OCR-based post-loan inspection system and method

An inspection method and inspection system technology, applied in the computer field, can solve problems such as inaccurate identification and captured content, and achieve the effect of improving accuracy

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

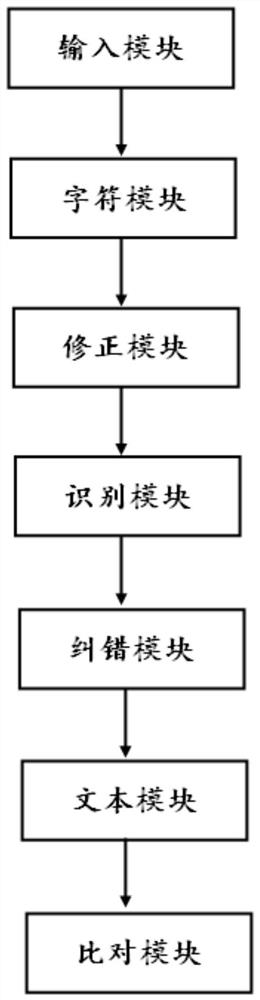

[0059] The embodiment of the OCR-based post-loan inspection system of the present invention is basically as attached figure 1 shown, including:

[0060] The input module is used to take and extract the text picture of the photocopy of customer information;

[0061] The character module is used to input the text image into the pre-trained text correction network model, and output the classification saliency map at the character level;

[0062] The correction module is used to correct the text picture and the classification salient map by using the strip region transformation algorithm, and output the corrected picture;

[0063] The recognition module is used to convert the printed characters in the corrected picture into a black and white dot matrix image file by using optical character recognition technology, convert the text in the image file into a text format, and output the recognized text;

[0064] The error correction module is used for associating and identifying the ...

Embodiment 2

[0085] The only difference from Embodiment 1 is that the error correction module also includes a confusing unit, which determines the confusing words corresponding to the wrong word segmentation, determines the degree of confusion of the confusing words corresponding to the wrong word segmentation; and based on the confusing words corresponding to the wrong word segmentation; For the degree of confusion of the confused word, the confusing word corresponding to the wrong word segmentation is selected according to the preset rules, and the selection result is used as the error correction word corresponding to the wrong word segmentation. In this embodiment, confusing words are collected in advance, such as "reservation", "reservation", "deposit" and "deposit". For identifying the wrong word segmentation in the text, based on the pre-collected data, determine the confusing word corresponding to the wrong word segmentation, and manually set the confusing degree of the confusing wor...

Embodiment 3

[0087] The only difference from Embodiment 2 is that it also includes a client, which is used to collect the behavior data related to the loan of the user in real time, analyze the behavior data, and judge whether the user is a high-quality customer with both repayment willingness and repayment ability . In this embodiment, the client is a bank APP, which is provided to the user for free for a period of time, and collects data related to the user's loan behavior in real time during the user's usage period.

[0088]Specifically, read the text messages received by the user every day, and conduct semantic analysis by extracting keywords in the text messages, so as to make a judgment on the user's repayment willingness and repayment ability. For example, the user's bank card text message may contain words such as "balance" and "arrears". At this time, semantic analysis is performed to determine whether the balance of the bank card is less than the arrears, and at the same time cou...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com