Check writing point of sale system

a point of sale and check writing technology, applied in the field of point of sale systems, can solve the problems of inability to work, inability to read account and other information, and inability to use the deming system to transfer finds, so as to improve the prospect of collecting the underlying monies, reduce the time for collecting cash receipts, and increase the access to and use of funds.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

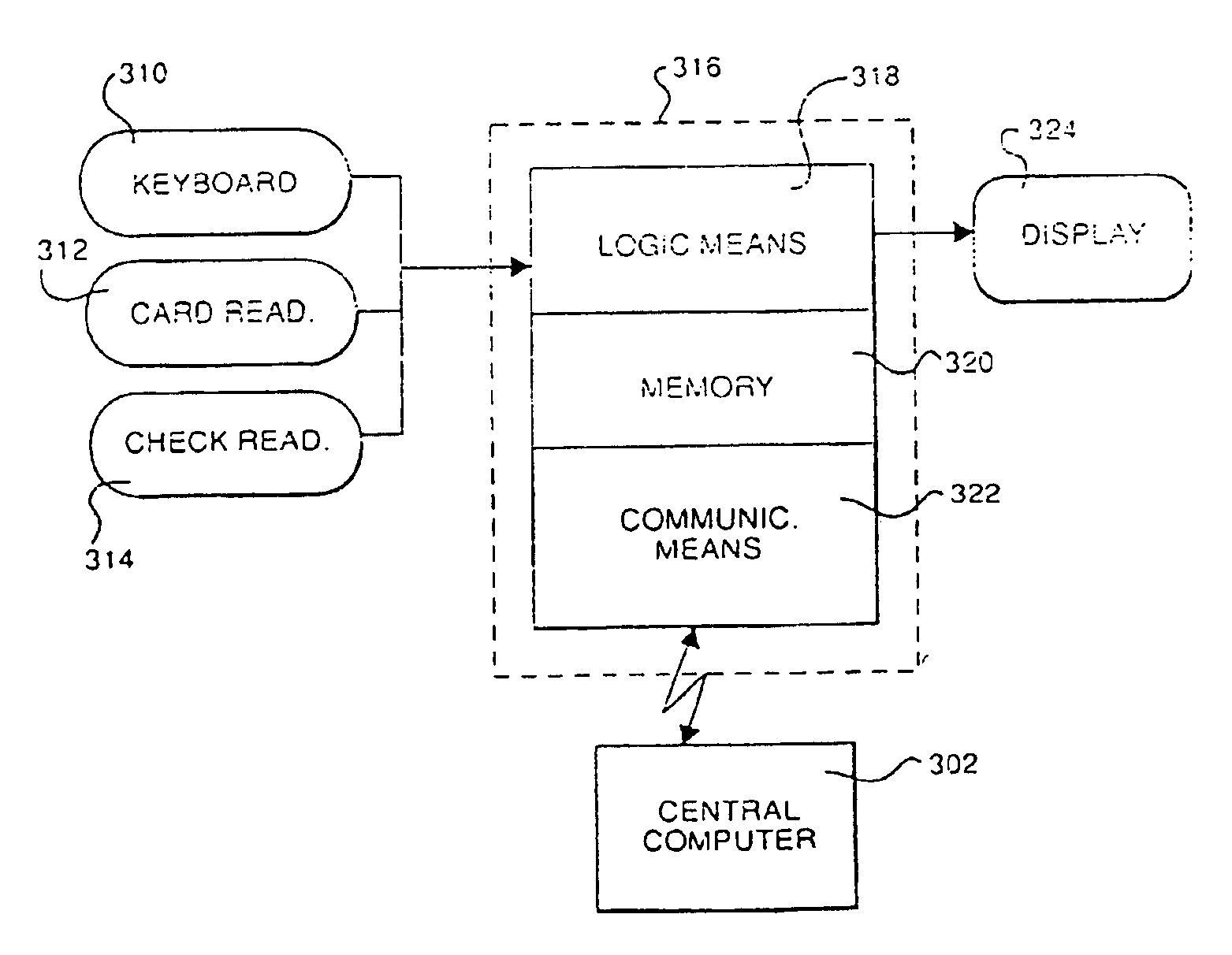

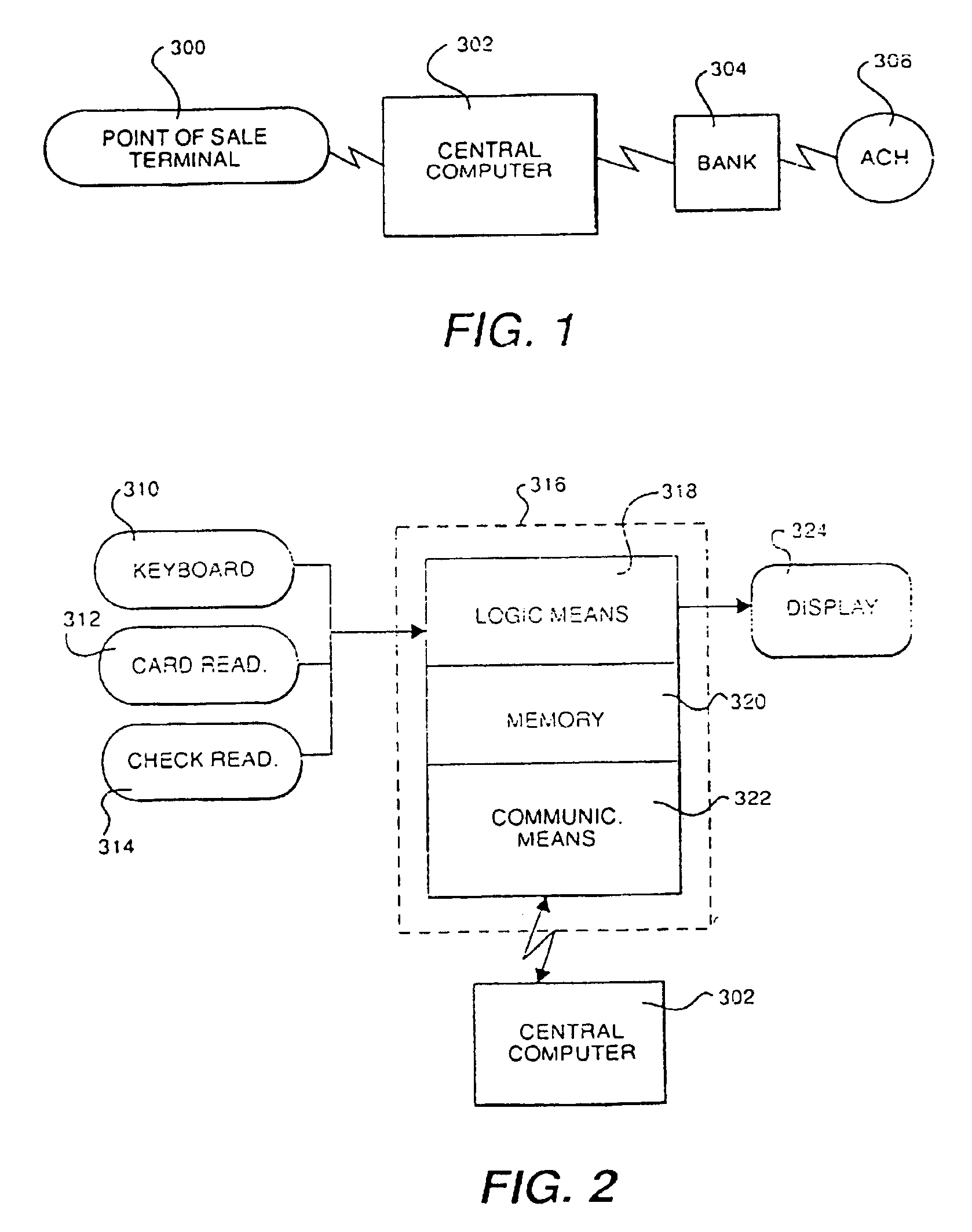

[0028]The method of the present invention begins with the electronic capturing of consumer information at a system subscriber's location using a point-of-sale terminal and related equipment. This information is obtained in the presence of the consumer and occurs prior to any “Approval” for the Transaction Event or for the ultimate crediting of the System subscriber's designated depository account.

