Bank invoice tax number change processing method and system based on block chain

A change processing and blockchain technology, applied in data processing applications, special data processing applications, other database retrievals, etc., can solve problems such as inability to perform normal operations, tracking and analysis of unfavorable problems, and inability to use functions normally. Improve the effect of customer physical examination, easy tracking and analysis, and easy supervision

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0057] The principle and spirit of the present invention will be described below with reference to several exemplary embodiments. It should be understood that these embodiments are given only to enable those skilled in the art to better understand and implement the present invention, rather than to limit the scope of the present invention in any way. Rather, these embodiments are provided so that this disclosure will be thorough and complete, and will fully convey the scope of the disclosure to those skilled in the art.

[0058] Those skilled in the art know that the embodiments of the present invention can be implemented as a system, device, device, method or computer program product. Therefore, the present disclosure may be embodied in the form of complete hardware, complete software (including firmware, resident software, microcode, etc.), or a combination of hardware and software.

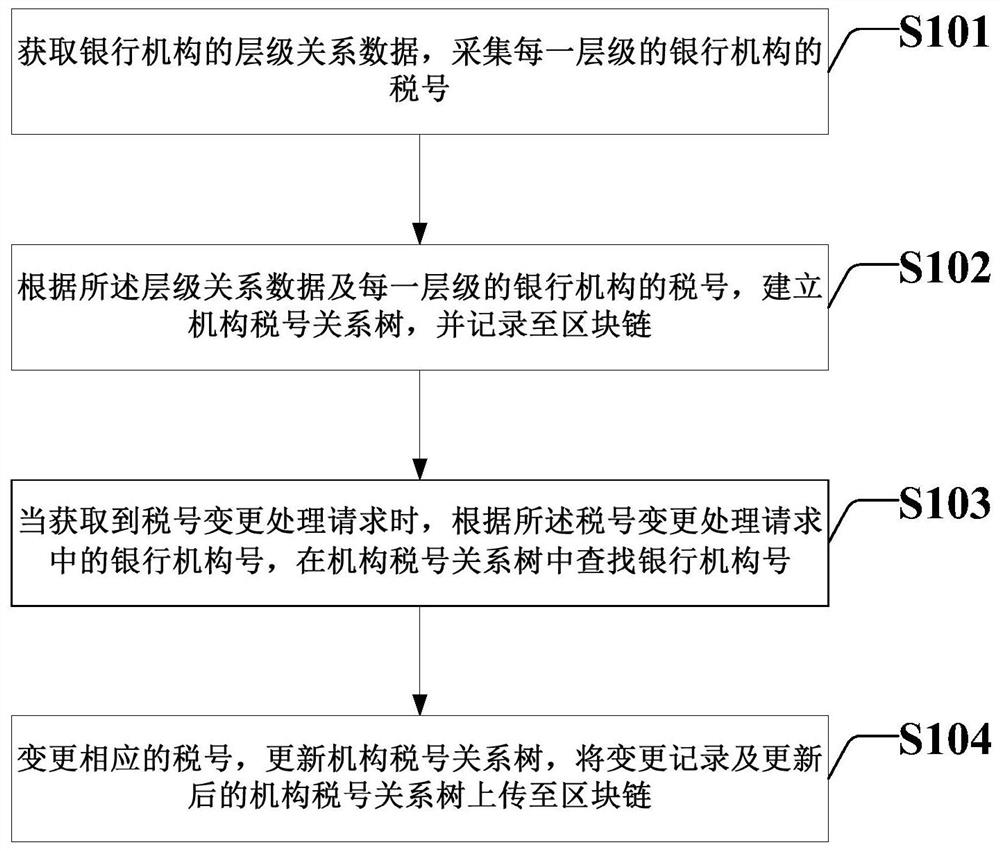

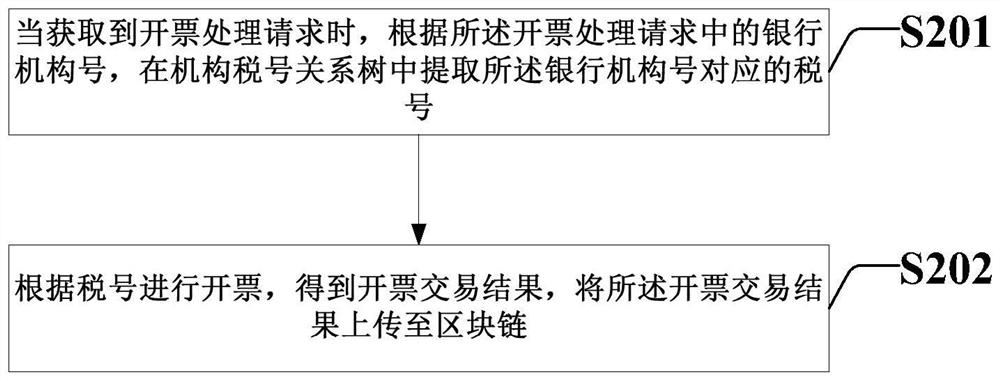

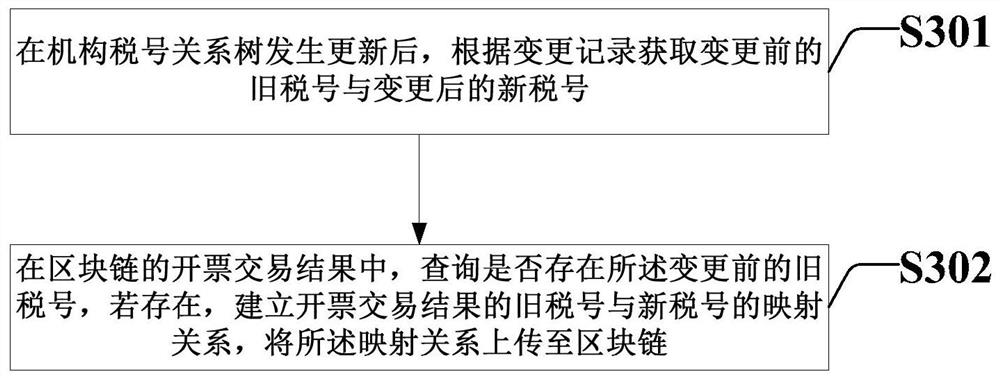

[0059] According to the embodiment of the present invention, a block chain-based bank invo...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com