Pre-loan credit evaluation method and device

A credit evaluation and user information technology, applied in the computer field, can solve problems such as regulatory difficulties, increase the risk of data violations, leak user privacy data, etc., and achieve the effect of avoiding private data, reducing the risk of data violations, and improving performance

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

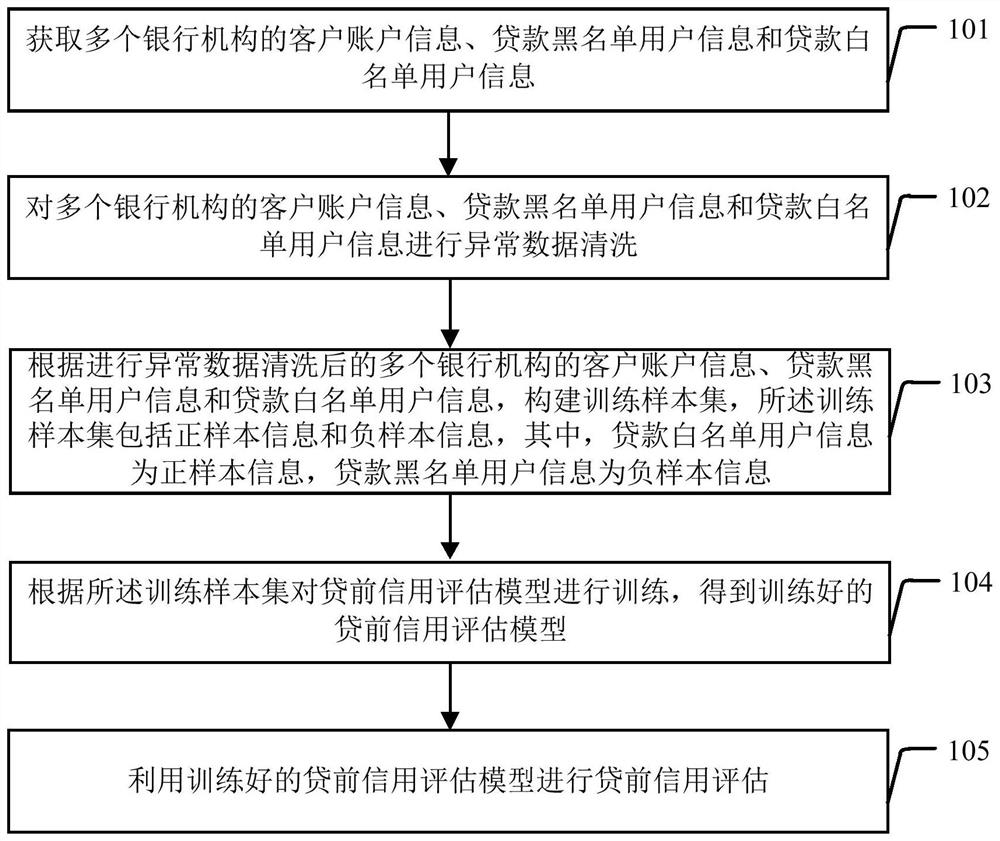

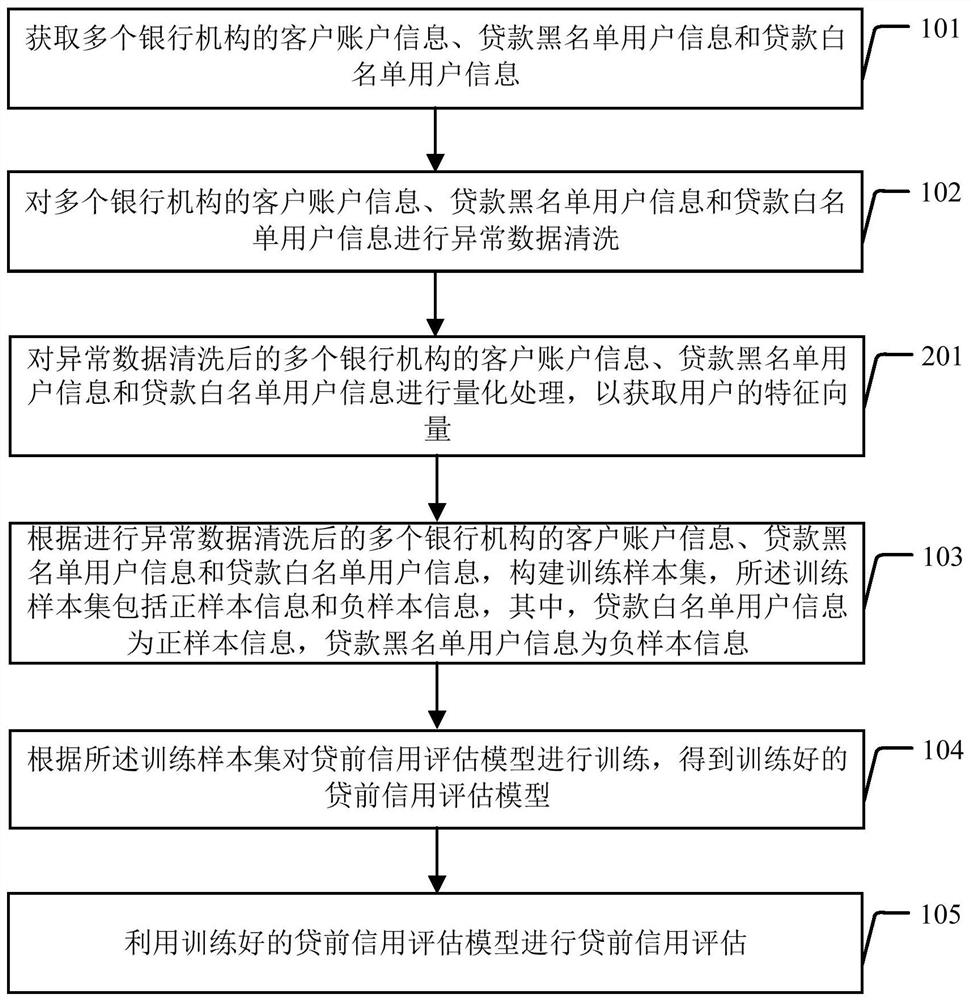

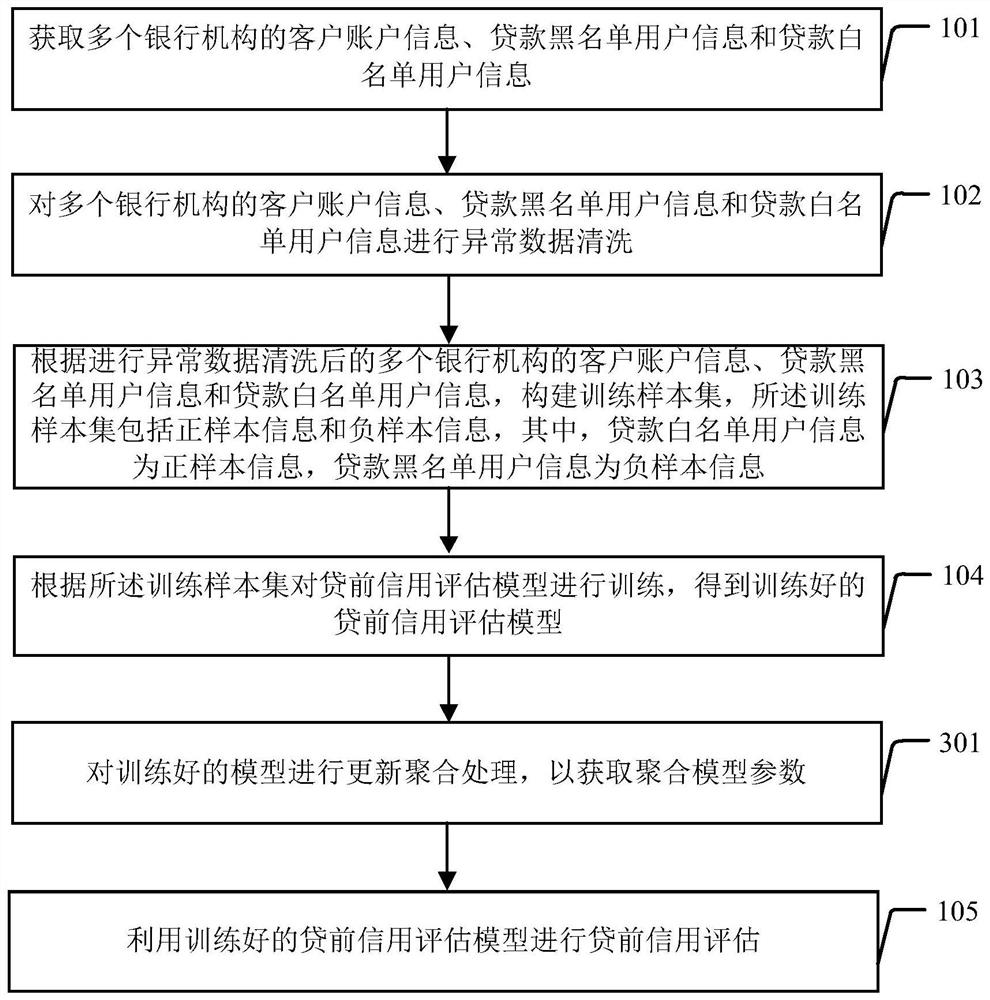

[0039] In order to make the purpose, technical solutions and advantages of the embodiments of the present invention more clear, the embodiments of the present invention will be further described in detail below in conjunction with the accompanying drawings. Here, the exemplary embodiments and descriptions of the present invention are used to explain the present invention, but not to limit the present invention.

[0040] With the development of machine learning and artificial intelligence, the application of machine learning in the field of commercial bank loan credit evaluation is currently a direction of exploration. However, machine learning requires a large amount of data as the basis for learning. The data of each commercial bank is limited. It is difficult to train high-quality machine models only relying on the data of commercial banks themselves. If the data of other banking institutions are combined for training, the privacy of user data of each banking institution wil...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com