Dynamic assessment and forecasting method of local government debt risk

A forecasting method and dynamic evaluation technology, applied in forecasting, instrumentation, finance, etc., can solve the problems of multicollinearity of indicators, unstable conclusions, and single research object, so as to avoid economic losses, ensure economic security, and stabilize financial markets. Effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

[0052] The present invention will be further described below in conjunction with the accompanying drawings.

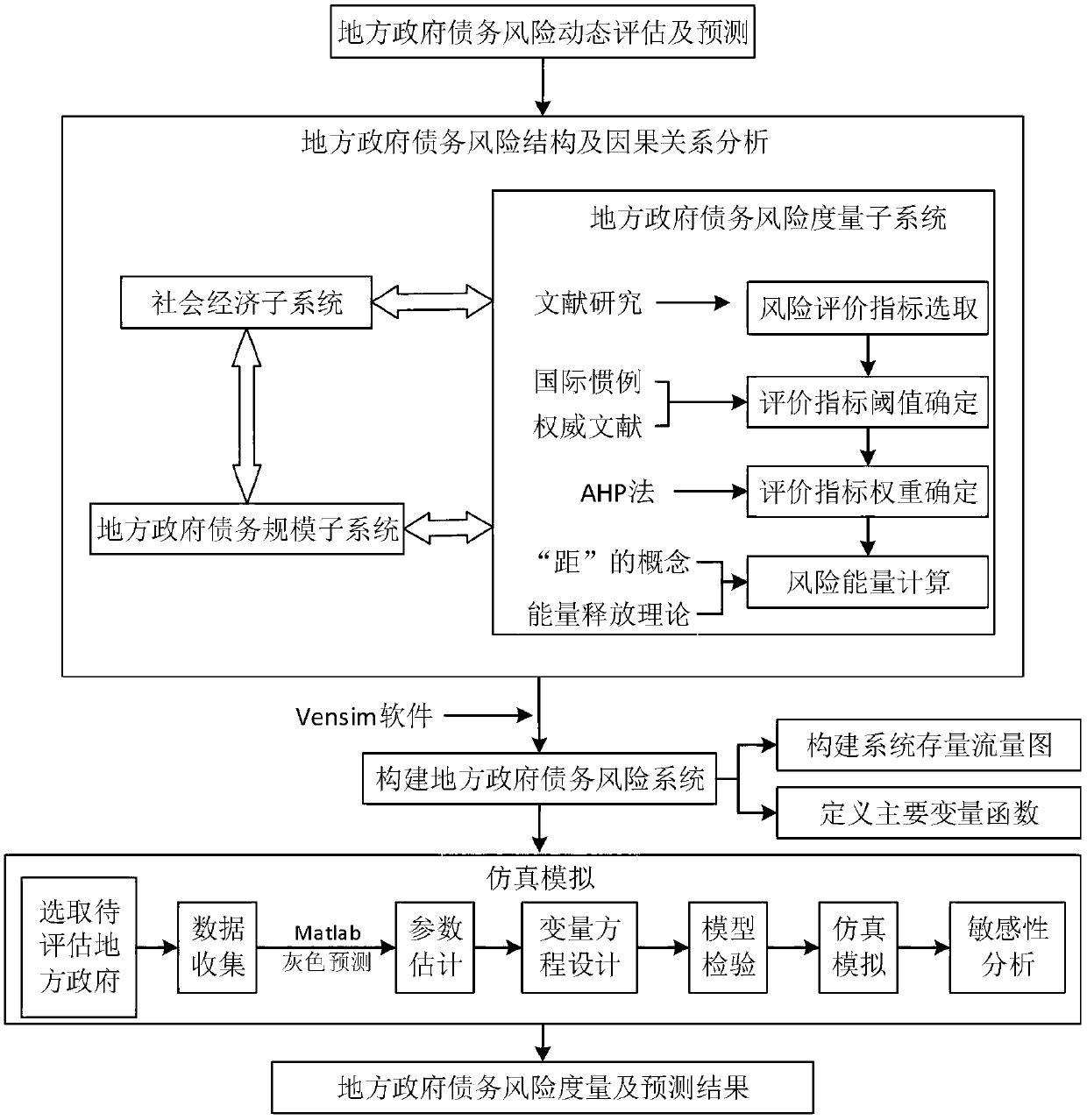

[0053] refer to figure 1 , a dynamic assessment and prediction method for local government debt risks, including the following steps:

[0054] The first step is to analyze the system structure and causality of local government debt risk.

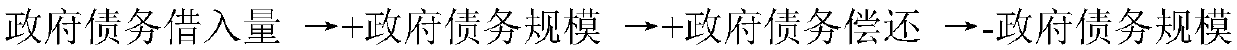

[0055] The local government debt risk system is composed of internal and external systems that affect the borrowing and repayment of local government debt. The external environment that has the greatest impact on government debt is social and economic development, and the internal system that has the greatest impact on government debt is the change in debt scale and debt. There are two aspects of risk. Therefore, the local government debt risk system mainly includes three subsystems: social economy, local government debt scale, and local government debt risk measurement. feedback structure.

[0056] (1) Socio-economic subsystem. ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com