Payment Processing Platform

a payment processing platform and payment processing technology, applied in the field of payment processing, can solve problems such as limiting customer exposure, and achieve the effect of limiting customer exposure and reducing financial institution expenses

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

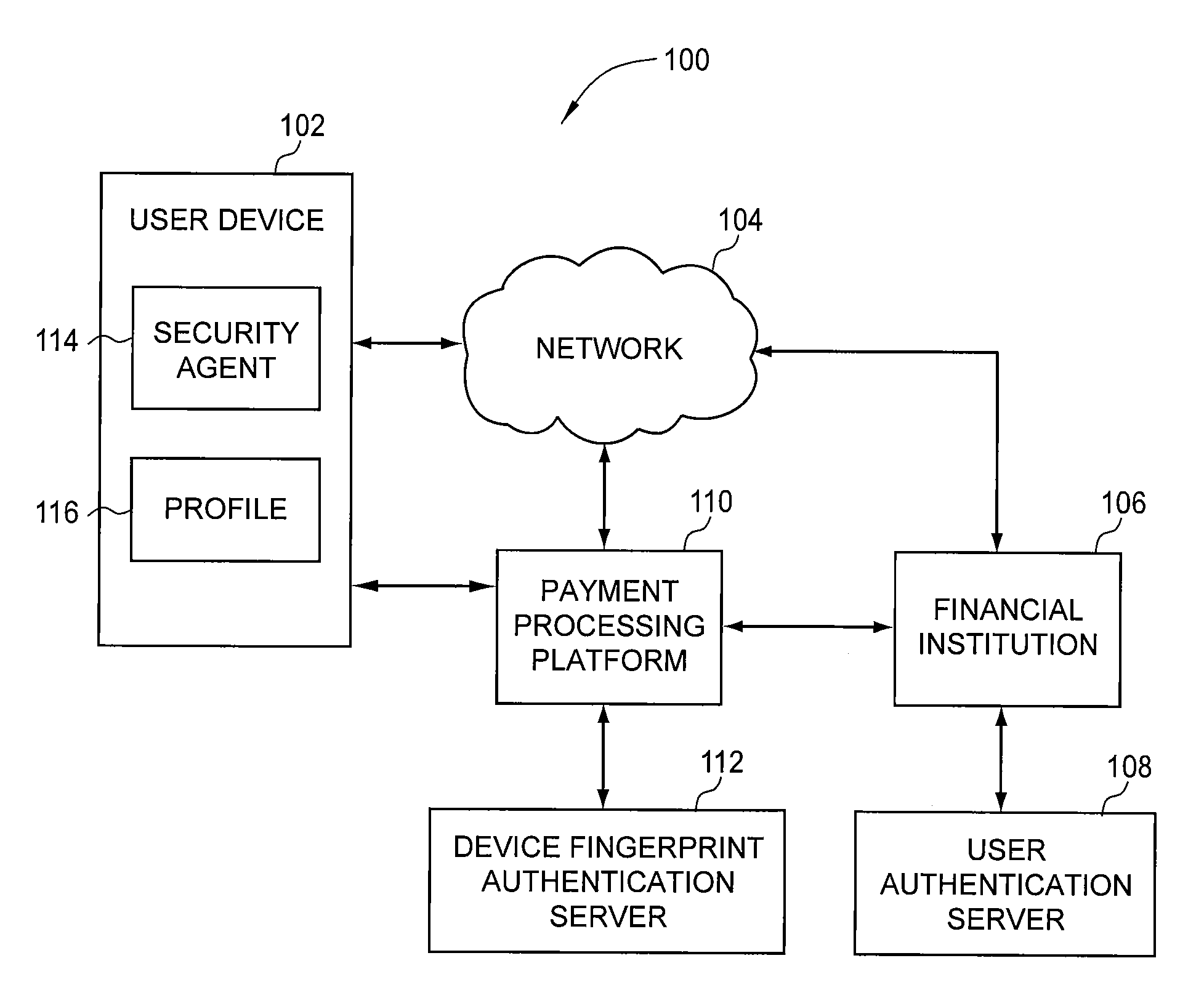

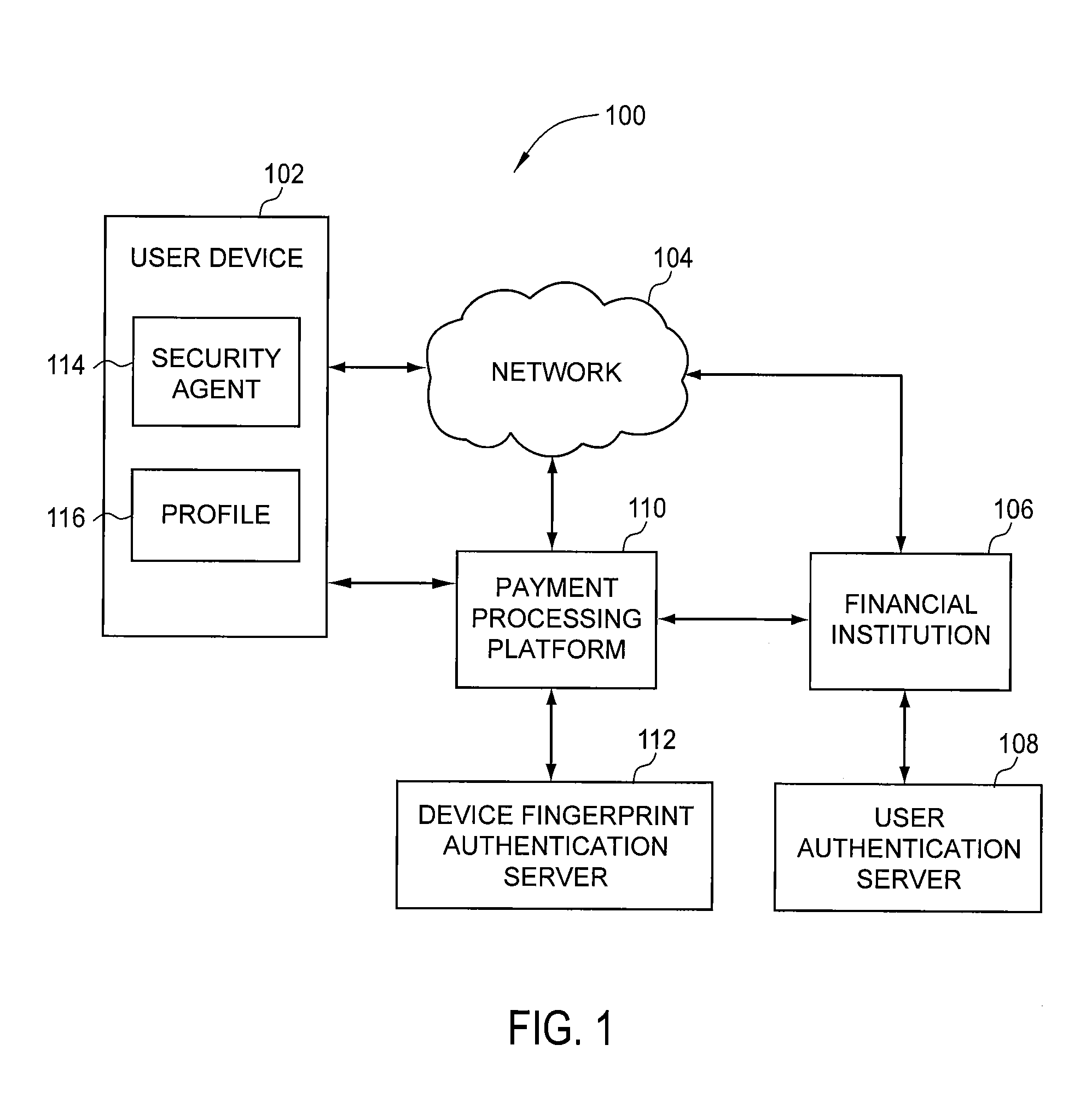

[0032]FIG. 1 is a block diagram illustrating components of a system 100 configured to implement one or more aspects of the present invention. As shown, the system 100 includes a user device 102, network 104, financial institution 106, user authentication server 108, payment processing platform 110, and device finger print authentication server 112.

[0033]The user device 102 may be any type of individual computing device such as, for example, a desktop computer, a laptop computer, a hand-held mobile device, a personal digital assistant, or the like. Alternatively, the user device 102 may be any other device, such as a standard telephone, or an ATM terminal for a financial institution, or a terminal used by a customer representative at a financial institution, or the like. In one embodiment, the user device 102 is configured to be in communication with the other components in the system 100 via the network 104. The network 104 may be any type of data network, such as a local area netwo...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com