Intelligent tax processing method and device, terminal and medium

A processing method and technology of the tax side, applied in the computer field, can solve problems such as cumbersome operation, inconvenient operation, and affecting user experience, and achieve the effect of simplifying the operation process, improving efficiency, and improving operation convenience

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

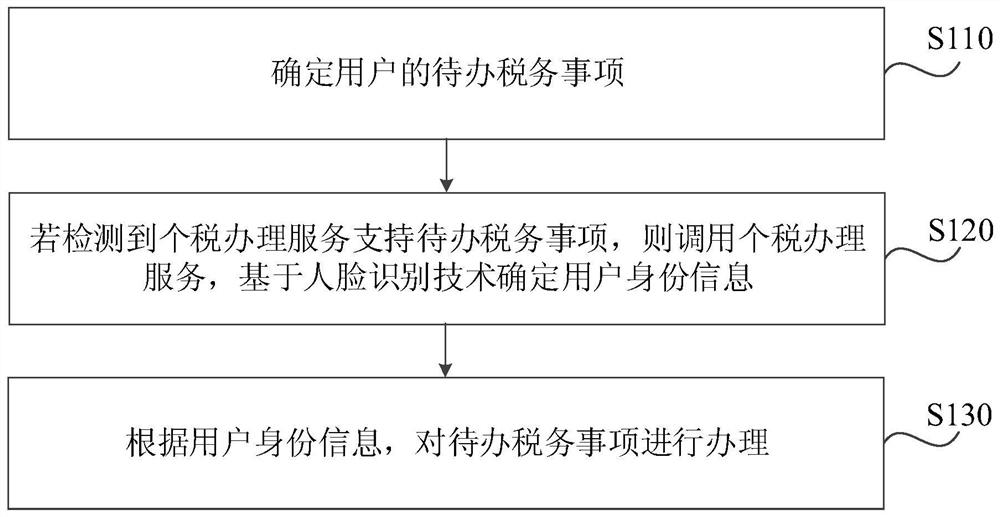

[0028] figure 1 It is a flow chart of the intelligent tax processing method provided by Embodiment 1 of the present invention. This embodiment is applicable to the situation where the user’s tax matters are processed online according to the user’s tax processing requirements. The method can be executed by an intelligent tax processing device. The device can be realized by means of software and / or hardware, and can be integrated on a terminal, such as a mobile terminal, a computer, an intelligent interactive robot, and an intelligent home appliance.

[0029] Such as figure 1 As shown, the intelligent tax processing method provided in this embodiment may include:

[0030] S110. Determine the tax matters to be done by the user.

[0031] When the user needs to handle tax matters, the terminal can learn the tax matters that he needs to handle through the interaction with the terminal. In this embodiment, the pending tax matters may include any type of business related to taxatio...

Embodiment 2

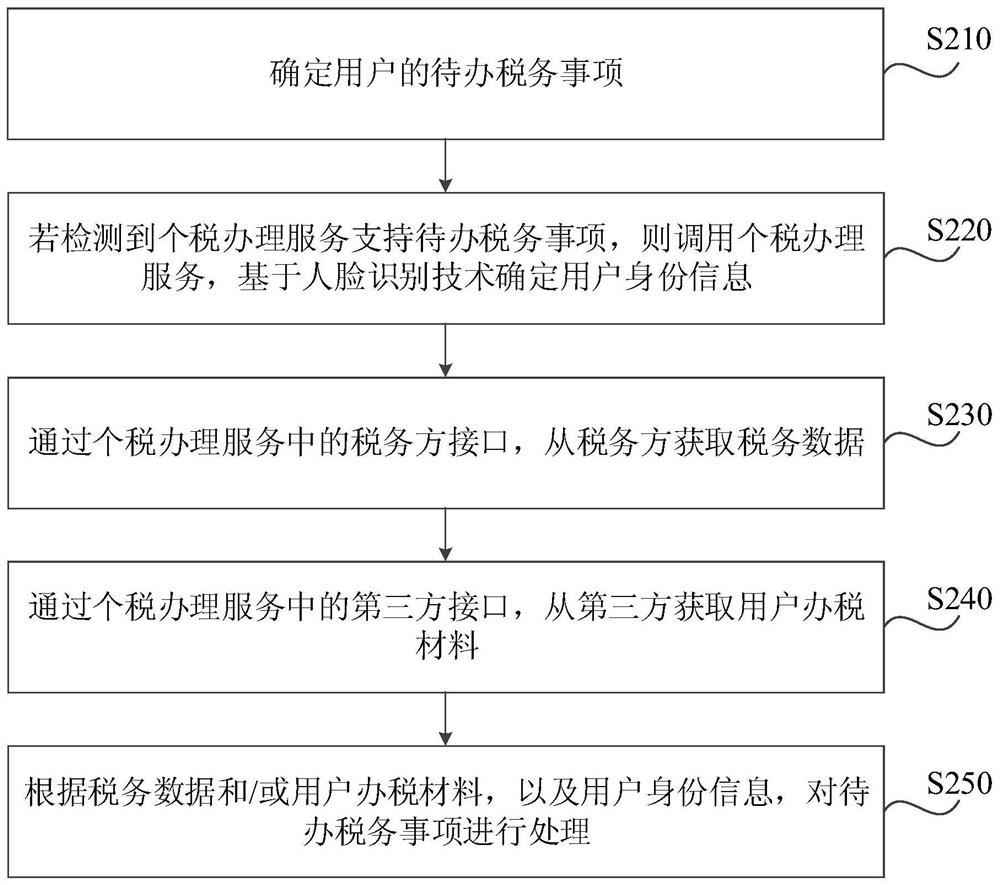

[0049] image 3 It is a flow chart of the intelligent tax processing method provided in Embodiment 2 of the present invention. This embodiment is further expanded and optimized on the basis of the foregoing embodiments. Such as image 3 As shown, the method may include:

[0050] S210. Determine the tax matters to be done by the user.

[0051] S220. If it is detected that the personal tax processing service supports pending tax matters, call the personal tax processing service, and determine user identity information based on face recognition technology.

[0052] S230. Obtain tax data from the tax party through the tax party interface in the individual tax processing service.

[0053] Wherein, the tax party interface refers to an interface for data communication between the terminal and the tax party database, and the tax party may be a tax department in any administrative region. By calling the tax party interface to obtain tax data, the reliability and security of the sou...

Embodiment 3

[0065] Figure 4 The structure schematic diagram of the intelligent taxation processing device provided by the third embodiment of the present invention, this embodiment is applicable to the situation of processing the user's taxation matters online according to the user's taxation processing requirements. The device can be realized by means of software and / or hardware, and can be integrated on a terminal, such as a mobile terminal, a computer, an intelligent interactive robot, and an intelligent home appliance.

[0066] Such as Figure 4 As shown, the intelligent tax processing device provided in this embodiment may include a pending tax matter determination module 310, a user identity information determination module 320, and a pending tax matter processing module 330, wherein:

[0067] To-do tax matters determining module 310, configured to determine the user's to-do tax matters;

[0068] The user identity information determination module 320 is used to call the individua...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com