Three-party data source test evaluation system and method

A technology for evaluating systems and data sources, applied in data processing applications, instruments, finance, etc., can solve problems such as poor data applicability

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

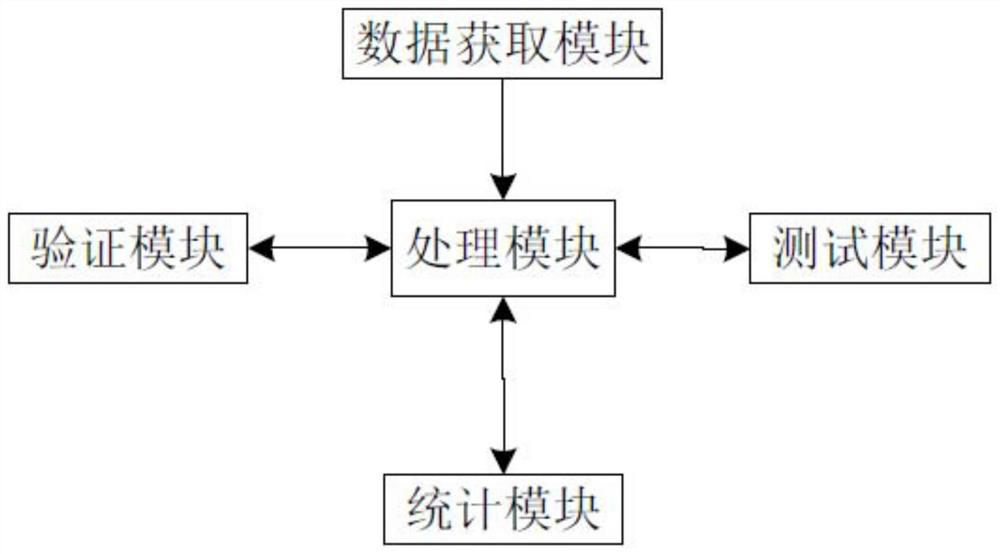

[0035] The test and evaluation system of the third-party data source, such as figure 1 shown, including:

[0036] The data acquisition module is used to obtain the test data of the data supplier according to the specified target. For example, the ID number of the customer who goes to the bank for loan business is used as the specified target to obtain the test data of the data supplier. The test data is the third-party data, such as the customer's Test data for fixed property and other credit information;

[0037] The processing module is used to receive the test data from the data acquisition module for preprocessing, such as performing sampling processing on the third-party data, and the processing module sends the preprocessed test data to the statistical module at the same time;

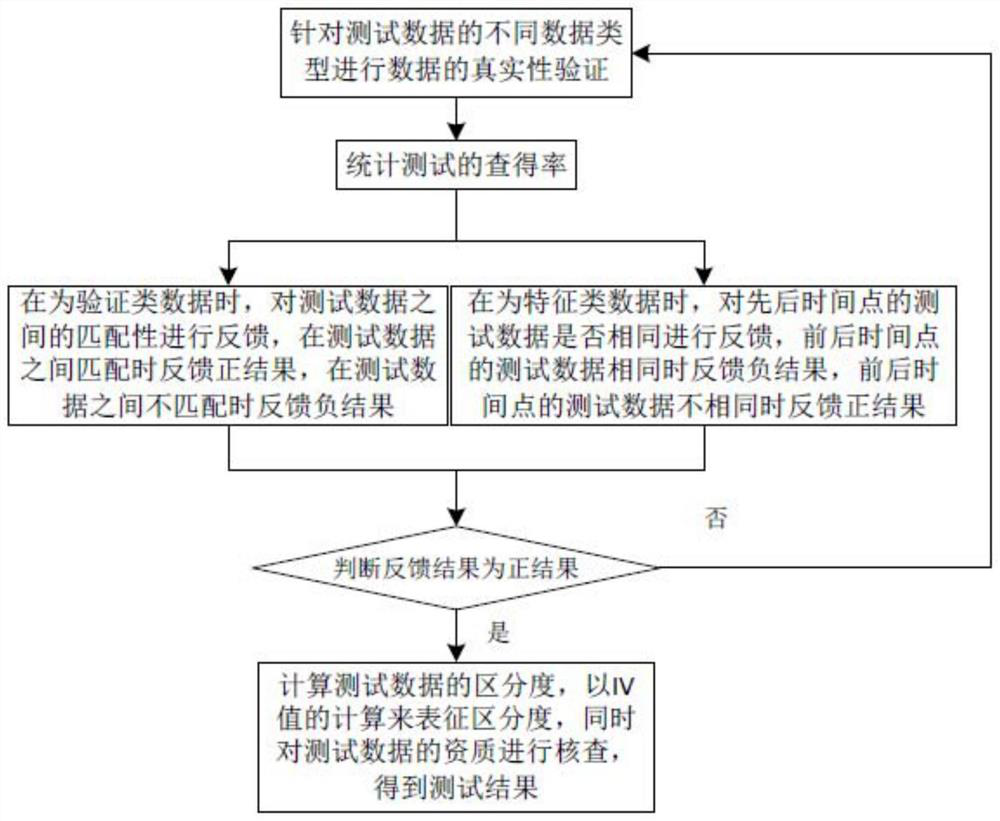

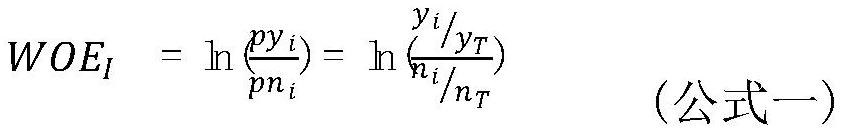

[0038] Statistical module, used for counting the retrieval rate of the verified test data and feeding back to the processing module, and the processing module sends the statistical test data and...

Embodiment 2

[0056] The difference from Embodiment 1 is that when the data type is verification data, the processing module obtains direct real data or similar real data and sends it to the test module. The real data is data that can be directly obtained, such as customer data inside the bank and can The data obtained from the data supplier is used to calculate the confusion matrix with direct real data and test data when obtaining direct real data through the test module. The similar real data is the test data of the same type of manufacturer as the data supplier. For example, the similar real data is the public security agency. The blacklist data is similar to the real data. By comparing the test data provided by multiple data suppliers of the same type, select the data of multiple data suppliers with the same test data, and use the test module to combine the test data with similar real data. Calculate the confusion matrix, and the test module calculates the accuracy of the test data acco...

Embodiment 3

[0068] The difference from Embodiment 1 is that when the test data is characteristic data, the work status of the customer is tracked, because the customer's work status may be falsified, such as not working in the company and passing the official seal of another company way to fabricate a unit of work. Since the work unit is fabricated, the user's repayment ability and repayment awareness cannot be guaranteed after the customer is approved for lending or lending money. In this way, it will lead to a delay in lending or repayment after lending. If the number of such customers reaches a certain order of magnitude, it will cause a greater blow to the loan business.

[0069] Track the customer's work status through the mobile terminal, and at the same time disguise the function of the mobile terminal as the information application function of the banking institution, so as to avoid the deliberate forgery of information after the customer knows it and fail to achieve the purpose o...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com