Internet-based joint loan business solving method

A business solution and Internet technology, applied in the field of joint loans, can solve the problems of narrow processing coverage, low bank service efficiency, low service volume, etc., and achieve the goal of improving security and operation and maintenance efficiency, simplifying loan business, and simple business process Effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

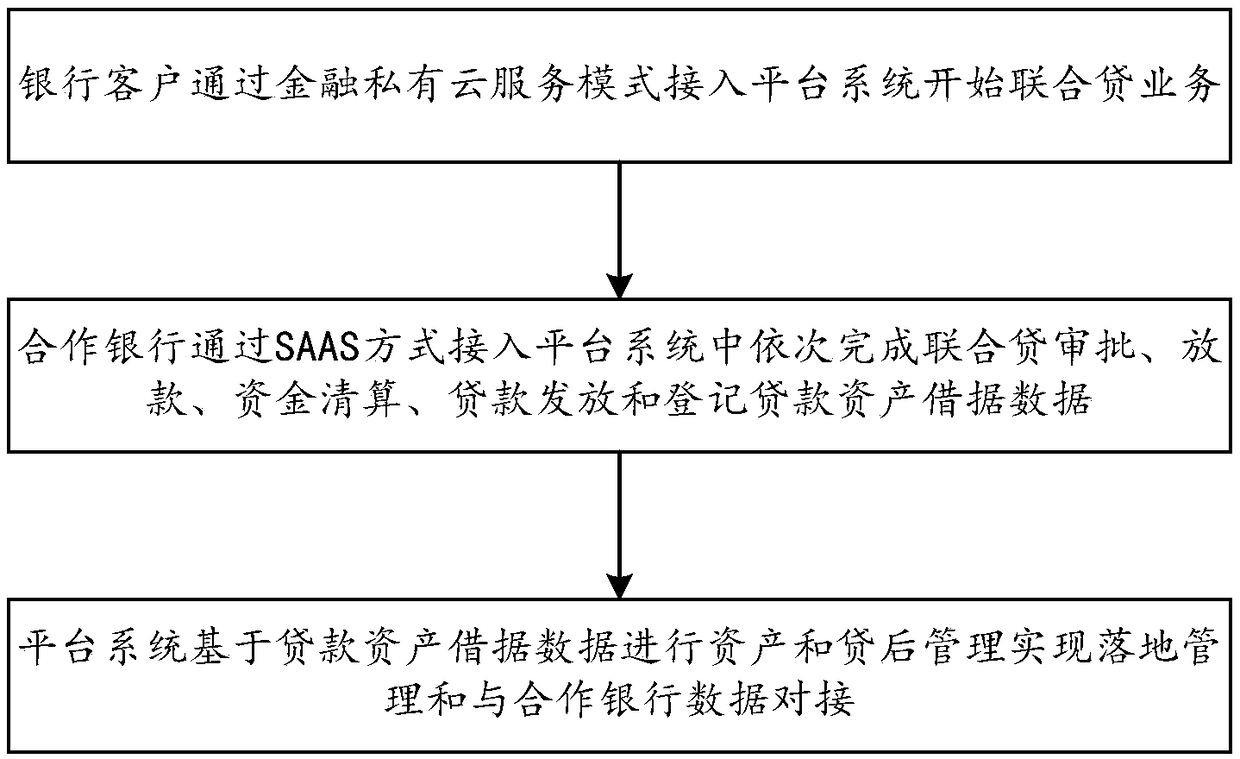

[0043] Judging whether the bank customers meet the conditions for using the platform system, if so, access the platform system through the financial private cloud service model, if not, then cannot access the platform system; the conditions for use are to sign corresponding business cooperation contracts and capital cooperation agreements ; After accessing the platform system, select the Internet financial asset business to start the joint loan business; after entering the joint loan business through the Internet channel according to the selected joint loan business, the service platform of the platform system automatically initiates a joint credit application to the cooperative bank customer according to the incoming data; the cooperative bank The customer completes the joint approval through the customer credit service and credit scoring model integrated by the platform system through the SAAS service, or completes the credit approval of the incoming materials based on the cor...

