System and method for processing financial transactions

a financial transaction and system technology, applied in the field of retail transactions, can solve the problems of high cost of implementation of customer purchasing trends tracking system for the purpose of identifying loyal customers, time-consuming process for promoting retail store loyalty, and high sales volume of retail store chains, so as to increase customer confidence, enhance security, and facilitate the effect of promotion

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

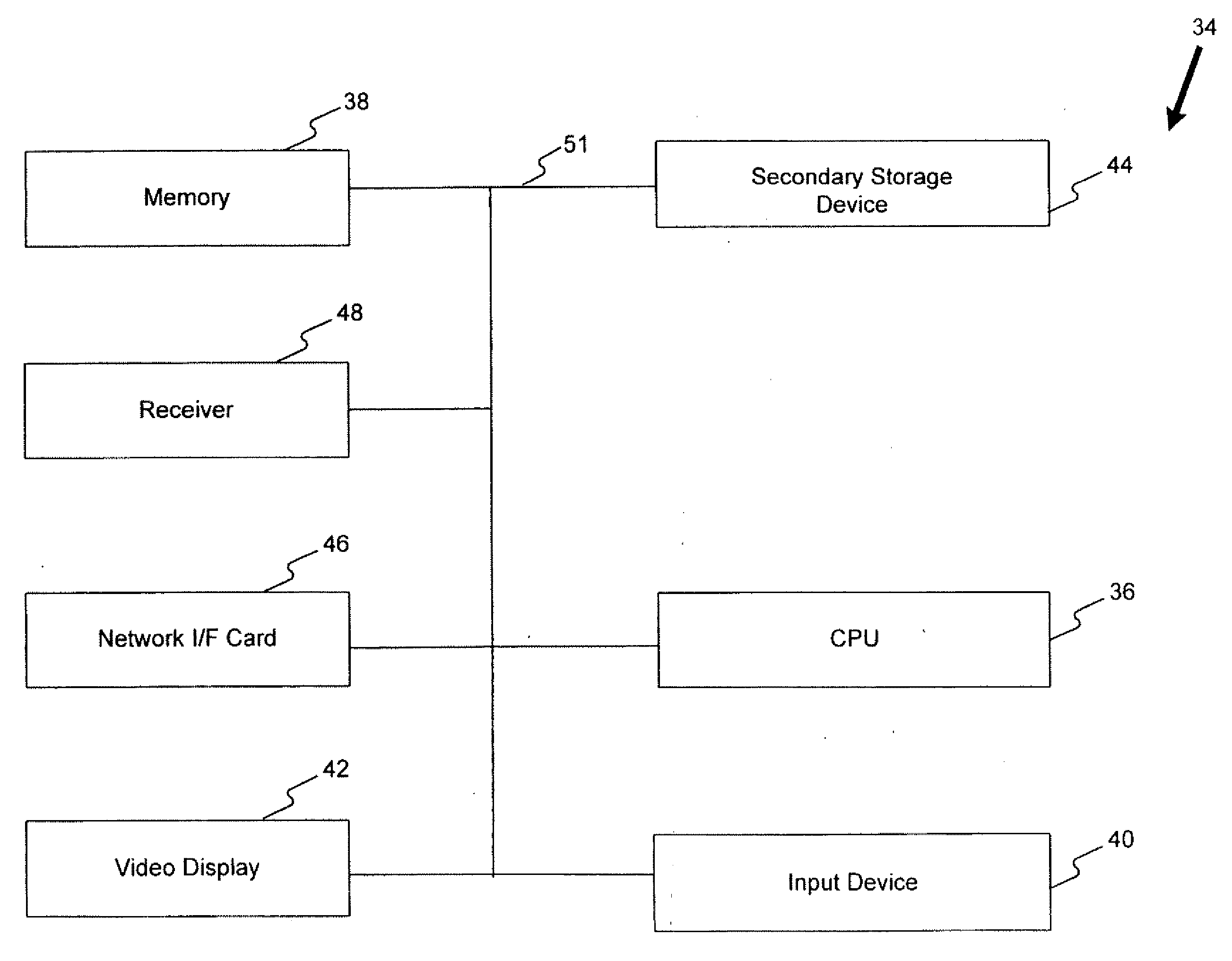

