[0016]The present invention satisfies the above needs, and overcomes the above-stated and other deficiencies of the prior art, by providing systems, web-sites, methods and related software products that enable users to temporarily store and subsequently retrieve

financial transaction information in a simpler, more timely and more cost effective manner. Generally, the present invention makes these and other benefits possible by providing a

central database (preferably coupled to a web-site) that is accessible via a communication network and that has the ability to receive financial transaction information from individual users, store such information and subsequently provide such information to the respective users. The particular manner in which the

database stores and provides this financial information is defined by a number of financial profile parameters which are preferably supplied by the users. If the users advantageously specify these parameters, the transaction information may be easily integrated into each user's personal finance software resident on the user's

personal computer. Alternatively, a predetermined and generic financial profile can be used by the

database to assist information upload and subsequent download, there being a likelihood that any given user can effectively use the database financial profile. The present invention, thus, enables the users to upload financial information to the database from a wide variety of remote input devices, via the communication network, and subsequently permits the users to download and integrate that information into their respective personal finance applications.

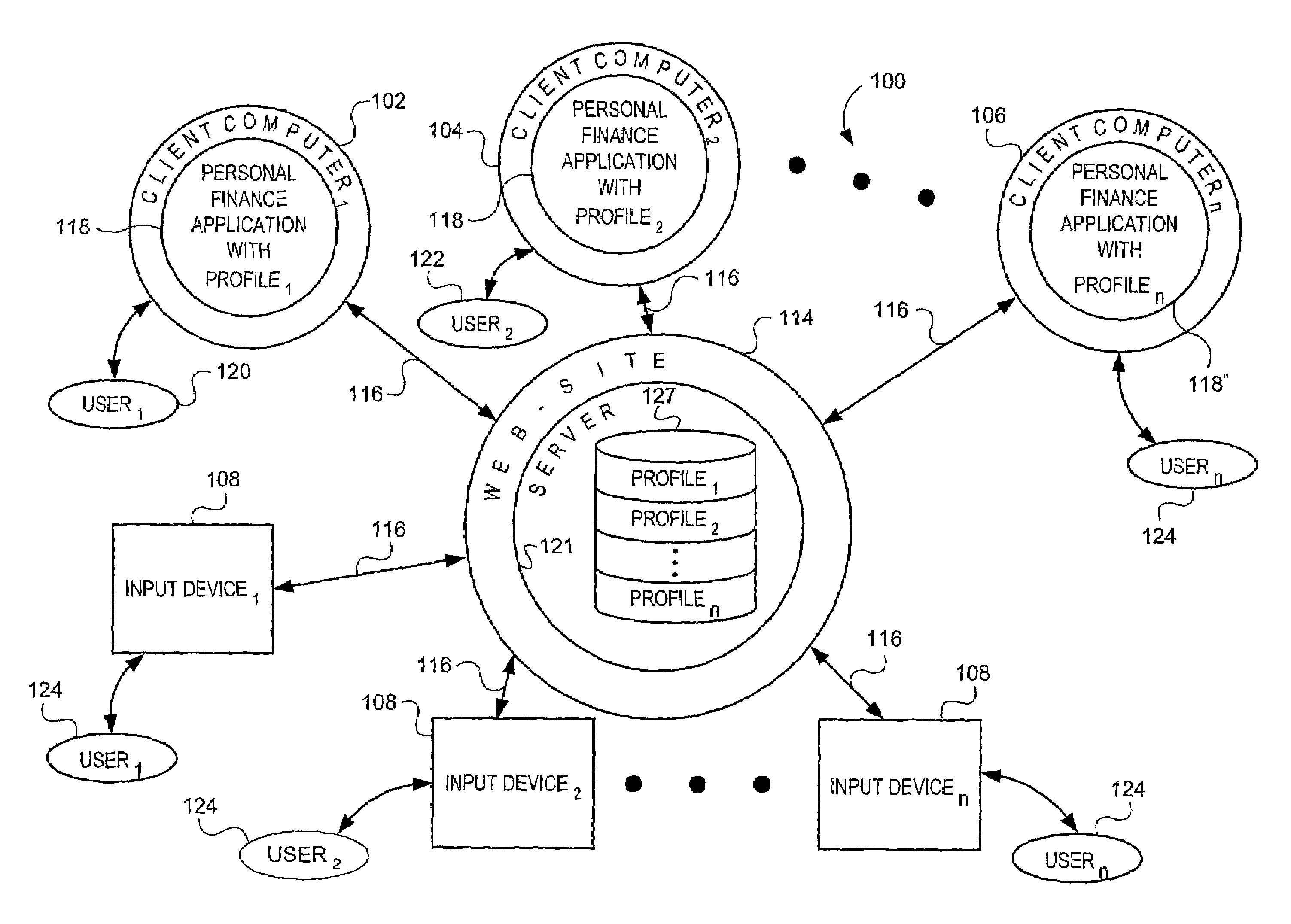