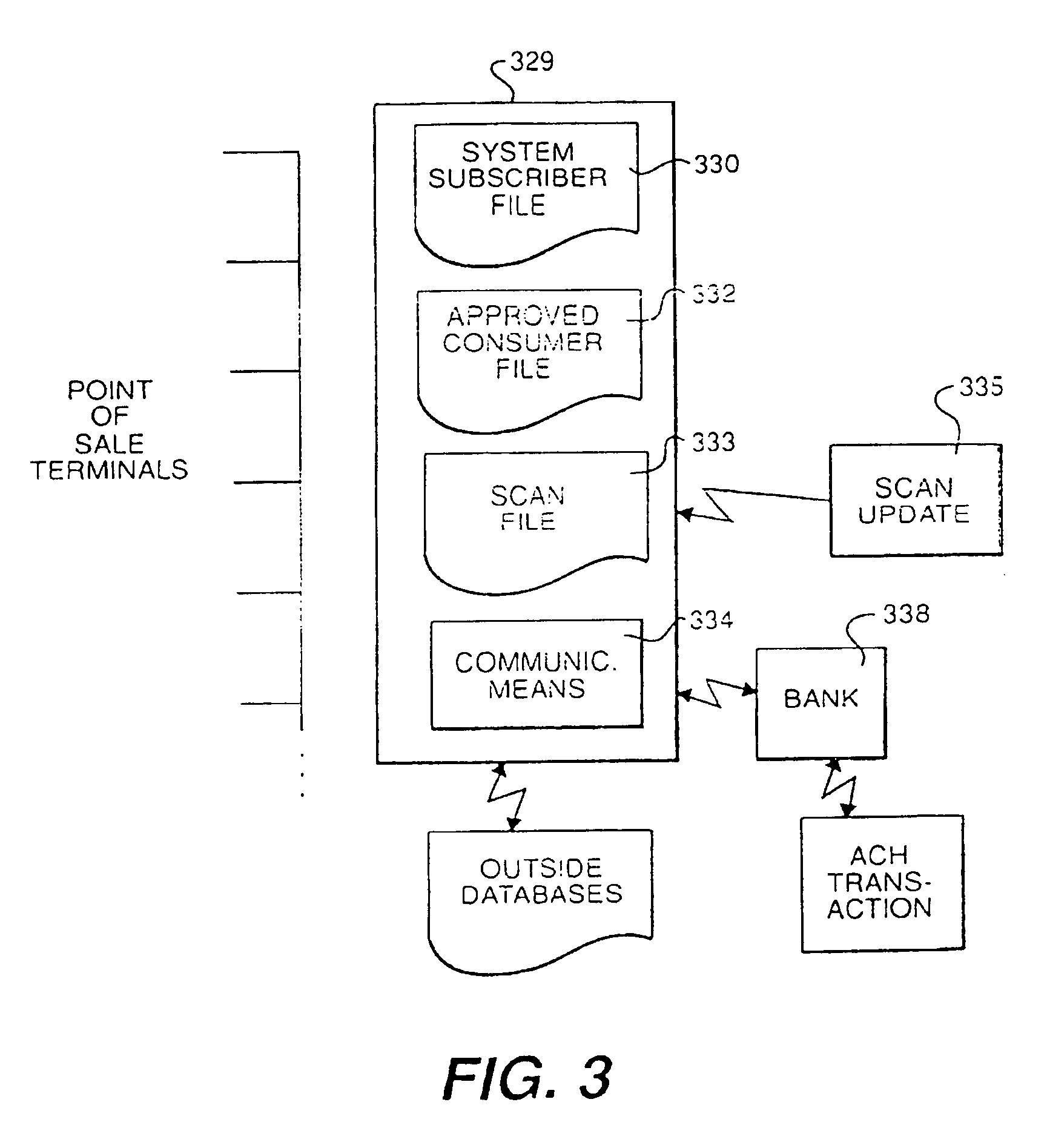

[0029]A Transaction Event involves a series of events initiating with a system subscriber's intent to sell goods or services, the payment for which would be funds secured in a consumer's banking account. The consumer's banking account status would first be verified by accessing the central computer files of the present invention. Verification is performed by use of an encoded, magnetic stripe card, where presented by the consumer or by input of account numbers from a consumer's specimen check. The present invention also contemplates compatibility with “SMART card” technology, whereby a cons...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com