Personal loan credit scoring method based on BA-WNN

A technology of credit scoring and bat algorithm, applied in the field of risk control of the Internet financial industry, can solve the problems of slow network convergence, low robustness, slow convergence, etc., achieve strong global search ability, improve prediction accuracy, improve The effect of convergence speed

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

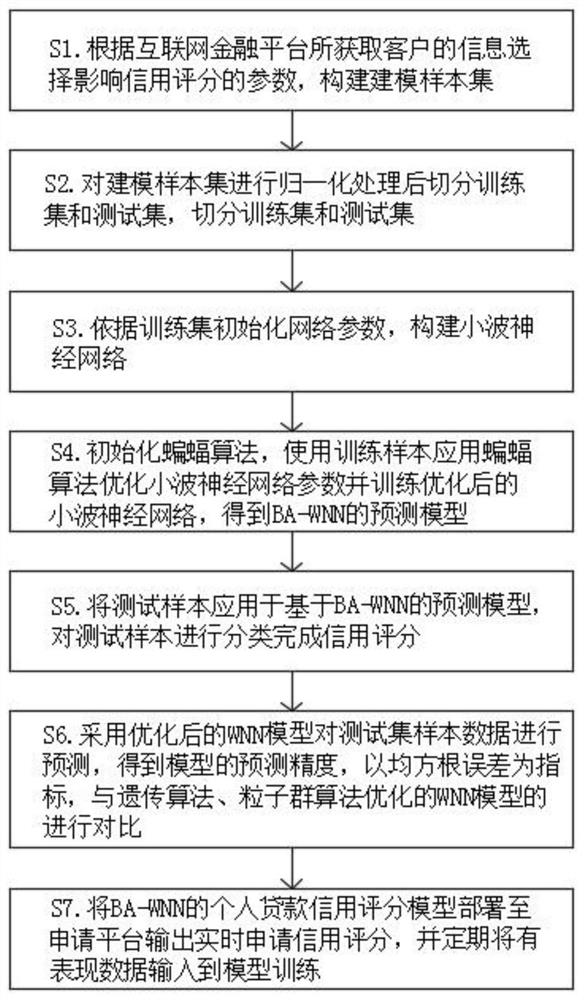

[0040] see figure 1 , the present invention provides a kind of technical scheme: a kind of personal loan credit scoring method based on BA-WNN, comprises the following steps:

[0041] S1. Select the parameters that affect the credit score according to the customer information obtained by the Internet financial platform, and construct a modeling sample set;

[0042] S2. Segment the training set and the test set after normalizing the modeling sample set, and segment the training set and the test set;

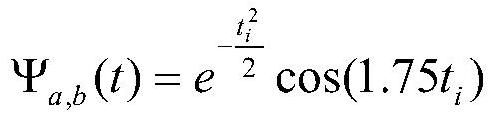

[0043] S3. Initialize the network parameters according to the training set, and construct the wavelet neural network;

[0044] S4. Initialize the bat algorithm, use the training sample to apply the bat algorithm to optimize the wavelet neural network parameters and train the optimized wavelet neural network to obtain the prediction model of BA-WNN;

[0045] S5. Apply the test sample to the prediction model based on BA-WNN, and classify the test sample to complete the credit scor...

Embodiment 2

[0109] A personal loan credit scoring system based on BA-WNN, comprising the following modules: a sample acquisition module, a data processing module, a network training module, a credit scoring module and a training module;

[0110] The sample acquisition module is used to acquire credit evaluation data including personal application information, operation behavior data and post-loan repayment performance as modeling samples;

[0111] The data processing module: used for feature extraction of acquired data samples, including data missing completion, outlier processing and normalization;

[0112] Described network training module: be used for initializing wavelet neural network parameter, utilize training sample to adopt the wavelet neural network training of bat algorithm optimization to obtain prediction model;

[0113] The credit scoring module: used for obtaining the credit score by the wavelet neural network prediction model after obtaining the personal credit evaluation ...

PUM

Login to view more

Login to view more Abstract

Description

Claims

Application Information

Login to view more

Login to view more - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap