The methods disclosed heretofore do not adequately satisfy the needs of enforcing signature verification and the privacy of customers' email addresses.

Although the PIN number adds security, the reliability of the intelligent credit card is not ensured as the key pad is not fail-proof and the battery can be out of power.

The intelligent credit card is useless when any such malfunction occurs.

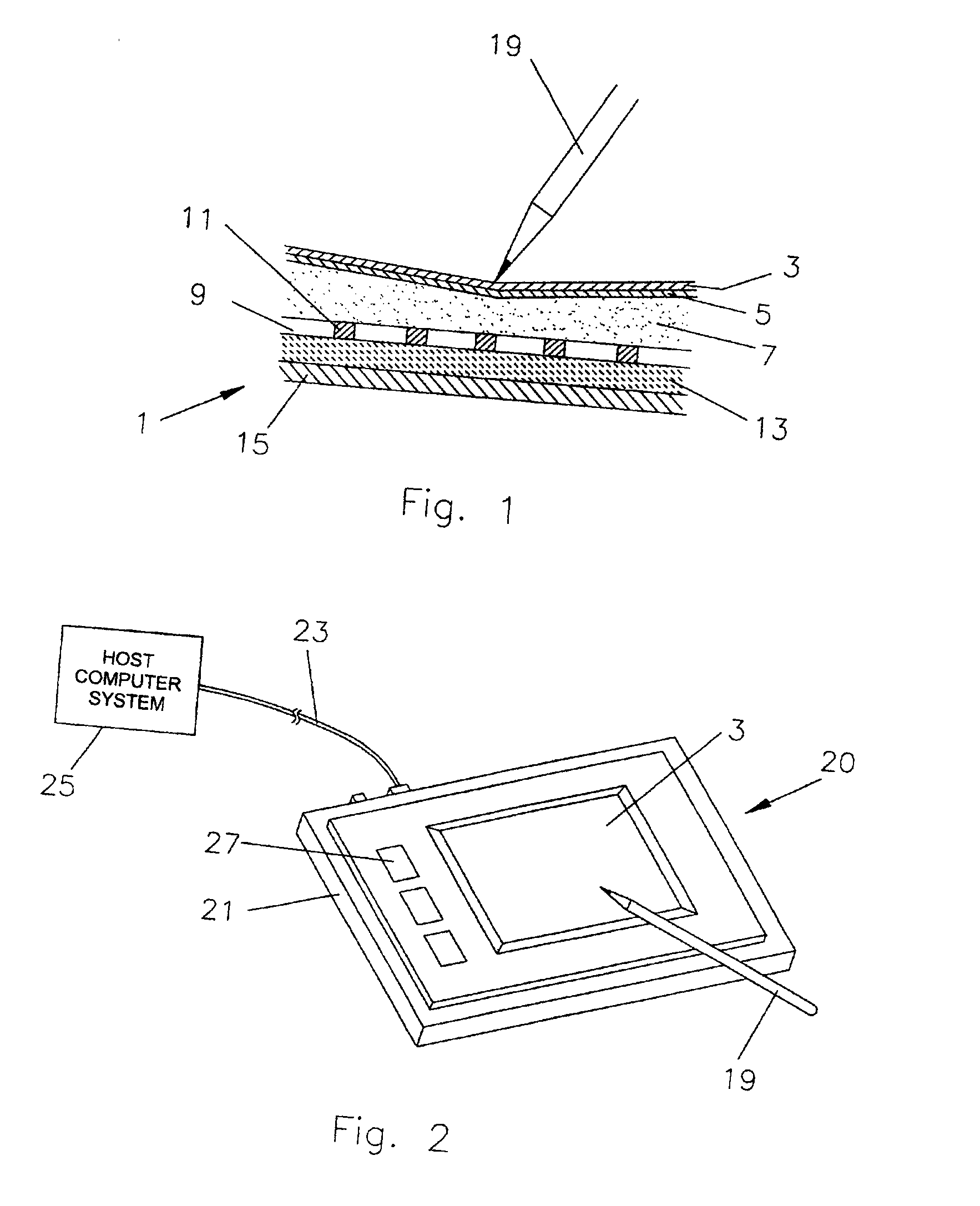

Automatic verification of a signature is extremely difficult because of large variation in a person's signature, even more so when signing at an unusual different pace or physical condition.

Applying to an automated operation, however, the method has a drawback as a current but non-representative signature may be stored and used for the next signature verification.

This lack of a constant reference signature may result in

confusion and verification errors.

In view of the

free form nature and inconsistency when writing a signature, it is unreliable for an automatic signature

verification system to distinguish irrelevant features of a test signature from meaningful characteristics of a template signature.

A major

disadvantage of the probability approach is that a set of weighting factors suitable for describing a person's signature variation over time may not be applicable to other persons.

Because it relies on the

optical density, the patent does not address possible errors due to the

optical density variations of different types of pens and usage conditions when writing signatures.

