Intelligent credit granting system and method for technical small and medium-sized enterprises

A technology for small and medium-sized enterprises and intelligent systems, applied in the field of credit system, it can solve the problems of easy loopholes in the overall process, unsupervised data upload, affecting user information security, etc., to reduce the difficulty of collection and identification, enhance security, improve The effect of utilization efficiency

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

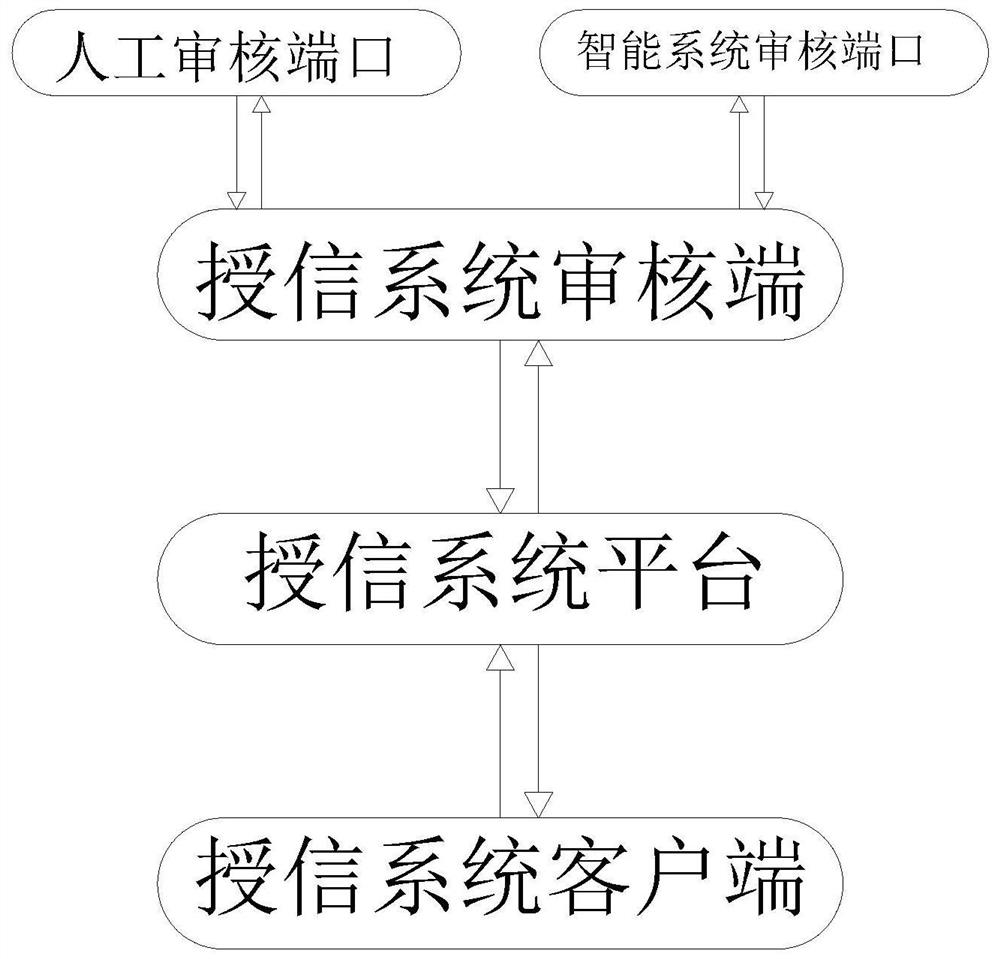

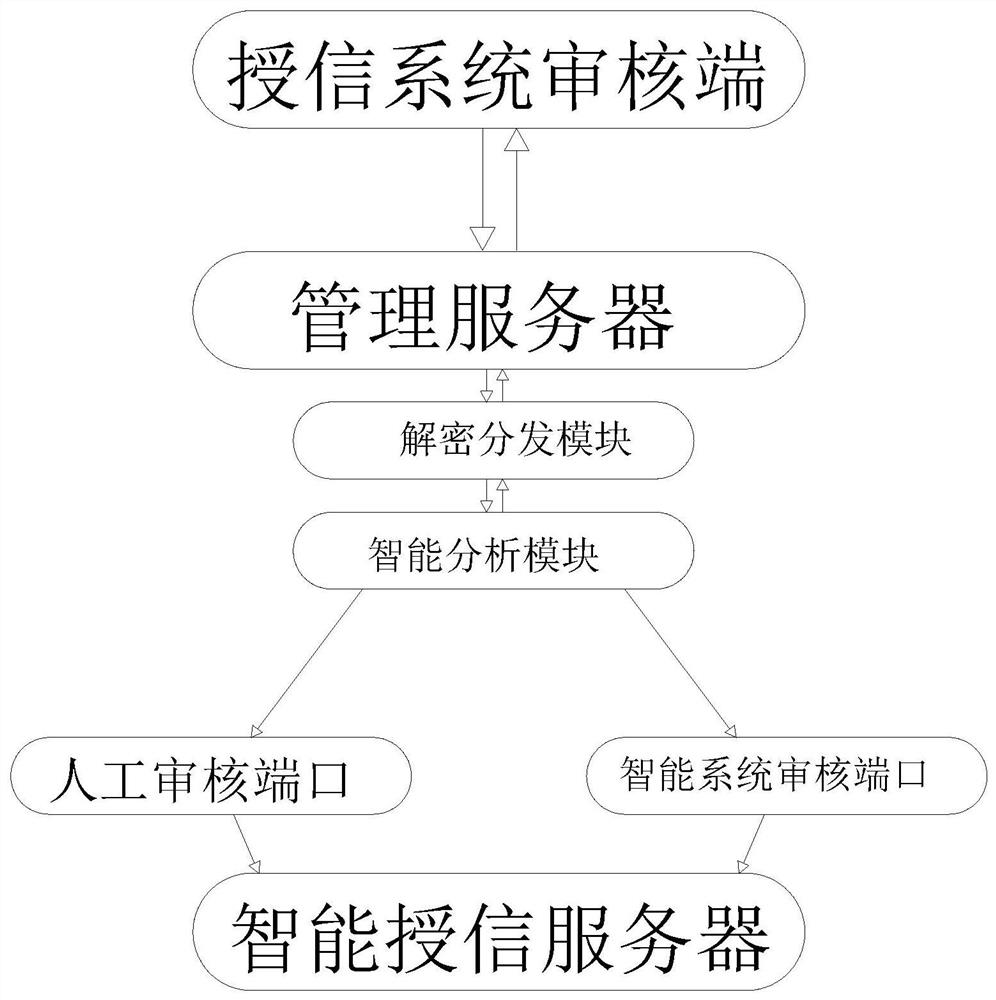

[0040] like figure 1 , image 3 , The present invention provides a system for smart credit SME, including a signal receiving end platform credit, credit credit platform is connected to the client system, the signal output terminal is connected to platform credit credit system audit end, credit system audit end comprises a manual review ports and intelligent systems audit port, manual review port and intelligent systems audit dual channel design port, not only improve the audit efficiency while reducing errors generated when the audit, further reducing the audit expenditure processes, intelligent systems audit signal at the output port is connected to a smart credit server, the output of the signal audits end of the credit system is connected to the management server, terminal power management server connected to decrypt the distribution module, the terminal decrypts the distribution module power connected intelligent analysis module by with decryption distribution modules and intel...

