Early-warning analysis method and system of false invoicing of value-added tax invoices

A technology of early warning analysis and value-added tax, which is applied in invoicing/invoicing, special data processing applications, instruments, etc., can solve problems such as few office buildings and commercial areas, and achieve the effect of increasing work efficiency, speeding up the analysis process, and reducing system redundancy.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

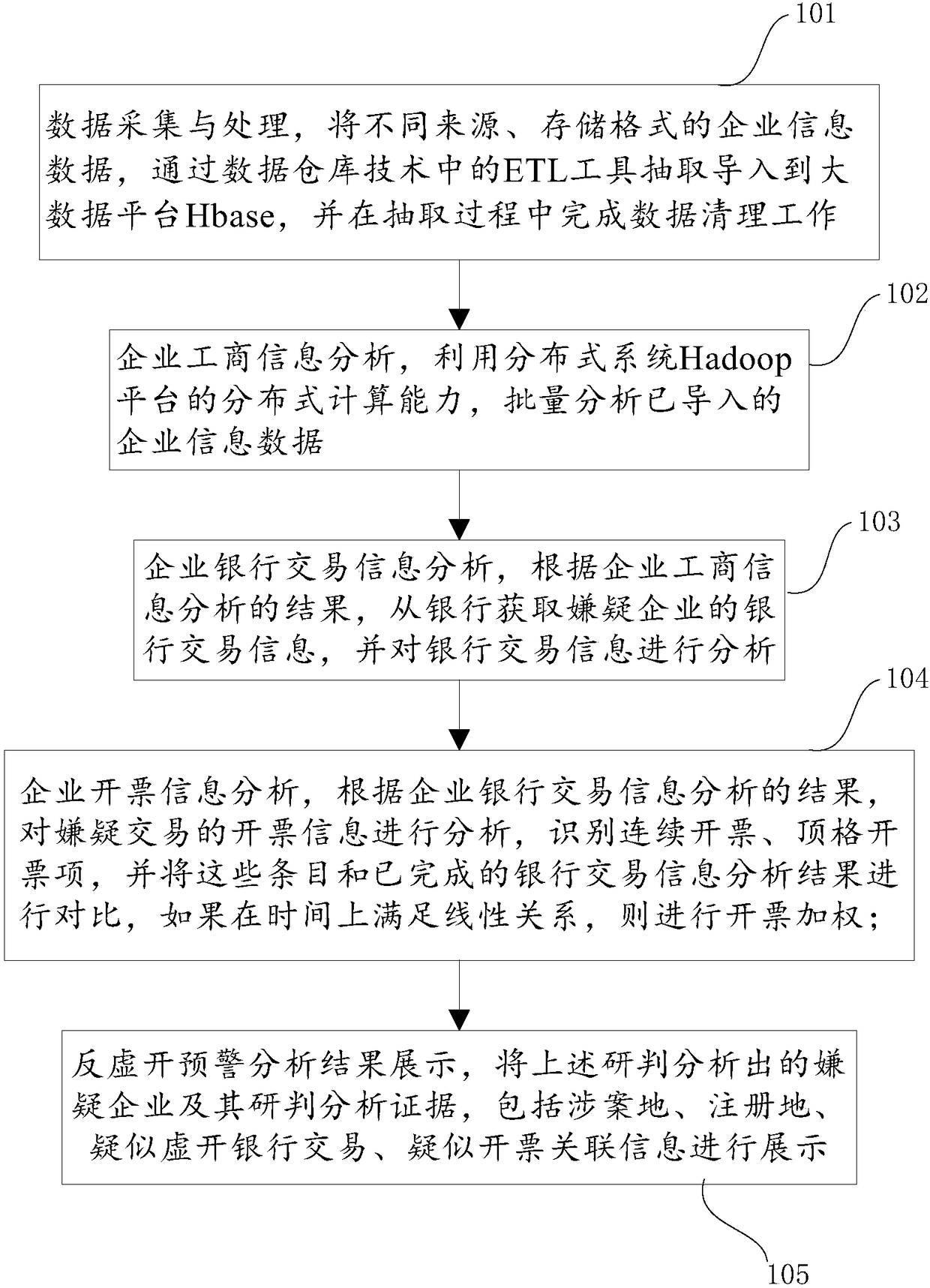

[0062] Such as figure 1 Shown is a flow chart of an early warning analysis method for falsely issuing value-added tax invoices according to an embodiment of the present invention. The early warning analysis method includes:

[0063] Step 101: data collection and processing, the enterprise information data of different sources and storage formats are extracted and imported into the big data platform Hbase through the ETL tool in the data warehouse technology, and the data cleaning work is completed during the extraction process;

[0064] Step 102: analysis of enterprise business information, utilizing the distributed computing power of the distributed system Hadoop platform to analyze the imported enterprise information data in batches;

[0065] Step 103: Analyze the bank transaction information of the enterprise, obtain the bank transaction information of the suspected enterprise from the bank according to the analysis results of the enterprise's business information, and anal...

