Information theory learning-based stock market fluctuation section prediction method

A forecasting method and information theory technology, applied in the field of stock market fluctuation range forecasting based on information theory learning, can solve problems such as unsatisfactory forecasting performance, and achieve the effect of wide application, good accuracy and robustness

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

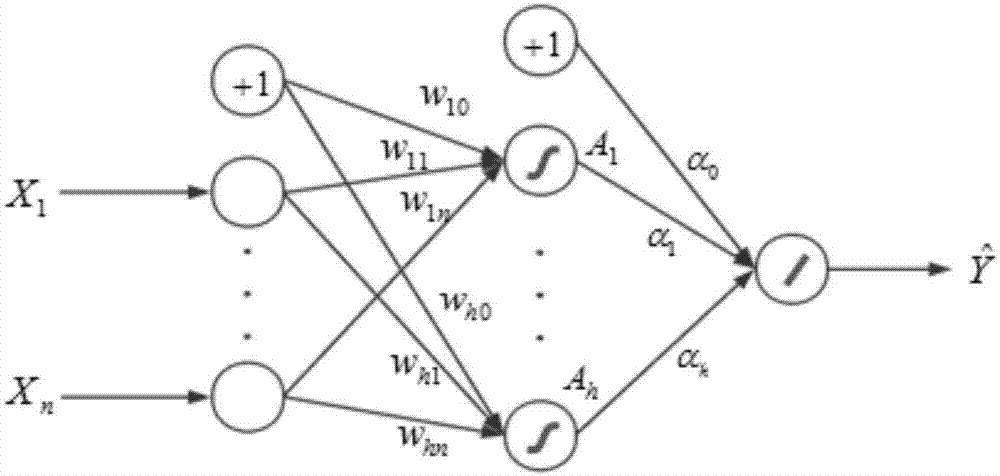

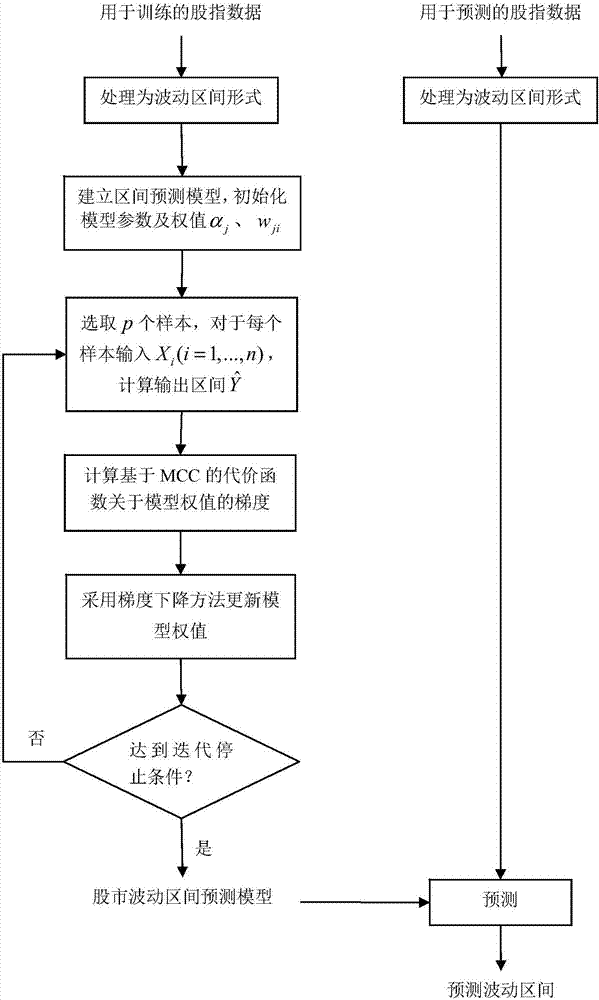

Method used

Image

Examples

Embodiment 1

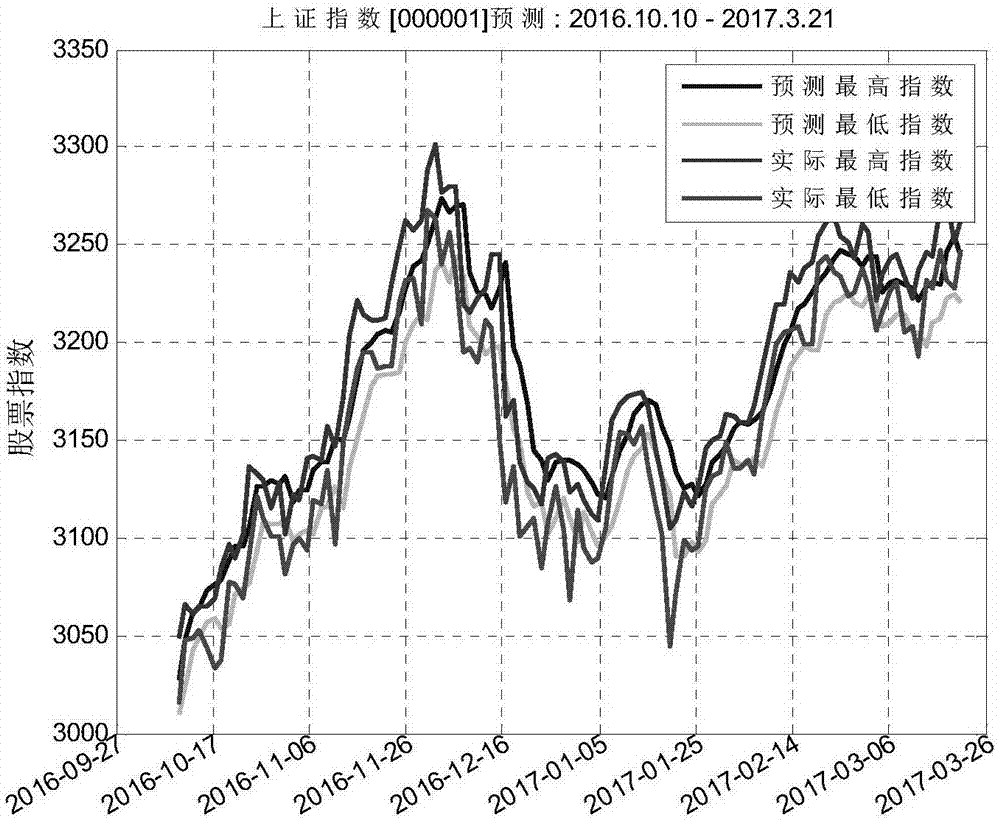

[0087] In order to verify the performance of the stock market fluctuation interval prediction method based on information theory learning described in the present invention, and the effect comparison with the MSE-based interval neural network prediction method, the method is applied in the prediction of my country's Shanghai Composite Index below. We selected the highest and lowest prices of the Shanghai Composite Index (code 000001) for a total of 539 days from January 1, 2015 to March 21, 2017 as the data set, of which a total of 428 111 days from October 10, 2016 to March 21, 2017 are used as the test set. The number of input layer units n=8, the number of hidden layer units h=15, the number of output layer units m=1, the sample batch size p=5, the weight of the cost function of the center and radius β=0.5, and the width of the relevant entropy kernel function is taken as σ = 0.3. The predicted results and actual interval values on the test set are attached image 3 As ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com