System and method for online user authorization for banks

A technology for enterprises and customers, applied in special data processing applications, instruments, electrical digital data processing, etc., can solve problems such as being involved in crises, lack of efficient, centralized, and unified control methods, and financial debt crises

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

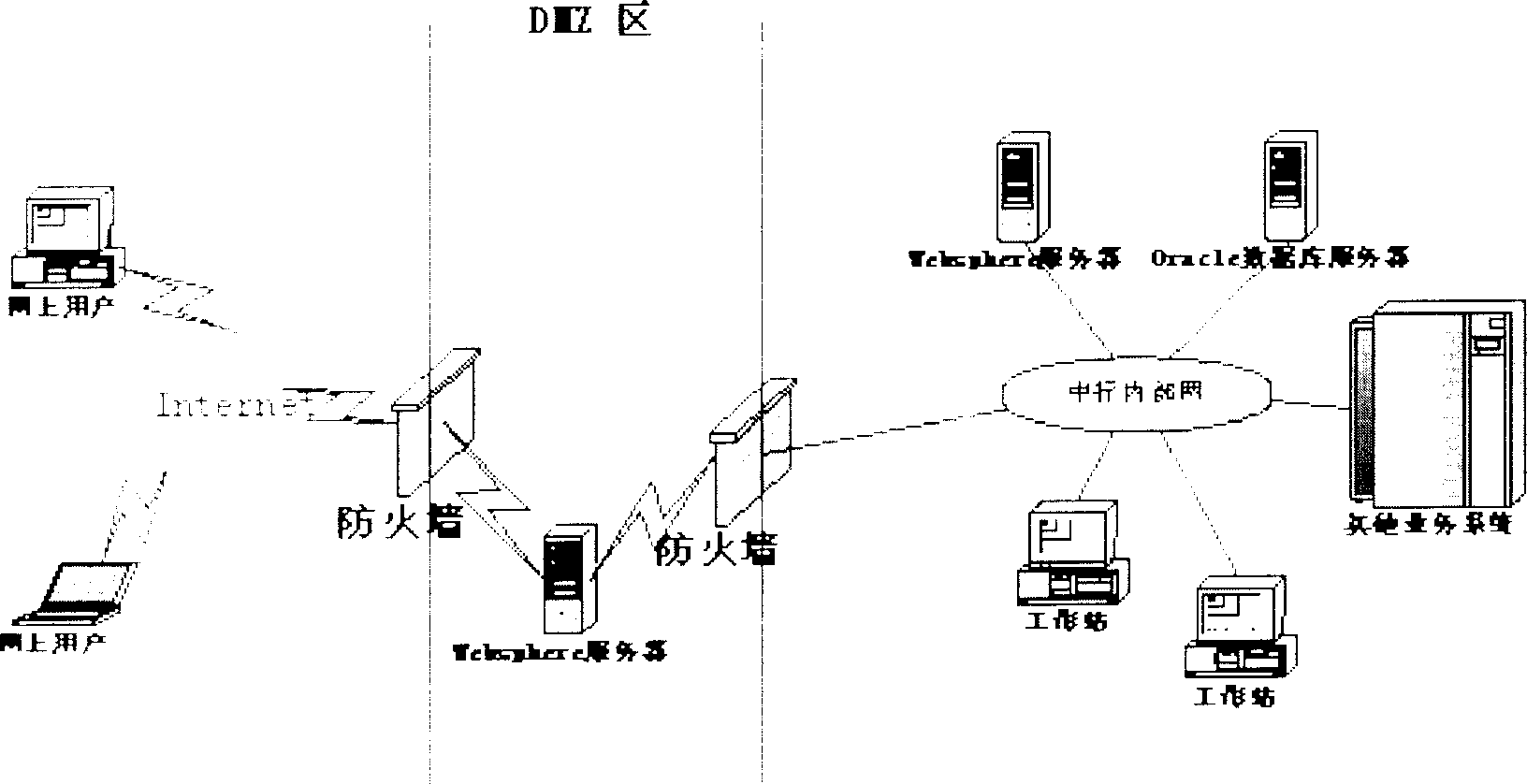

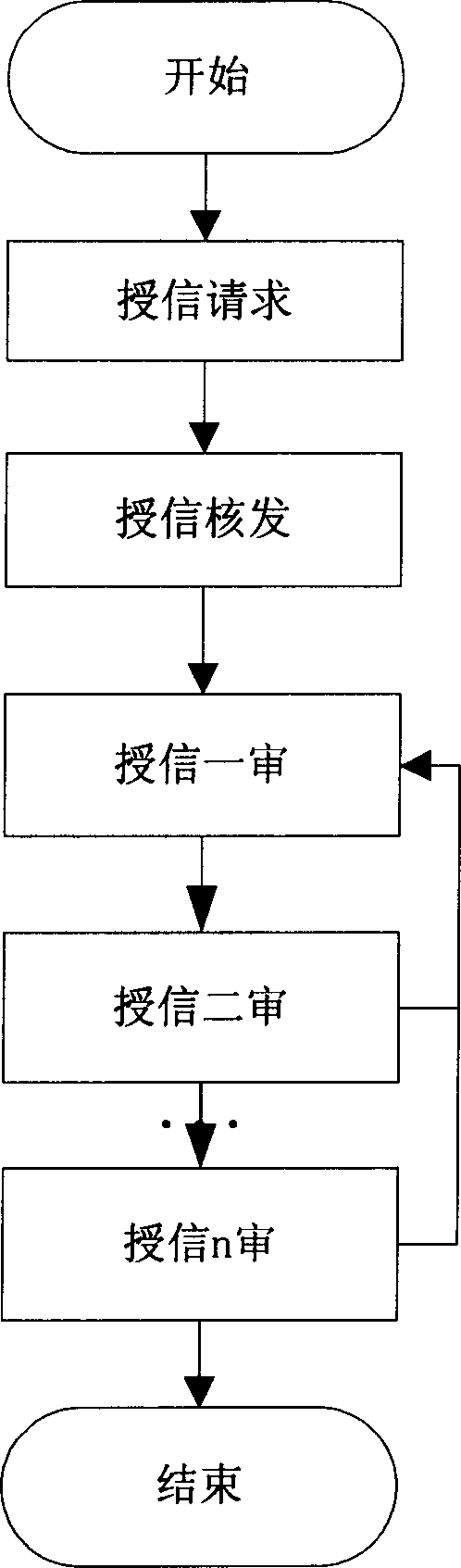

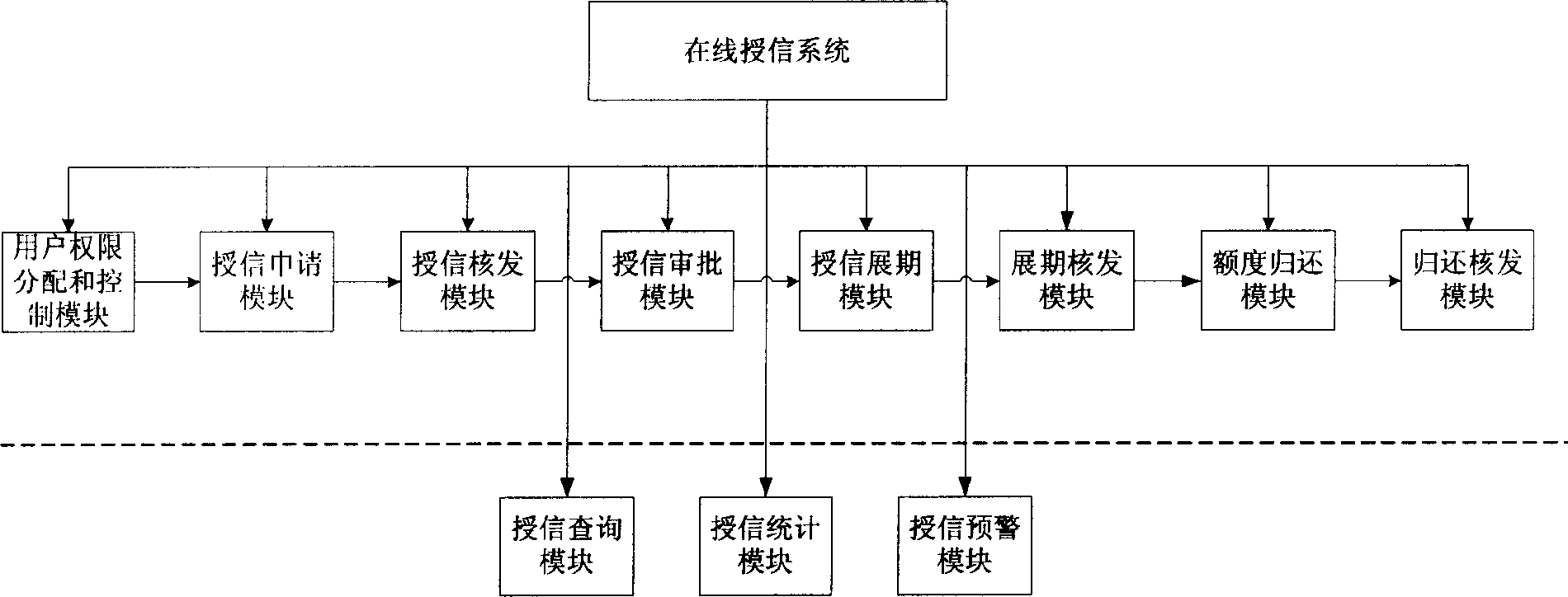

[0062] Figure 5 Shown is the relationship diagram of the online credit system of the present invention. Such as Figure 5As shown, (1) the user initiates a rating request on the selected institution on the client; (2) the client uses JavaScript code to verify the integrity, legality, and consistency of the data input by the user; (3) if the request passes the data verification , the browser uses the SSL (Security Socket Layer) protocol to encrypt the data, and transmits it to the server (WebSphere application server) through the HTTP protocol; (4) The WebSphere application server forwards the request to the corresponding process control module (small service) according to the request submitted by the client Program Servlet), and verify the identity and authority of the user who submitted the request. If the verification is not passed, it will be forwarded to the corresponding error handling module, and the error page will be returned, indicating the error code. If the verifi...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com