A value-added tax invoice application analysis system based on big data center

An application analysis and value-added tax technology, applied in the field of VAT invoice application analysis system, to achieve the effect of promoting specialization, improving work efficiency and quality, and improving the quality of collection and management

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0034] Embodiments of the present invention will be further described below in conjunction with the accompanying drawings.

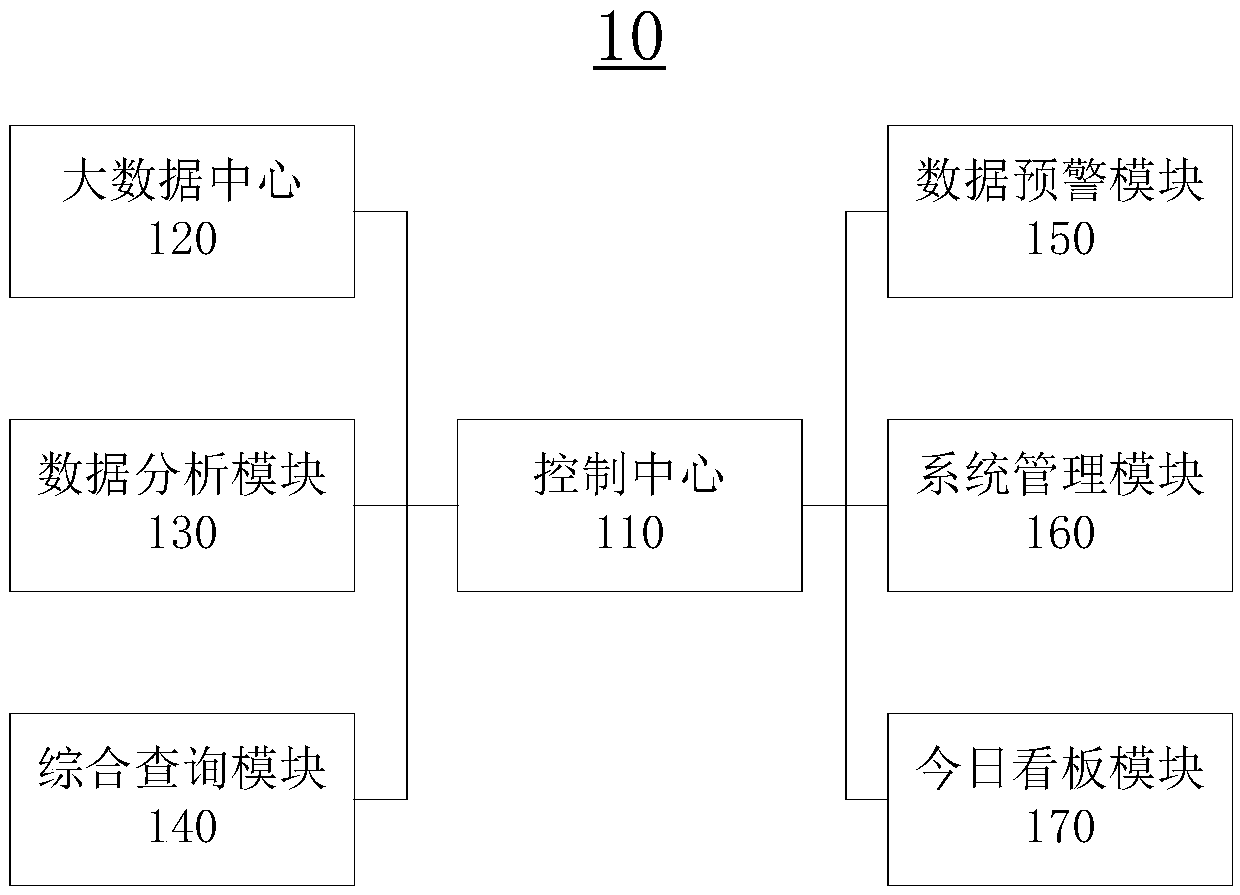

[0035] see figure 1 , the present invention provides a value-added tax invoice application analysis system 10 based on a big data center 120, including: a control center 110, a big data center 120, a data analysis module 130, a comprehensive query module 140, a data early warning module 150, and a system management module 160 And today's kanban module 170, the control center 110 is connected with the big data center 120, data analysis module 130, comprehensive query module 140, data early warning module 150, system management module 160 and today's kanban module 170 as a data transmission center.

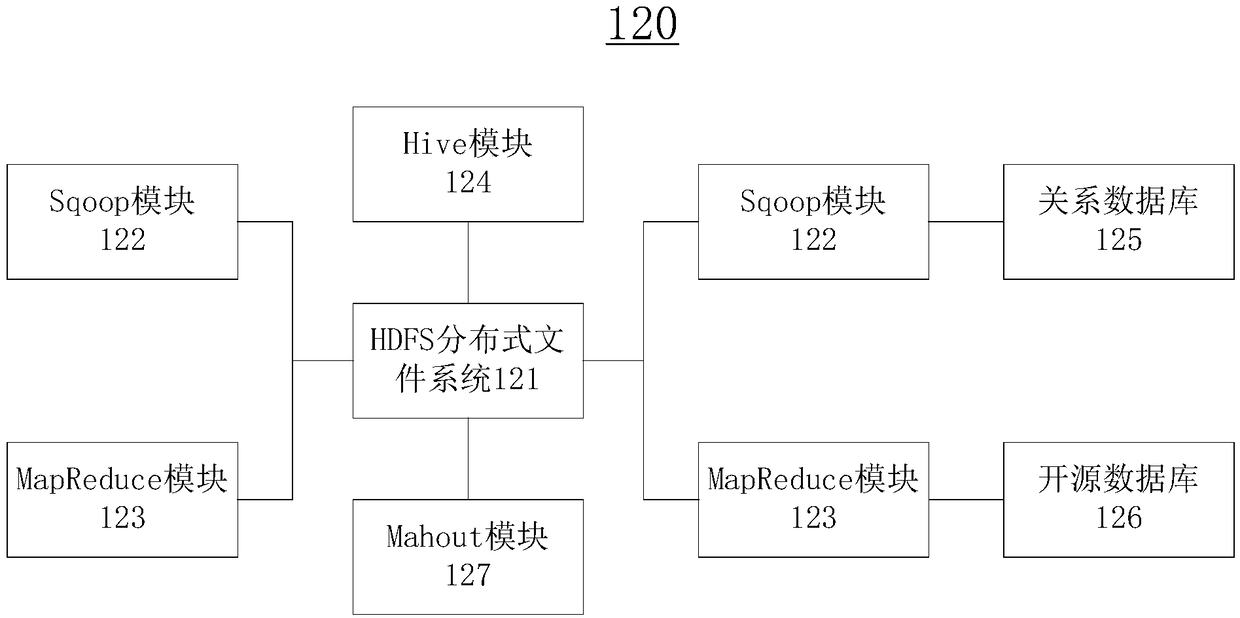

[0036]This system adopts the separation structure of the front and back, and the software environment used in the background is the Linux operating system, builds Hadoop clusters, uses hive to realize the ETL process of multiple data sources, and goes through ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com