Embodiment 2

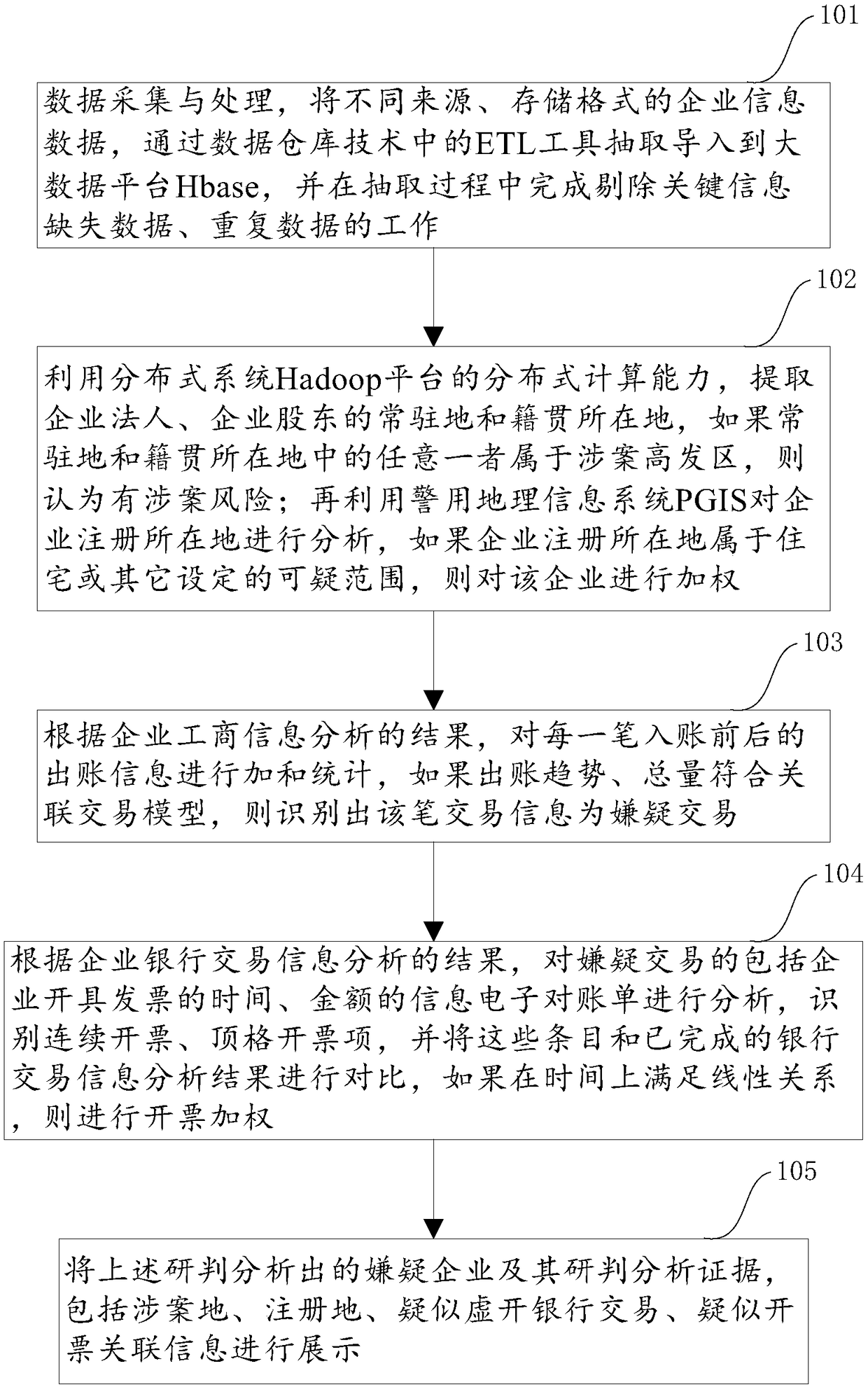

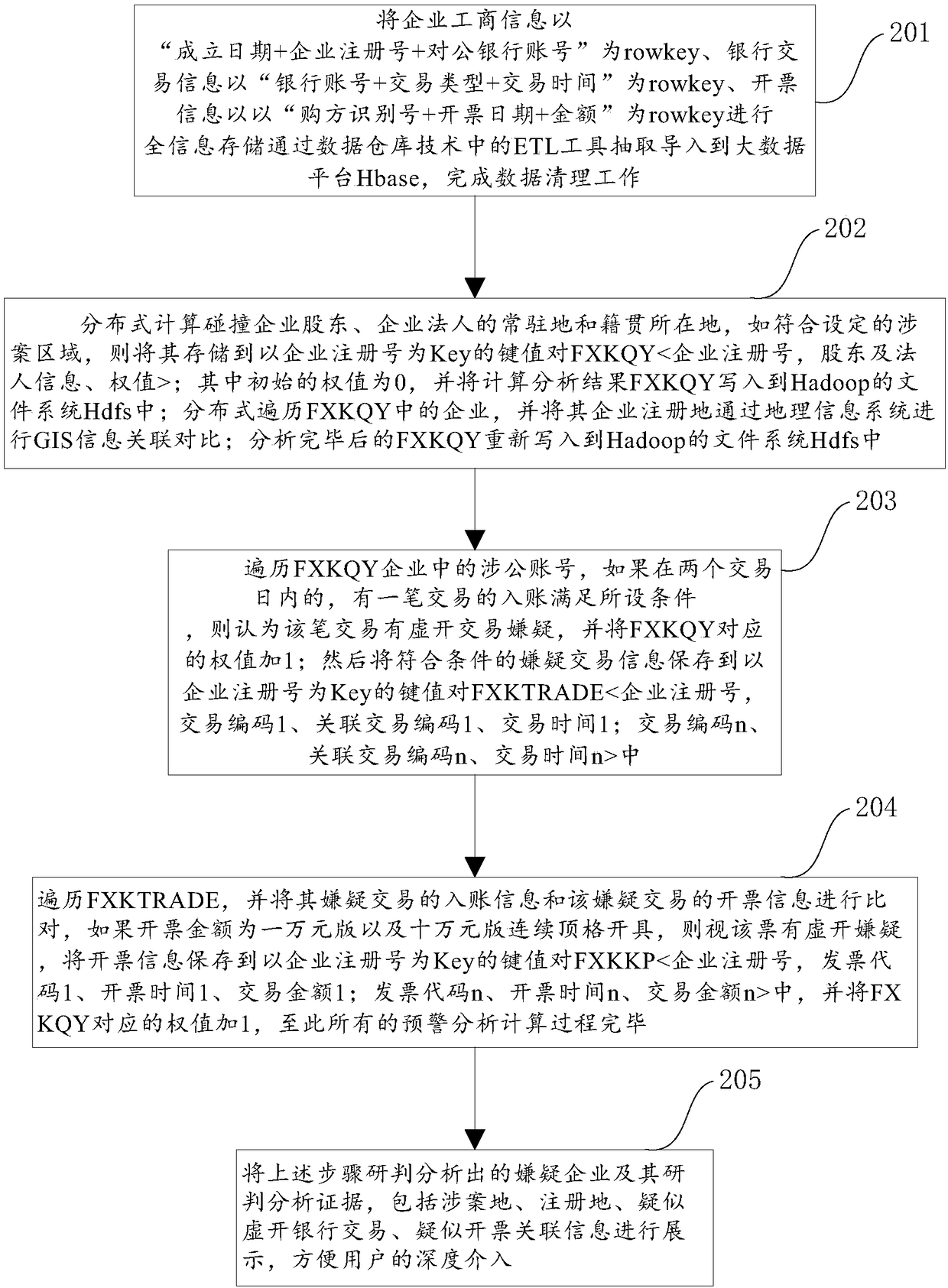

[0076] Such as image 3 Shown is a flowchart of another early warning analysis method for falsely issuing value-added tax invoices according to an embodiment of the present invention. The early warning analysis method includes:

[0077]Step 201: Data collection and processing, the business information of the enterprise is stored with "date of establishment + enterprise registration number + corporate bank account number" as the rowkey, and the full information is stored with "bank account number + transaction type + transaction time" as the rowkey The stored bank transaction information and the invoicing information stored in full information with "purchaser identification number + invoicing date + amount" as the rowkey are extracted and imported into the big data platform Hbase through the ETL tool in the data warehouse technology, and are completed during the extraction process Data cleansing work;

[0078] Step 202: Using the MapReduce technology of the distributed system ...

Embodiment 3

[0088] Such as Figure 4 Shown is a schematic diagram of the composition of an early warning analysis system for falsely issuing value-added tax invoices according to an embodiment of the present invention. The system includes: a data acquisition and processing module 31, an enterprise business information analysis module 32, an enterprise bank transaction information analysis module 33, Enterprise billing information analysis module 34, analysis result display module 35;

[0089] Data acquisition and processing module 31 is used to extract and import enterprise information data of different sources and storage formats into the big data platform Hbase through the ETL tool in the data warehouse technology, and complete the data cleaning work during the extraction process;

[0090] Enterprise business information analysis module 32, is used for utilizing the distributed computing ability of distributed system Hadoop platform, batch analysis has imported enterprise information da...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com