Payment cards and devices operable to receive point-of-sale actions before point-of-sale and forward actions at point-of-sale

a payment card and payment system technology, applied in the field of magnetic cards and payment systems, can solve the problems of slow payment card transactions and deficient traditional systems, and achieve the effects of reducing the time the user spends reducing the time it takes to complete a transaction at a pos device, and facilitating the change of the tip

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

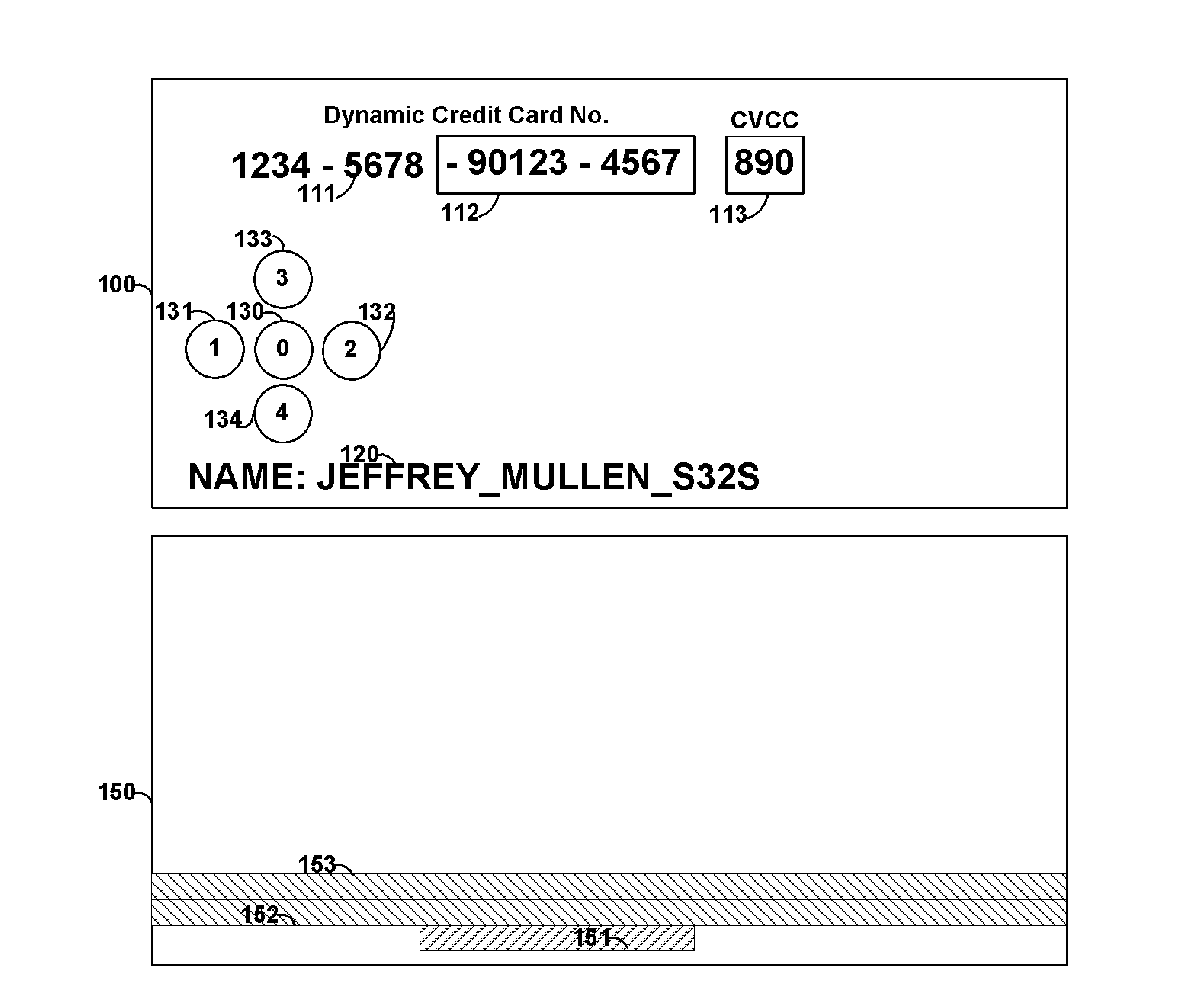

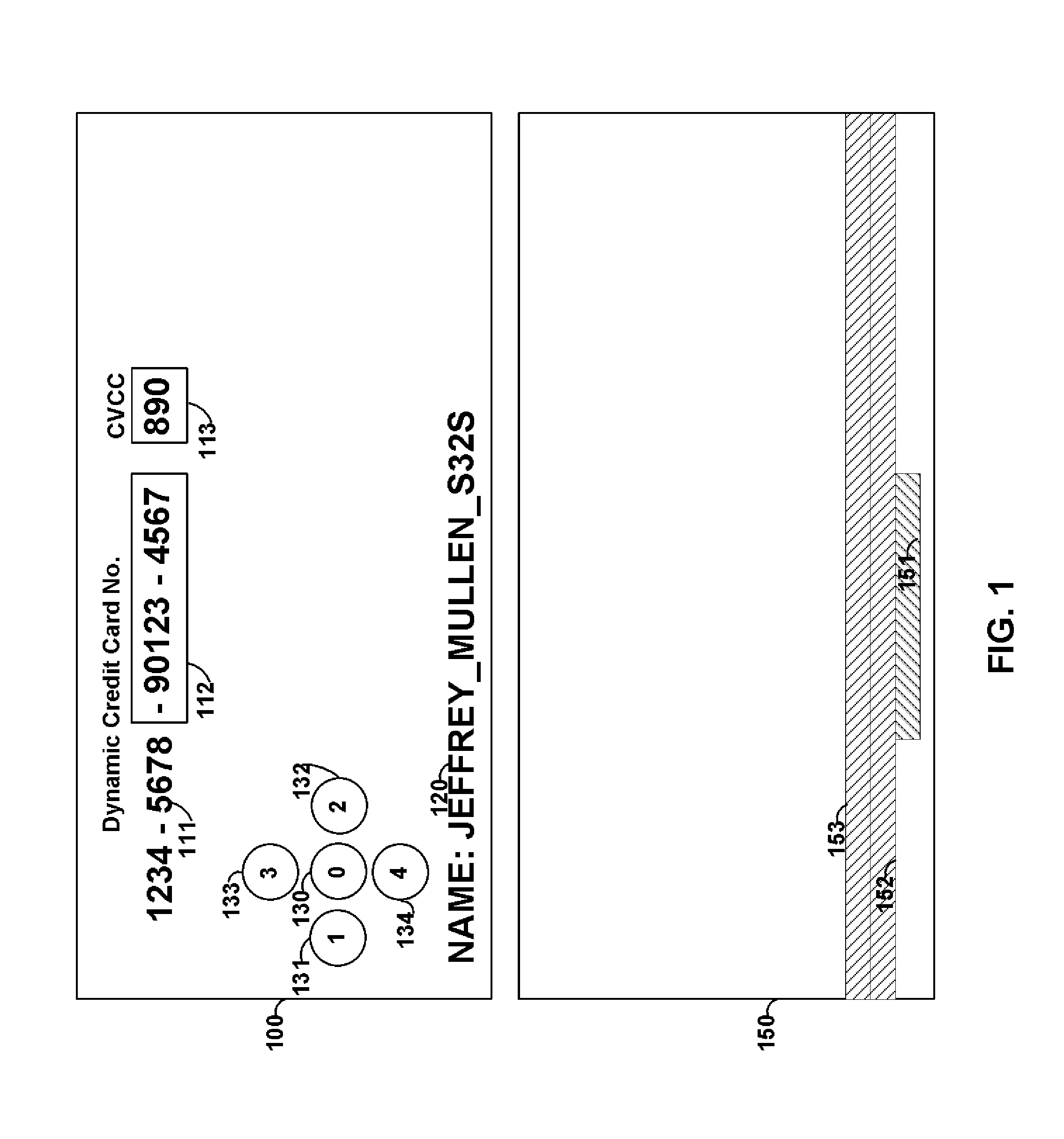

[0056]FIG. 1 shows card 100 that includes printed information 111 and 120, displays 112 and 113, and buttons 130-134. Card 100 may be, for example, a payment card such as a credit card, debit card, and / or gift card or any other type of card (e.g., security access or identification card). Payment information, such as a credit / debit card number may be provided as static information 111, dynamic information 112 and / or 113, or any combination thereof.

[0057]For example, a particular number of digits of a credit card number (e.g., the last 3 digits) may be provided as dynamic information. Such dynamic information may be changed periodically (e.g., once every hour). Information may be changed via, for example, encryption. Software may be provided at, for example, the payment verification server that verifies the dynamic information for each period of time such that a payment can be validated and processed for a particular user. A user may be identified using, for example, static informatio...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com