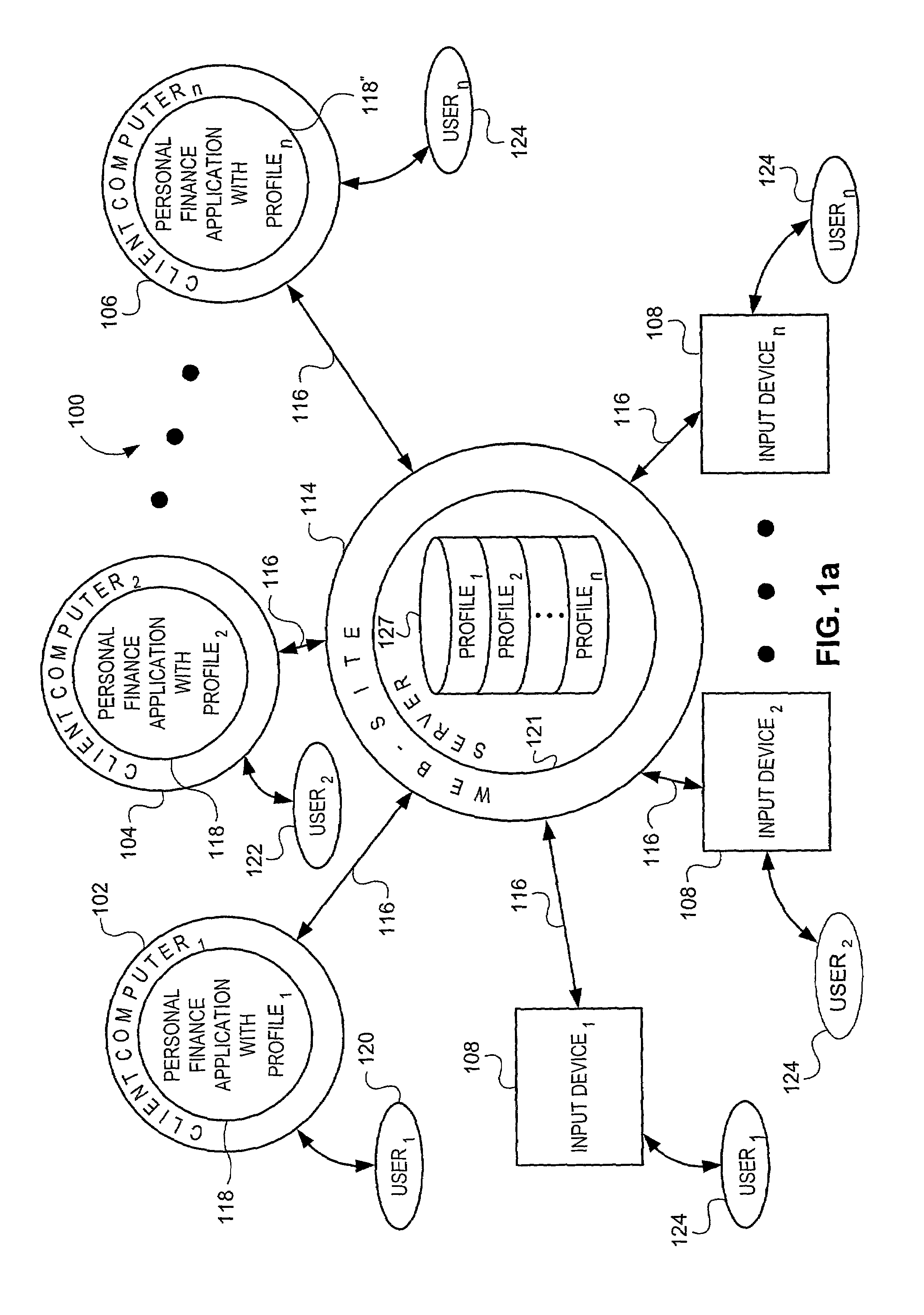

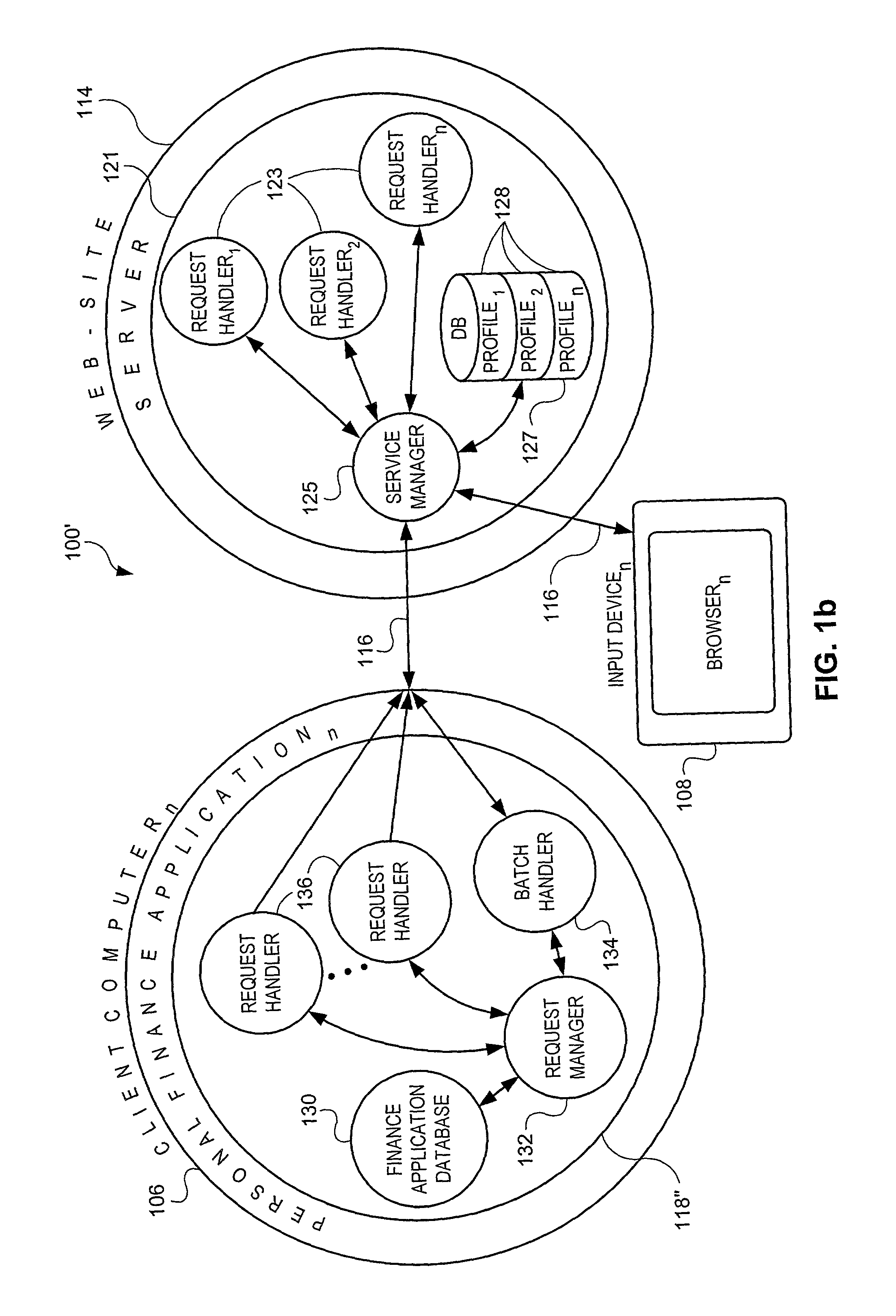

[0017]The

system embodiments of the present invention generally comprise a plurality of input devices,

client computers (each having a user-specific personal finance application) and a web-site server with a database. The input devices, client computers and web-site server are communicatively linked via a communication network so that a plurality of users can temporarily store and / or manipulate financial transaction information on the server from any of the input devices. Each user can also transmit financial profile information to the server. In one embodiment, the profile describes a user's accounts and categories. It may also, optionally, describe a user's classes. The profile information enables the creation of financial profiles which correspond with the unique profiles of each user's

financial application. This, in turn, simplifies remote entry of information, subsequent download of that information and integration of such information into each user's personal finance application. Therefore, when the user subsequently accesses a respective client computer having the user's customized personal finance application, the user can download the previously stored information and, at least partially automatically, integrate the information into the user's finance application.

[0021]One significant benefit offered by the present invention is a reduction in the probability that erroneous entries could be made in a user's personal finance application. One manner in which this benefit is realized is by increasing the timeliness with which financial information can be recorded. With the advent of the present invention, users no longer need to directly access their personal computers or PDAs in order to input financial transactions. Instead, users can

