Hardware-Based Zero-Knowledge Strong Authentication (H0KSA)

a technology of strong authentication and zero-knowledge, applied in the field of secure financial transactions, to achieve the effect of reducing the risk of fraudulent purchases

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

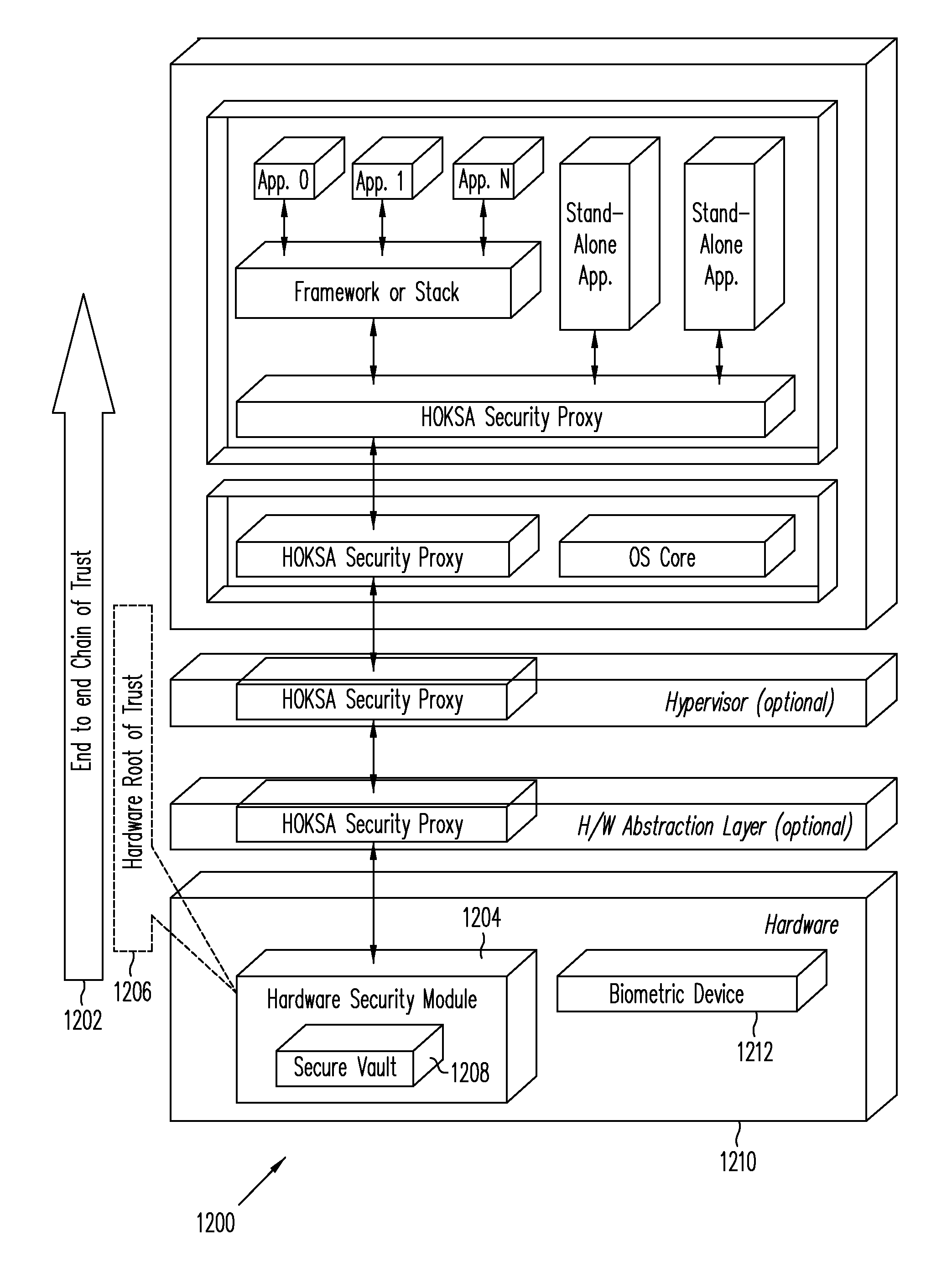

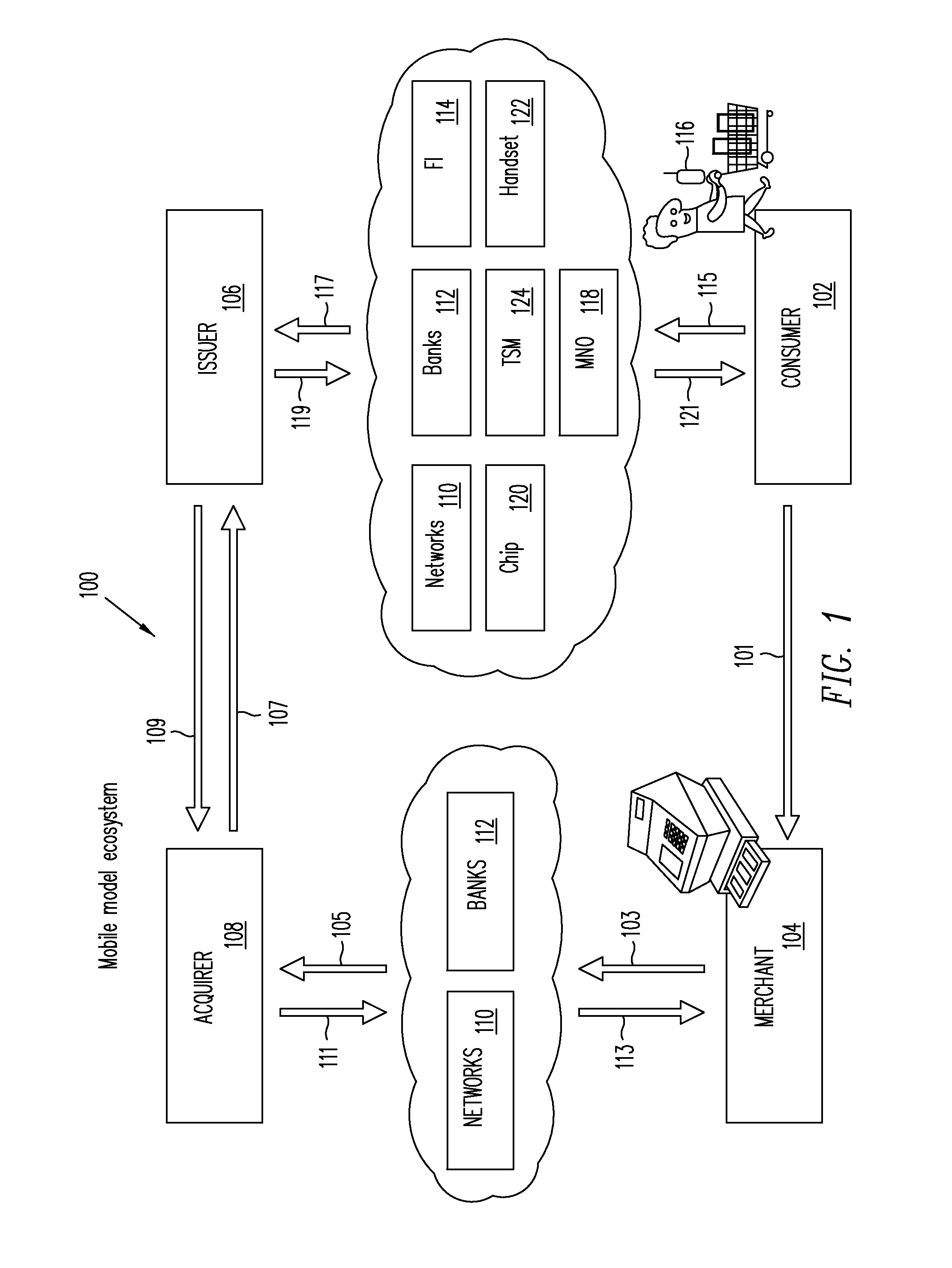

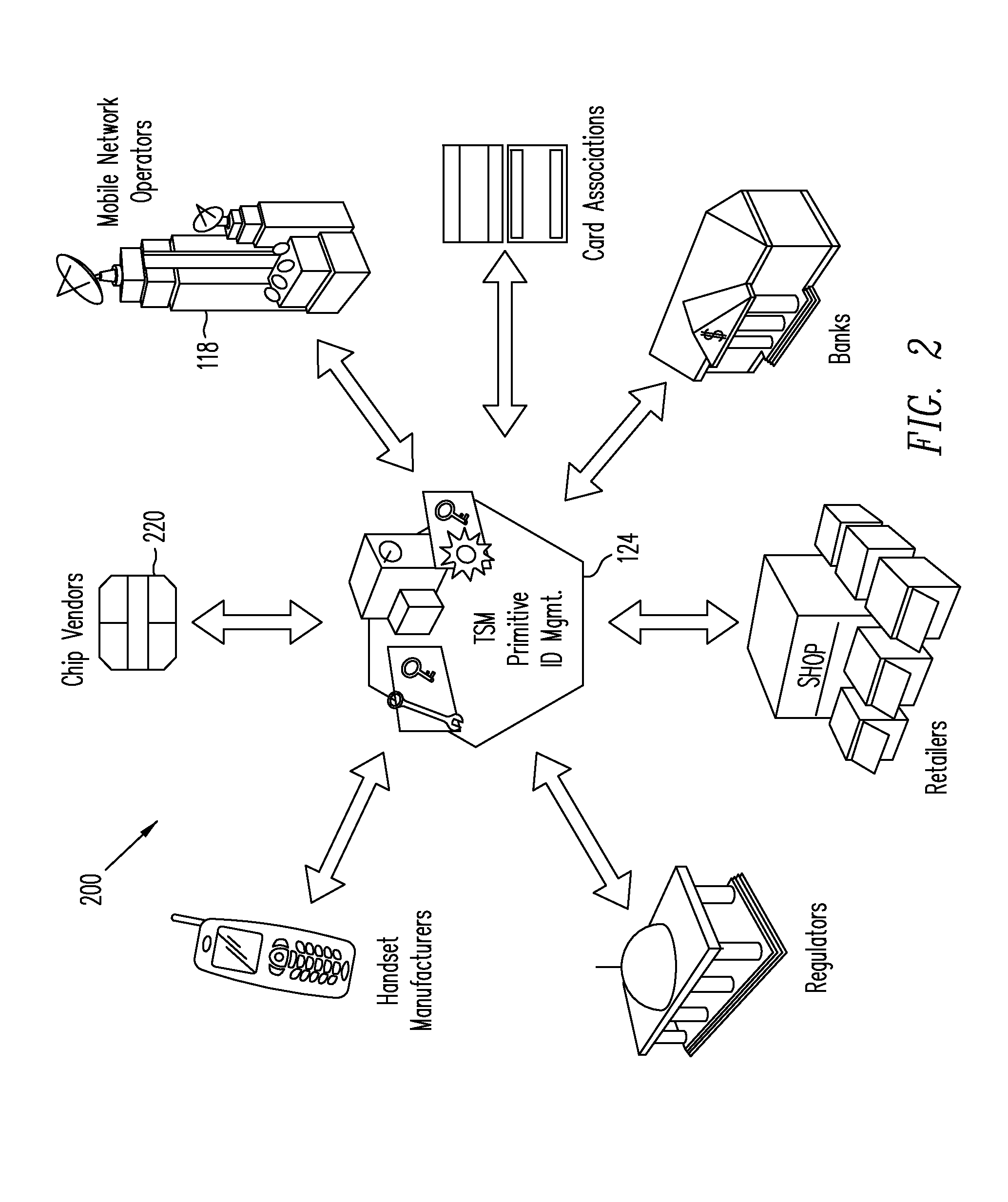

[0030]Embodiments of the present invention relate to mobile embedded payment (MEP) systems and methods for providing secure financial transactions over a network using a Trusted Service Manager. In one embodiment, a Trusted Integrity Manager (TIM)—which may also be referred to as a Trusted Authentication Provider (TAP)—is provided in addition to a Trusted Service Manager (TSM) that manages financial-related communication between carriers, consumers, retailers, and financial institutions. The TIM (acting, e.g., as MEP system server and providing various service processes) and the ability to use the phone function (acting, e.g., as MEP client) to feed data back to the TIM are novel concepts in the financial industry. By coupling the TIM server functions to an embedded secure element (eSE) client inside the handset, a new level of verification and security may be introduced into the financial industry.

[0031]The functioning of the TIM may be considered the “trust foundation” of the TSM ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com