[0043] figure 2 Shown is a schematic structural diagram of a payment system provided by Embodiment 2 of the present invention, such as figure 2 As shown, the system specifically includes: a first mobile terminal 210 , a second mobile terminal 220 and a payment platform 230 .

[0044] Wherein, the first mobile terminal 210 includes an NFC module 211 and a payment module 212 ; the second mobile terminal 220 includes an NFC module 221 and a payment module 222 . The NFC module 211 of the first mobile terminal is used to send a payment request to the NFC module 221 of the second mobile terminal, and after the payment request is encrypted, the payment module 212 of the first mobile terminal is sent; the NFC module 221 of the second mobile terminal, It is used to generate a payment instruction according to the payment request, and after encrypting the payment instruction, send it to the payment module 222 of the second mobile terminal; the payment module 212 of the first mobile te...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com