Embodiment 2

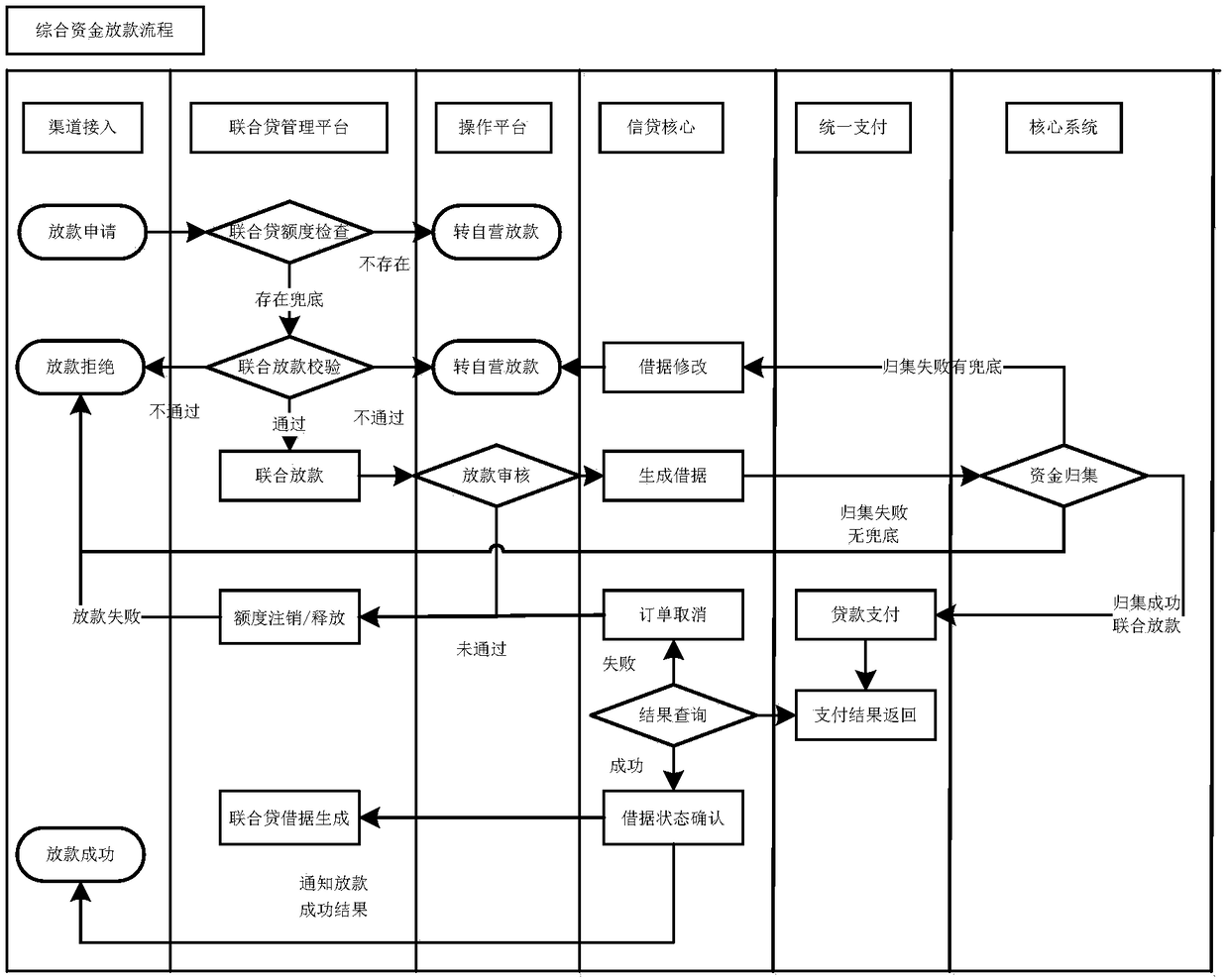

[0045] The platform system includes a joint loan management unit. The joint loan management unit includes a loan approval strategy module, a loan verification rule module, and a joint loan module. If it exists, it will be reviewed by the joint loan module after passing the verification of the joint loan. After passing the review, the details and collected funds will be generated, and finally the loan payment will be completed through unified payment. If the review fails, the amount will be cancelled, and the loan rejection information will be returned; No syndicated loan business.

