Stock investment method based on weighted dense connection convolution neural network deep learning

A convolutional neural network and dense connection technology, applied to biological neural network models, neural architectures, instruments, etc., can solve problems such as difficulty in predicting price changes, achieve the effect of reducing convergence difficulties and reducing model size

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0041] The technical solutions of the present invention will be further described in detail below in conjunction with the accompanying drawings and specific embodiments.

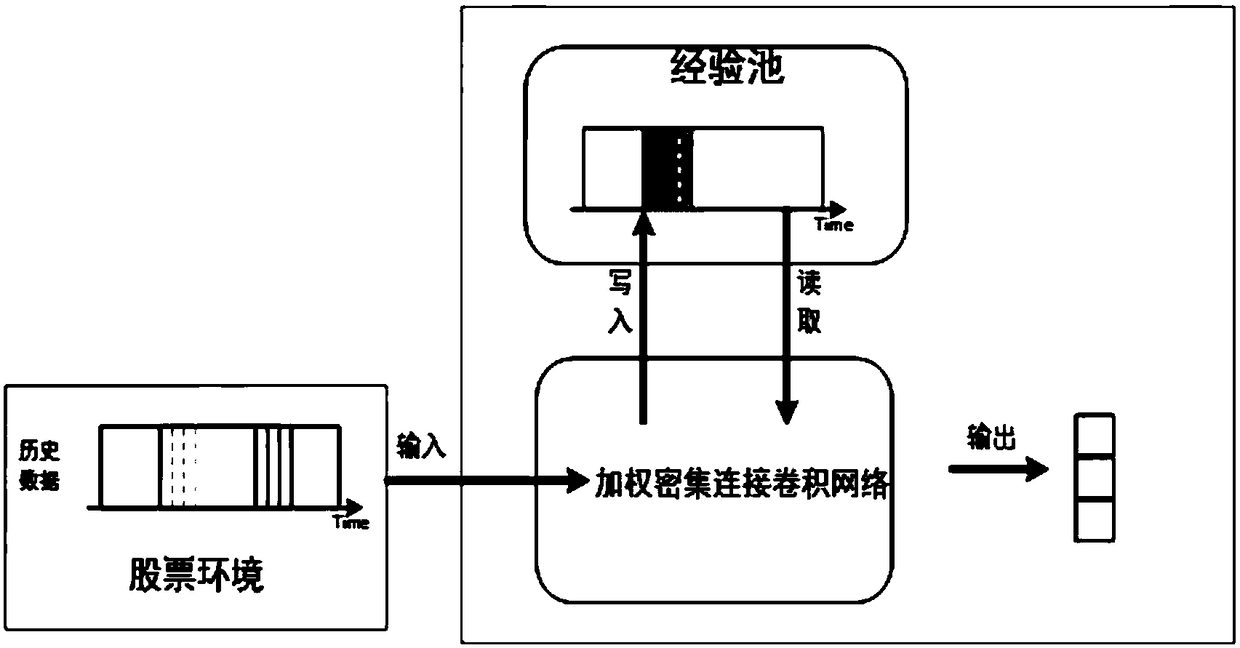

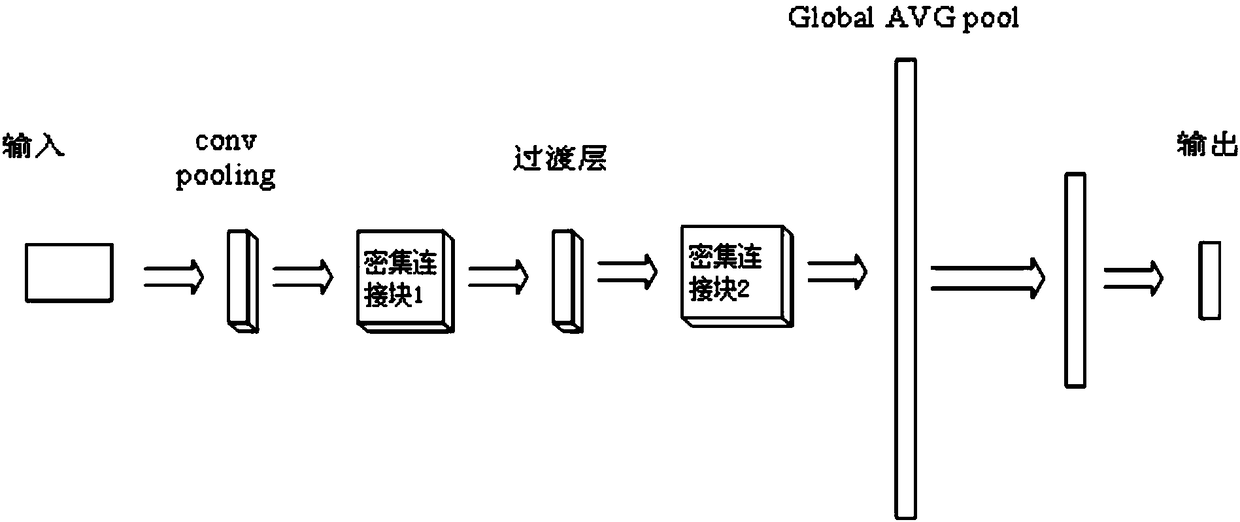

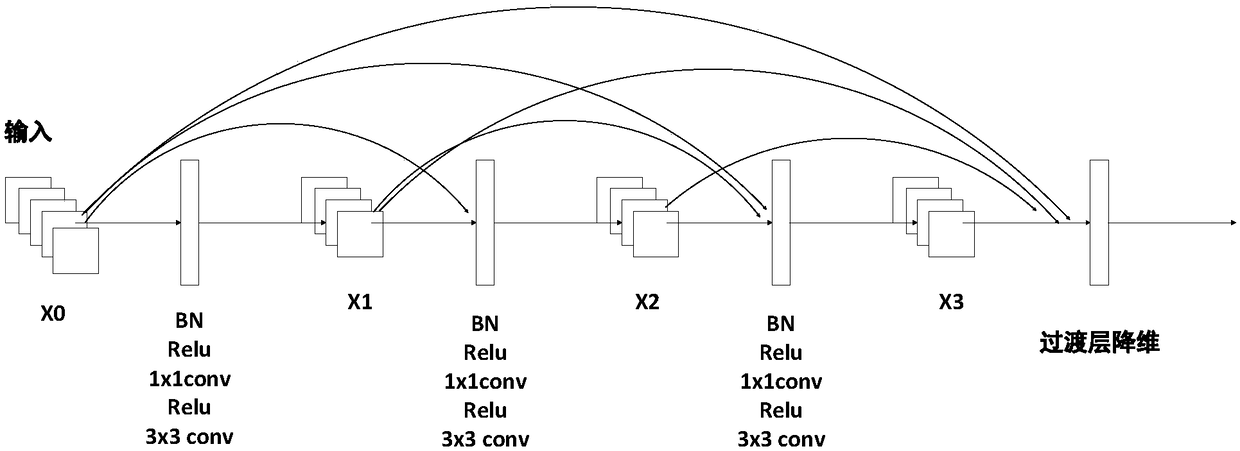

[0042] Such as figure 1 As shown, the weighted densely connected convolutional neural network deep reinforcement learning stock investment method of this embodiment includes the following steps:

[0043] Step 1) Construction of the input stock information matrix: In the present invention, the stock data is divided into time periods T of equal length, and each time period contains several days of historical stock data. During the T time period, the input stock historical information is constructed into a one-dimensional space matrix X t (m,n), where m represents the attributes of stock data (opening price, closing price, lowest price, highest price, trading volume, turnover, rise and fall, etc.), and n represents the number of days in the current time period. The stock environment state s in the reinforceme...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com