Intelligent tax processing method and device, terminal and medium

A processing method and tax technology, applied in the computer field, can solve problems affecting user experience, inconvenient operation, cumbersome operation, etc., and achieve the effect of reducing the operation of manual input of information, improving the convenience of operation, and simplifying the operation process.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

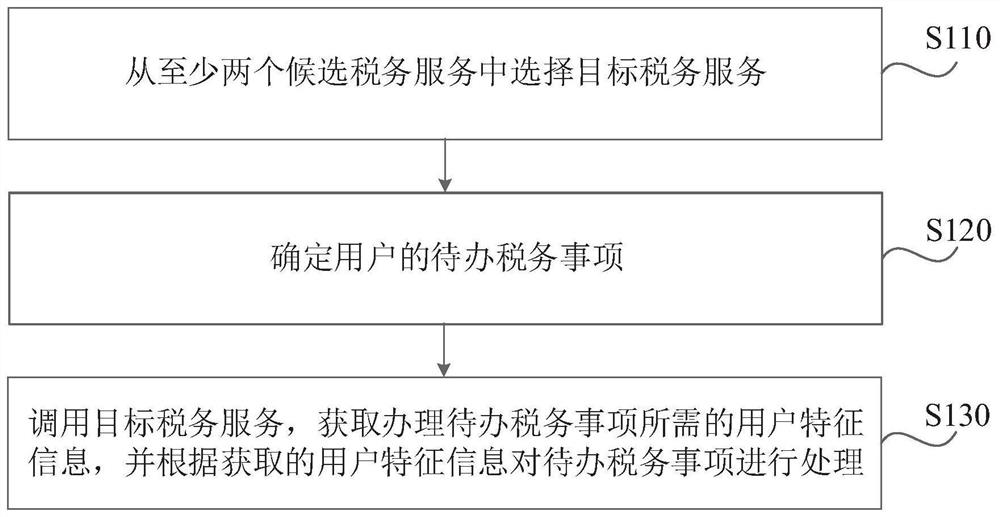

[0040] figure 1 It is a flow chart of the intelligent tax processing method provided by Embodiment 1 of the present invention. This embodiment is applicable to the situation where the user’s tax matters are processed online according to the user’s tax processing requirements. The method can be executed by an intelligent tax processing device. The device can be realized by means of software and / or hardware, and can be integrated on a terminal, such as a mobile terminal, a computer, an intelligent interactive robot, and an intelligent home appliance.

[0041] Such as figure 1 As shown, the intelligent tax treatment method provided in this embodiment may include:

[0042] S110. Select a target tax service from at least two candidate tax services.

[0043] The user mentioned in this embodiment may be a taxpayer. When the user needs to handle tax matters, he can interact with the terminal to let the terminal know his handling needs. According to the user's handling needs, the t...