Embodiment 3

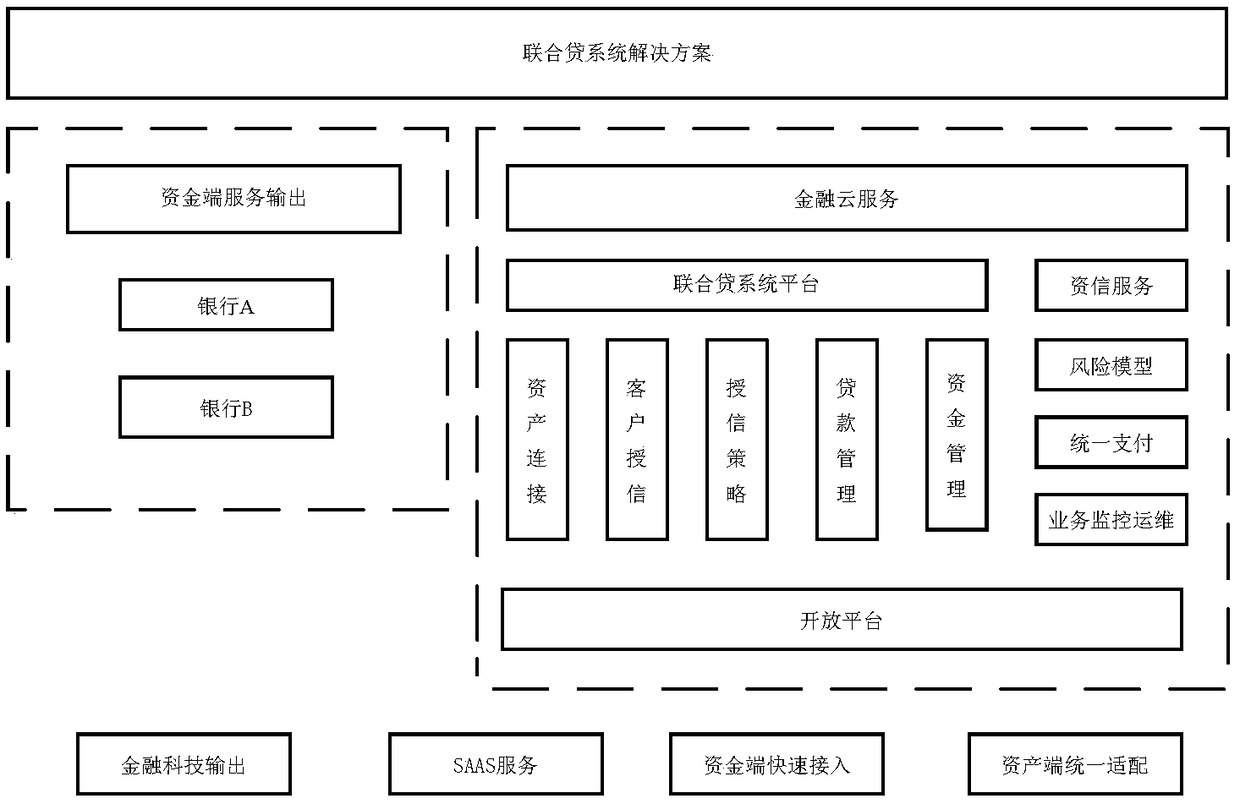

[0047]The platform system includes an open platform, a fund channel management unit, a joint credit management unit, a comprehensive fund operation management unit and a fund post-loan management unit; the fund channel management unit includes a joint loan module, and the joint credit management unit includes joint credit management, comprehensive fund The operation management unit includes a joint approval module, and the fund post-loan management unit includes a post-loan risk management module. The credit access process is as follows: access the credit application through the private mode of the financial cloud, and judge whether the fund channel is a joint loan, and if so, determine whether there is a valid line. Establish the credit line after completing the credit line, and then complete the establishment of the credit line at the customer level / order level, sign the joint credit line contract and return the credit line result; if it does not exist, the joint loan busines...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com