Also, the patent does not define a characteristic height of a signature for the size normalization.

This time-related method is not applicable to the signature verification of a conventional credit card, as the credit card does not contain any SDC information of the template signature on the card.

Nevertheless, the scanned template signature is obtained by manually swiping the credit card against the stationary

scanner by which the swiping motion is not controlled at a constant travel speed.

Consequently, the scanned template signature is subject to image

distortion due to the variation of swiping speed in the length of the template signature that may lead to verification errors.

Besides the

disadvantage of using two cameras, the method as described does not lead to normalization of

thumb print images because of the lack of well defined features in a

thumb print for reference for achieving the same orientation and size.

Besides, the inking of a user's

thumb is an objectionable invasive action.

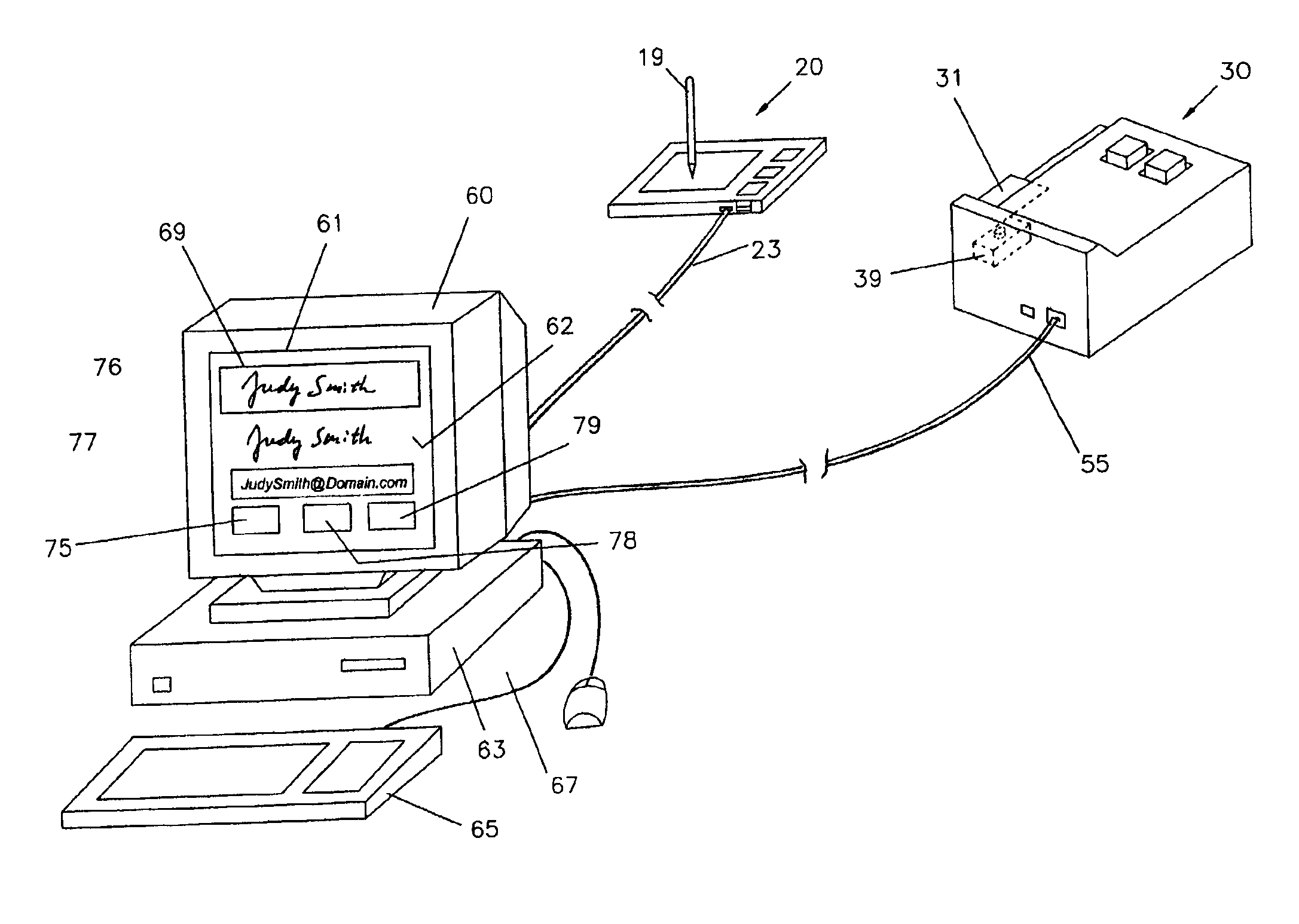

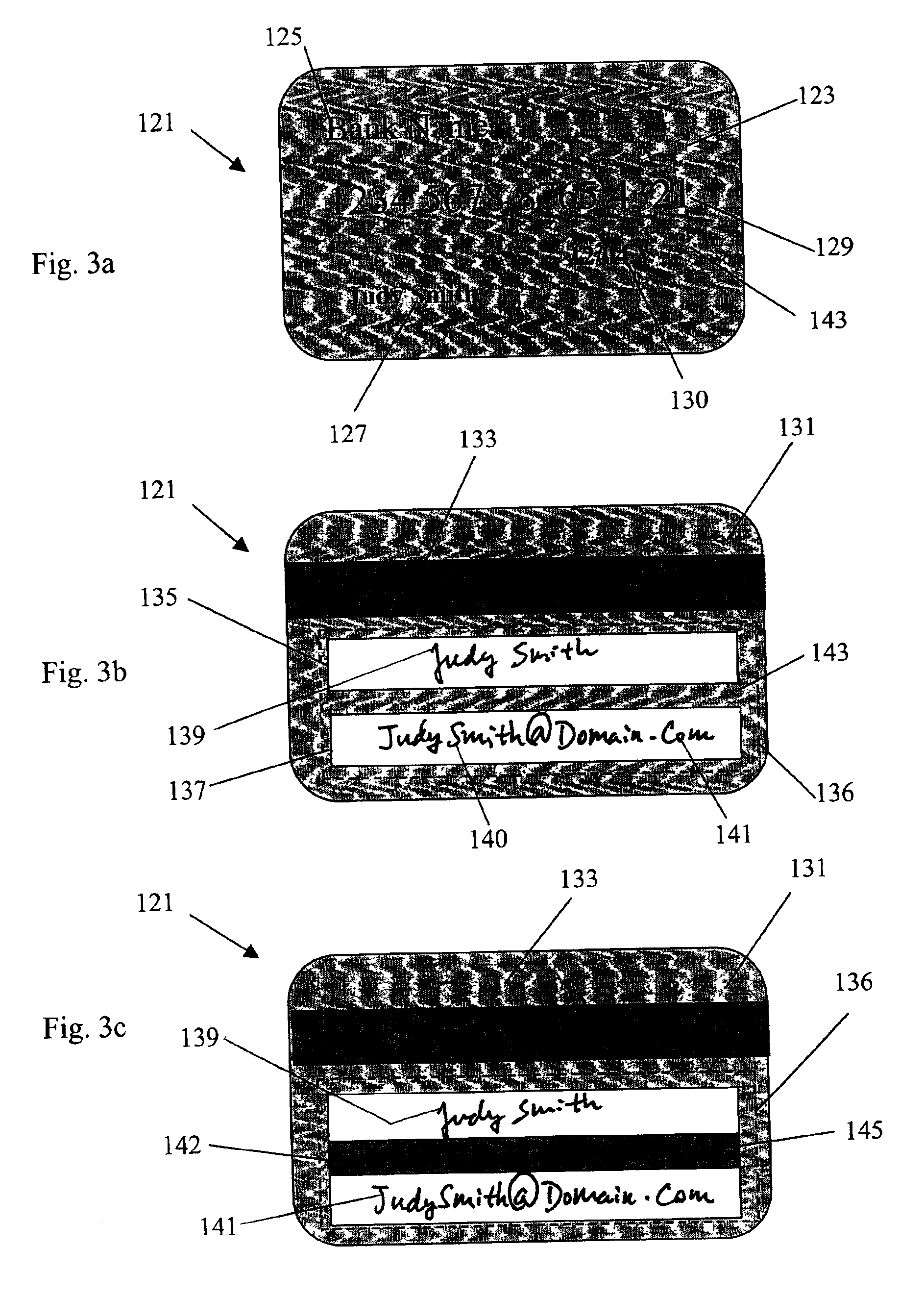

Although the display as described displays a signature on the LCD screen, it does not enable concurrent display of the as-written (test) signature with the (template) signature contained in the credit card for verification.

This pre-registration requirement is objectionable to users who prefer privacy and nondisclosure of their email address for commercial use.

The use of a dedicated pen is a severe limitation for this method and the feature of disappearing signature has no advantages compared to a paper receipt having a visible signed signature.

Furthermore, it is not desirable to manually enter the email address by the operator or the credit card user at the POP terminal as it is a

time consuming practice.

Additionally, a

smart card containing broad-based information is undesirable, as disclosure of one type of information (in credit card use) does not prevent disclosure of other information (such as other

bank account data) when the

smart card is being processed in a computerized device.

However, none of the prior art patents are adequately applicable to the need of identifying the email address printed on a credit card.

However, the process of less than 100% confidence level can lead to errors in identifying the email address.

Without the exact correct email address, the email system of the

computer network cannot deliver the email to the customer.

Despite the prior art on signature verification and electronic receipts, there has been no system that addresses the need of enforcing signature verification and the selectivity of receiving an electronic receipt.

Login to View More

Login to View More  Login to View More

Login to View More