Embodiment 2

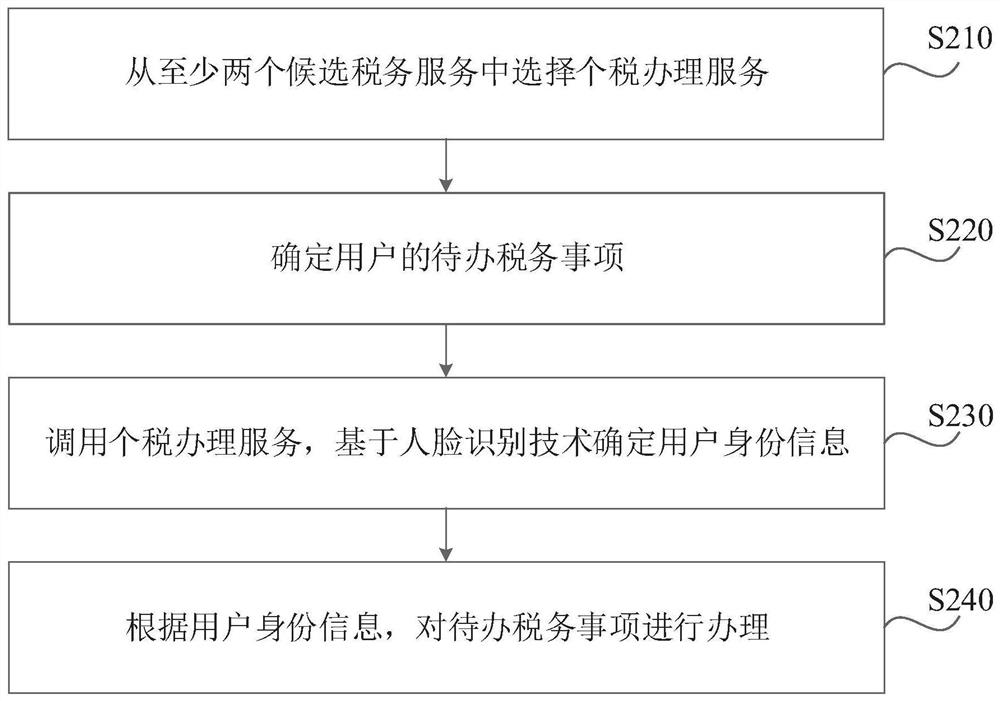

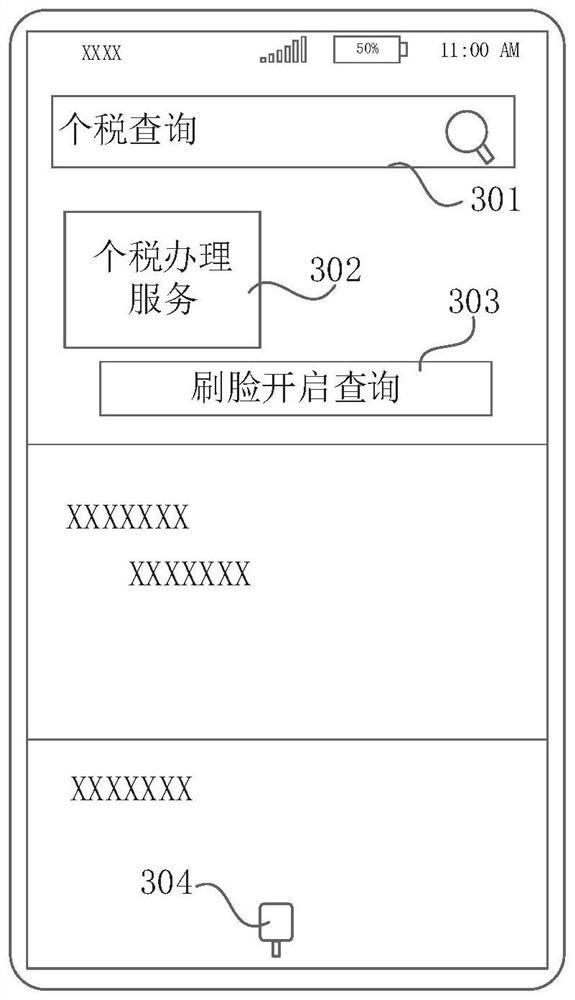

[0068] figure 2 It is a flow chart of the intelligent tax processing method provided in Embodiment 2 of the present invention. In this embodiment, the target tax service is an individual tax processing service as an example, and further expansion and optimization are carried out on the basis of the above embodiments. Such as figure 2 As shown, the method may include:

[0069] S210. Select an individual tax handling service from at least two candidate tax services.

[0070] Individual tax processing services refer to services that can provide users with services related to personal income tax. The terminal can select an individual tax handling service for the user from at least two candidate tax services supported by the terminal according to the user's needs for handling individual tax matters.

[0071] S220. Determine the tax matters to be done by the user.

[0072] Among them, pending tax matters include any business supported in the individual tax processing service, ...

Embodiment 3

[0087] Figure 4 It is a flow chart of the intelligent tax processing method provided by Embodiment 3 of the present invention. In this embodiment, the target tax service is an invoice query service as an example, and further expansion and optimization are carried out on the basis of the above embodiments. Such as Figure 4 As shown, the method may include:

[0088] S310. Select an invoice query service from at least two candidate tax services.

[0089] The terminal can select an invoice query service for the user from at least two candidate tax services supported by the terminal according to the user's demand for invoice query.

[0090] S320. Determine the tax matters to be done by the user.

[0091] Through the intelligent interaction with the user, determine the user's current pending tax matters. Among them, the pending tax matters include any business in the invoice inquiry service, such as the verification of the authenticity of the invoice.

[0092] S330. Call the in...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com