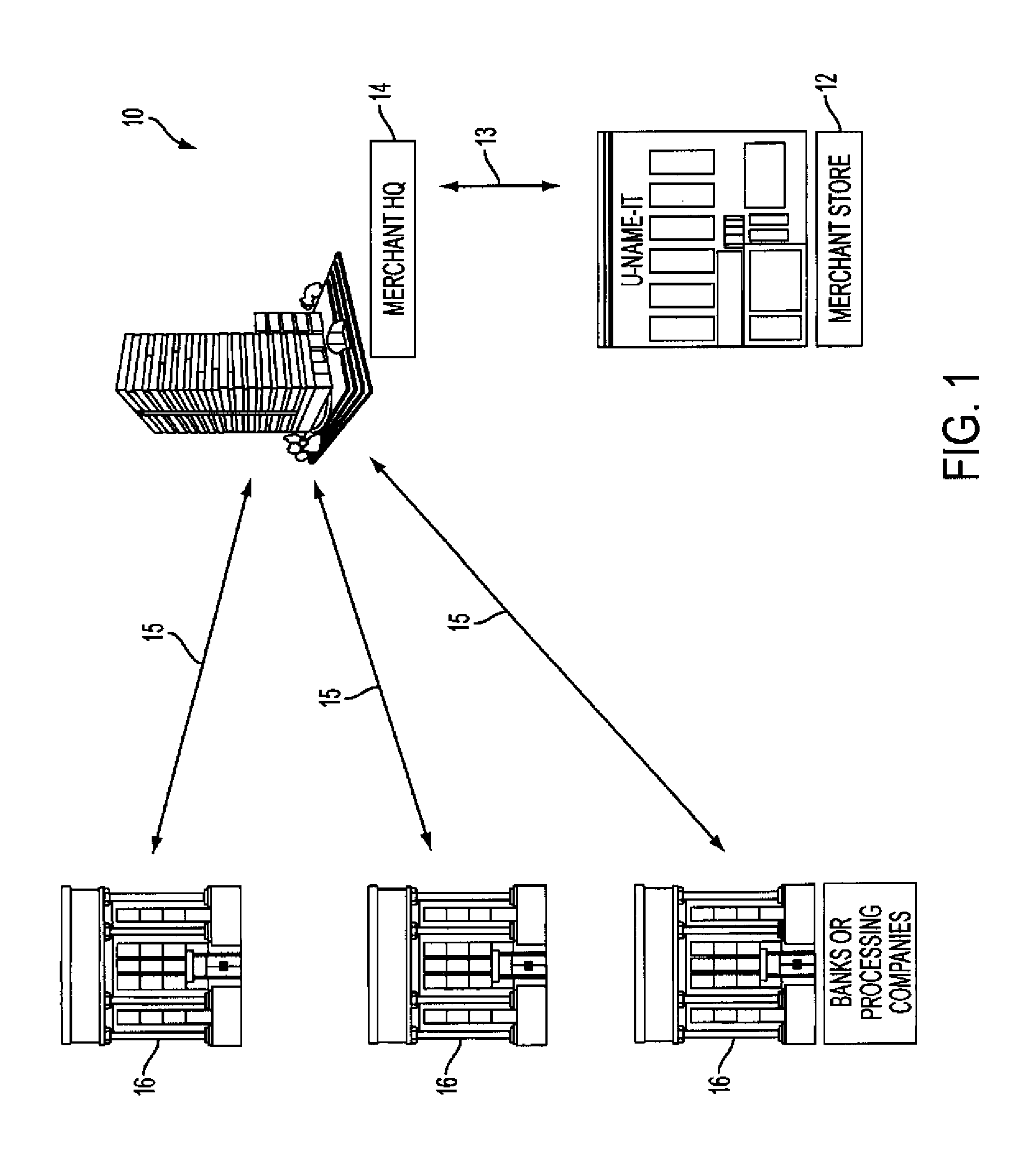

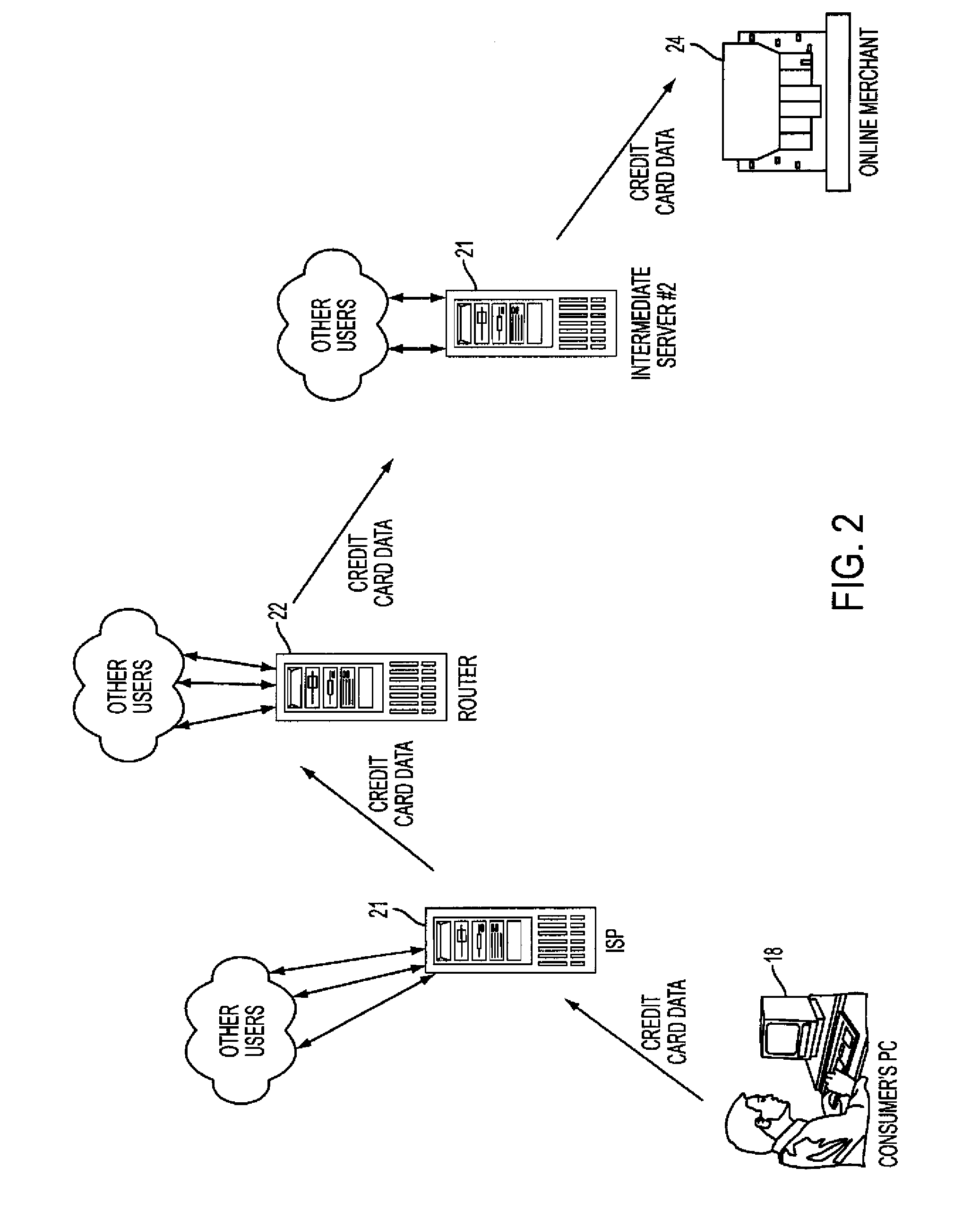

[0037]In the following detailed description of the preferred embodiment, reference is made to the accompanying drawings that form a part thereof, and in which is shown by way of illustration a specific embodiment in which the invention may be practiced. This embodiment is described in sufficient detail to enable those skilled in the art to practice the invention and it is to be understood that other embodiments may be utilized and that structural changes may be made without departing from the scope of the present invention The following detailed description is, therefore, not to be taken in a limited sense.

[0038]To achieve these and other advantages, and in accordance with the purpose of the invention as embodied and broadly described, the invention provides a system for processing retail transactions. The system comprises a customer transceiver preprogrammed with a unique customer / transmitter ID number, and a merchant transceiver that receives a customer identification signal from ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com