record financial transactions from any of the nearly ubiquitous input devices, such as personal computers, which provide access to a communication network such as

the Internet. In one embodiment of the invention, the information can even be automatically delivered from another web-site where a user has consummated a transaction. In this case, the possibility of

human error is entirely eliminated and recordation occurs at least substantially, and preferably virtually, instantaneously.

[0022]The possibility of erroneous entries occurring is further reduced because the present invention offers the ability to input financial transaction information from remote input devices in the same manner as a given user would input such information on the user's own personal computer. More specifically, because the database preferably stores each user's account

list, category

list and class

list, a user is able to store transaction information as easily as if they were entering the transaction into their personal finance application directly. Naturally, this feature reduces the possibility of erroneous entries because it reduces the possibility of

confusion. Finally, the present invention reduces the possibility of erroneous entries even more effectively than the use of personal digital assistants (PDAs) in the related art. This is because the present invention does not require any additional physical equipment. Thus, the chance of a failure to input information because a PDA was forgotten or damaged is eliminated.

[0023]The present invention also offers the benefit of increased convenience for a number of reasons. First, unlike the use of PDAs, the present invention does not entail the burden of carrying additional equipment. Moreover, since the present invention is preferably able to store on the web-site a copy of the financial profile of each user's personal finance application, each user can quickly and easily store and retrieve information in a manner which is customary to each user. This feature also facilitates subsequent download of stored information and automatic integration of such information into the user's personal finance application. Finally, the skyrocketing popularity of personal computers and communication networks such as

the Internet means that it is becoming more convenient to use the present invention with every day that passes.

[0024]Still another benefit offered by the present invention is that all of the above-discussed benefits are now available to users at virtually no additional expense. Unlike the above-discussed related art, the present invention does not require the purchase of any additional equipment such as a personal digital assistant. Moreover it is expected that in most circumstances users will be able to access an appropriate communication network at little cost, if any. This is in contrast to

the Internet access fees customarily assessed to users of personal digital assistants. In short, the present invention is an improvement over the prior art in that it offers all of the benefits of storing financial transaction information on a personal digital assistant, without any of the associated deficiencies of such a

system.

Login to View More

Login to View More  Login to View More

Login to View More