Embodiment 2

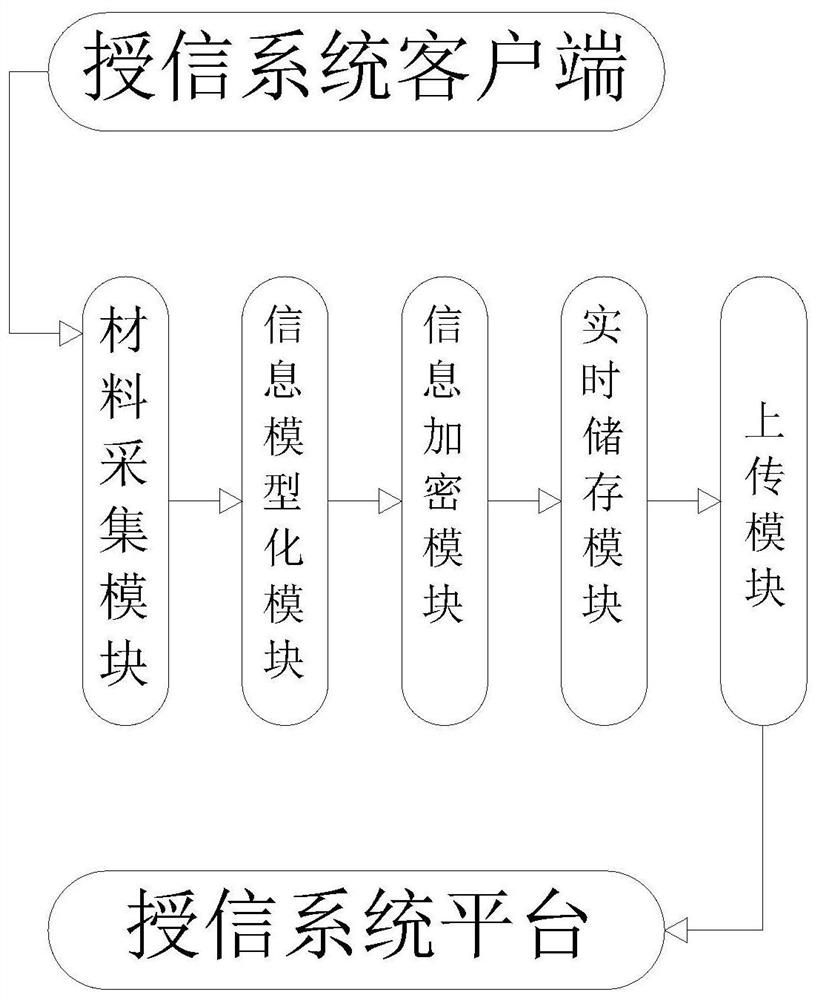

[0042] like Figure 1-3, In the embodiment 1 on the basis of embodiments, the present invention provides a technical solution: Preferably, the credit system client module comprises a collection material, terminals electrically connected to material information acquisition module modeling module, collected through the material with module and an information model of the module, reducing the difficulty of information collection, while using a model of the design, such information architecture review more intuitively clear, further reducing the difficulty of review, the terminal electrical information modeling module is connected encrypted module terminals electrically encryption module is connected to the real-time storage module terminal electrically real storage module is connected to upload module, the receiving end the signal is connected uploading module output terminal of the credit platform, using information encryption module and real-time with the storage module, real-time d...

Embodiment 3

[0044] like Figure 1-5 As shown, on the basis of Example 1, Example 2, the present invention provides an intelligent method of credit for SME, smart credit for SME method, comprising the steps of:

[0045] Step one, the client uploads collected material;

[0046] Step two, the credit classification system platform distribution;

[0047] Step three, credit audit system audit end;

[0048] Step four, credit analysis and evaluation, in particular: Credit Analysis and Evaluation of mating by intelligent analysis module and smart credit server, intelligent analysis module first sends material information to the intelligent system audit port, approval is sent to the smart credit server, assigned credit limit, by using intelligent analysis module and intelligent system audit port with reduced labor costs review process to produce consumption and improve audit efficiency, if the audit fails, the feedback to the intelligent analysis module, intelligent analysis module will review the mater...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com